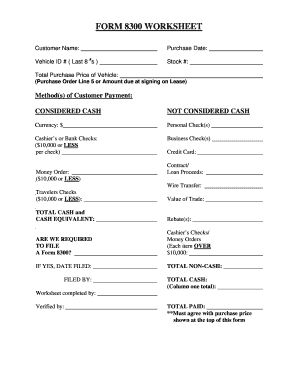

FORM 8300 WORKSHEET

What is the FORM 8300 WORKSHEET

The FORM 8300 WORKSHEET is a document used by businesses to report cash payments exceeding $10,000 received in a single transaction or related transactions. This form is mandated by the Internal Revenue Service (IRS) to help combat money laundering and other financial crimes. It captures essential information about the transaction and the parties involved, ensuring compliance with federal regulations. The worksheet is particularly relevant for businesses that deal with large cash transactions, providing a structured way to document these interactions.

How to use the FORM 8300 WORKSHEET

Using the FORM 8300 WORKSHEET involves several straightforward steps. First, gather all necessary information regarding the transaction, including the amount received, the date, and details about the payer. Next, accurately fill out the worksheet with the required information, ensuring that all fields are completed to avoid delays or issues. Once completed, the worksheet must be submitted to the IRS within 15 days of the transaction. Keeping a copy for your records is also advisable for future reference and compliance verification.

Steps to complete the FORM 8300 WORKSHEET

Completing the FORM 8300 WORKSHEET requires careful attention to detail. Follow these steps for accurate completion:

- Identify the transaction: Determine if the cash payment exceeds $10,000.

- Collect information: Gather details about the payer, including name, address, and taxpayer identification number.

- Fill out the worksheet: Enter the transaction details, including the date and amount received.

- Review for accuracy: Double-check all entries to ensure compliance with IRS requirements.

- Submit the form: Send the completed worksheet to the IRS within the required timeframe.

Legal use of the FORM 8300 WORKSHEET

The legal use of the FORM 8300 WORKSHEET is crucial for businesses that engage in significant cash transactions. Failure to report these transactions can result in severe penalties, including fines and potential legal action. The worksheet serves as a protective measure, ensuring that businesses comply with federal regulations. By accurately completing and submitting the form, businesses can demonstrate their commitment to lawful financial practices and avoid complications with the IRS.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the FORM 8300 WORKSHEET. These guidelines outline the necessary information to include, the timeline for submission, and the consequences of non-compliance. Businesses must adhere to these guidelines to ensure they fulfill their reporting obligations. Understanding these regulations helps businesses maintain transparency and accountability in their financial transactions.

Penalties for Non-Compliance

Non-compliance with the requirements of the FORM 8300 WORKSHEET can lead to significant penalties. Businesses that fail to file the form or provide inaccurate information may face fines ranging from $250 to $25,000, depending on the severity of the violation. Additionally, repeated offenses can result in further legal repercussions. It is essential for businesses to understand these penalties to emphasize the importance of proper reporting and compliance.

Quick guide on how to complete form 8300 worksheet

Complete FORM 8300 WORKSHEET seamlessly on any device

Online document management has gained signNow traction among enterprises and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it on the internet. airSlate SignNow provides all the resources required to create, edit, and eSign your documents quickly without interruptions. Handle FORM 8300 WORKSHEET on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign FORM 8300 WORKSHEET effortlessly

- Find FORM 8300 WORKSHEET and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and select the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Alter and eSign FORM 8300 WORKSHEET to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8300 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM 8300 WORKSHEET and why is it important?

The FORM 8300 WORKSHEET is a comprehensive tool used to assist businesses in reporting cash transactions over $10,000 to the IRS. This worksheet helps ensure compliance with federal regulations, facilitating accurate and timely reporting. Utilizing the FORM 8300 WORKSHEET can help mitigate potential penalties and promote transparent financial practices.

-

How does airSlate SignNow help with the FORM 8300 WORKSHEET?

airSlate SignNow simplifies the process of completing and signing the FORM 8300 WORKSHEET electronically. With its intuitive interface, users can easily fill out the required fields, add signatures, and send the document securely. This streamlines the workflow, making compliance with tax obligations more efficient.

-

Can I integrate the FORM 8300 WORKSHEET with other tools?

Yes, airSlate SignNow offers several integrations that allow you to seamlessly work with the FORM 8300 WORKSHEET. Whether you need to connect with accounting software or CRM systems, airSlate SignNow ensures that your process remains unified and efficient. Integration signNowly enhances your workflow when managing financial documents.

-

What are the benefits of using the FORM 8300 WORKSHEET in airSlate SignNow?

Using the FORM 8300 WORKSHEET in airSlate SignNow provides numerous benefits, including enhanced accuracy and efficiency in document processing. The platform's eSigning features eliminate paper clutter and streamline compliance workflows. Additionally, it offers robust security to protect sensitive financial information throughout the signing process.

-

Is there a cost associated with using the FORM 8300 WORKSHEET in airSlate SignNow?

While airSlate SignNow operates on a subscription model, accessing the FORM 8300 WORKSHEET as part of your document workflow can be cost-effective. Pricing varies based on selected features and the size of your business, but many users find that the potential savings from improved compliance and efficiency justify the investment.

-

What types of users can benefit from the FORM 8300 WORKSHEET?

The FORM 8300 WORKSHEET is beneficial for a broad range of users, including small business owners, accountants, and finance professionals. These users need to maintain accurate records of cash transactions and ensure compliance with IRS requirements. By utilizing airSlate SignNow's tools, they can manage this aspect of their operations more effectively.

-

How secure is the FORM 8300 WORKSHEET when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the FORM 8300 WORKSHEET. The platform employs top-level encryption and security protocols to protect your information from unauthorized access. Users can confidently manage financial documents knowing they’re secure.

Get more for FORM 8300 WORKSHEET

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children minnesota form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497311878 form

- Mn incorporation form

- Mn professional corporation form

- Mn agreement form

- Bylaws 497311882 form

- Corporate records maintenance package for existing corporations minnesota form

- Minnesota articles corporation form

Find out other FORM 8300 WORKSHEET

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA