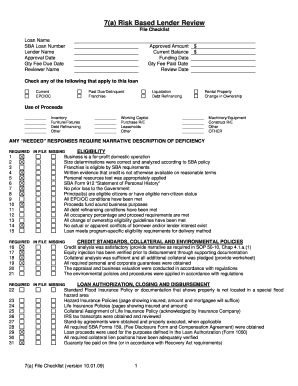

7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap Form

Understanding the Risk Based Lender Review Checklist

The risk based lender review checklist is a vital document used in the evaluation of loans, particularly under the SBA 7a program. This checklist helps lenders assess the risk associated with a borrower by collecting essential information. Key elements include the loan name, SBA loan number, lender name, approval date, guaranteed fee due date, reviewer name, approved amount, current balance, funding date, guaranteed fee paid date, and review date. Each of these components plays a crucial role in ensuring that the lender has a comprehensive view of the borrower's financial situation and compliance with SBA guidelines.

Steps to Complete the Risk Based Lender Review Checklist

Completing the risk based lender review checklist requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information, including the loan name, SBA loan number, and lender details.

- Fill in the approval date and due dates for any guaranteed fees.

- Document the approved amount and current balance accurately.

- Record the funding date and ensure that the guaranteed fee paid date is noted.

- Review the checklist for accuracy before submitting it for approval.

Legal Considerations for the Risk Based Lender Review Checklist

The risk based lender review checklist must adhere to specific legal requirements to ensure its validity. Compliance with regulations such as the ESIGN Act and UETA is essential for electronic signatures, making the document legally binding. This means that the signatures collected electronically must meet standards that verify the identity of the signer and the intent to sign. Using a reliable eSignature solution can help maintain compliance and provide an audit trail, which is crucial for legal purposes.

Key Elements of the Risk Based Lender Review Checklist

Several key elements are essential for the effective use of the risk based lender review checklist. These include:

- Loan Name: Identifies the specific loan under review.

- SBA Loan Number: A unique identifier for tracking purposes.

- Lender Name: The name of the financial institution providing the loan.

- Approval Date: The date when the loan was approved.

- Guaranteed Fee Due Date: The deadline for any fees associated with the loan guarantee.

- Reviewer Name: The individual responsible for reviewing the loan.

- Approved Amount: The total amount approved for the loan.

- Current Balance: The remaining balance on the loan.

- Funding Date: The date when the loan funds were disbursed.

- Guaranteed Fee Paid Date: The date when the guaranteed fee was paid.

- Review Date: The date the checklist was reviewed for accuracy.

Obtaining the Risk Based Lender Review Checklist

The risk based lender review checklist can typically be obtained through the lender's website or directly from the SBA. It is important to ensure that you are using the most current version of the checklist, as updates may occur based on regulatory changes. If you are unsure where to find the checklist, contacting your lender or the SBA directly can provide guidance on how to access the necessary forms.

Quick guide on how to complete 7a risk based lender review file checklist loan name sba loan number lender name approval date gty fee due date reviewer name

Effortlessly prepare 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap seamlessly

- Obtain 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 7a risk based lender review file checklist loan name sba loan number lender name approval date gty fee due date reviewer name

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a risk based lender review checklist?

A risk based lender review checklist is a systematic approach used by lenders to assess potential risks associated with borrowers. It guides them in evaluating creditworthiness and helps ensure compliance with regulatory requirements. Utilizing a comprehensive checklist can signNowly enhance the lender's decision-making process.

-

How can airSlate SignNow help with implementing a risk based lender review checklist?

airSlate SignNow offers customizable templates and tools that streamline the process of implementing a risk based lender review checklist. You can easily create, send, and eSign documents, ensuring that all necessary steps are followed efficiently. This automation not only saves time but also reduces errors in compliance.

-

What features of airSlate SignNow support a risk based lender review checklist?

AirSlate SignNow provides features such as document templates, automatic reminders, and secure eSigning that support the risk based lender review checklist process. These tools enhance collaboration and tracking, ensuring that all required documents are completed and signed on time. The integration of these features leads to a more organized review process.

-

Is there a free trial available for airSlate SignNow for the risk based lender review checklist?

Yes, airSlate SignNow offers a free trial that allows you to explore all its functionalities, including the risk based lender review checklist capabilities. This trial enables you to assess how the platform can meet your specific needs before committing to a subscription. You'll be able to see firsthand how effective the tool can be for your lending process.

-

How does pricing work for airSlate SignNow, particularly for features supporting a risk based lender review checklist?

AirSlate SignNow offers flexible pricing plans tailored to various business needs and sizes. The cost may vary based on the number of users and features included, such as those designed for a risk based lender review checklist. Review the pricing page to find the plan that matches your requirements and budget.

-

Can I integrate airSlate SignNow with other systems for my risk based lender review checklist?

Absolutely! AirSlate SignNow supports integrations with various CRM and document management systems, making it easy to incorporate your risk based lender review checklist into existing workflows. These integrations streamline processes and enhance data management, allowing you to maintain a comprehensive overview of lender activities.

-

What benefits does using a risk based lender review checklist provide?

Implementing a risk based lender review checklist can signNowly improve risk assessment accuracy, streamline the lending process, and enhance compliance with regulations. It empowers lenders to make informed decisions while providing a transparent framework that can be easily shared among stakeholders. Overall, it leads to more efficient and effective lending practices.

Get more for 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap

- Buyers notice of intent to vacate and surrender property to seller under contract for deed missouri form

- General notice of default for contract for deed missouri form

- Missouri disclosure form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497312981 form

- Missouri annual form

- Notice of default for past due payments in connection with contract for deed missouri form

- Final notice of default for past due payments in connection with contract for deed missouri form

- Assignment of contract for deed by seller missouri form

Find out other 7a Risk Based Lender Review File Checklist Loan Name SBA Loan Number Lender Name Approval Date Gty Fee Due Date Reviewer Name Ap

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself