Hsbc Fatca Declaration Form

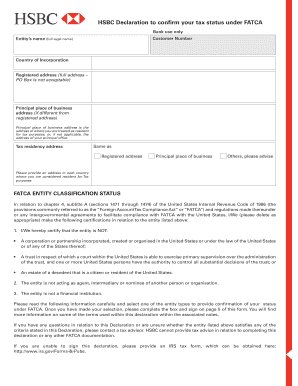

What is the HSBC FATCA Declaration Form

The HSBC FATCA Declaration Form is a document required for compliance with the Foreign Account Tax Compliance Act (FATCA). This U.S. law aims to prevent tax evasion by U.S. citizens and residents through foreign financial institutions. The form collects information about account holders, ensuring that HSBC can report relevant data to the Internal Revenue Service (IRS). Completing this form is essential for U.S. taxpayers who hold accounts with HSBC to avoid potential penalties and ensure proper tax reporting.

How to Use the HSBC FATCA Declaration Form

Using the HSBC FATCA Declaration Form involves several straightforward steps. First, ensure you have the latest version of the form, which can typically be obtained from HSBC’s website or directly from their customer service. Next, fill out the form with accurate personal information, including your name, address, and taxpayer identification number. It is crucial to provide truthful and complete information to avoid complications. After completing the form, you can submit it to HSBC either online or by mailing it to the designated address provided on the form.

Steps to Complete the HSBC FATCA Declaration Form

Completing the HSBC FATCA Declaration Form requires careful attention to detail. Follow these steps for a successful submission:

- Download the form from HSBC’s official website or request a physical copy.

- Fill in your personal details, including your full name, address, and taxpayer identification number.

- Indicate your U.S. citizenship status and provide any additional requested information regarding your financial accounts.

- Review the form thoroughly to ensure all information is accurate and complete.

- Sign and date the form to validate your submission.

- Submit the completed form according to the instructions provided, either online or by mail.

Legal Use of the HSBC FATCA Declaration Form

The HSBC FATCA Declaration Form serves a critical legal function in ensuring compliance with U.S. tax laws. By submitting this form, account holders affirm their status as U.S. persons, which obligates HSBC to report their financial information to the IRS. This legal requirement helps prevent tax evasion and ensures that U.S. citizens meet their tax obligations. Failing to submit the form or providing false information can lead to significant penalties, including fines and potential legal action.

Required Documents

To complete the HSBC FATCA Declaration Form, you may need to gather several documents. These typically include:

- A valid form of identification, such as a driver's license or passport.

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Any relevant financial statements or account information that may be required by HSBC.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Form Submission Methods

The HSBC FATCA Declaration Form can be submitted through various methods to accommodate different preferences. You can choose to submit the form online via HSBC’s secure portal, which allows for quick processing. Alternatively, you may opt to print the completed form and mail it to the address specified by HSBC. In-person submission may also be available at local HSBC branches, providing another option for account holders who prefer direct interaction.

Quick guide on how to complete hsbc fatca declaration form

Complete Hsbc Fatca Declaration Form smoothly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without hindrances. Handle Hsbc Fatca Declaration Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Hsbc Fatca Declaration Form effortlessly

- Locate Hsbc Fatca Declaration Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow simplifies your document management needs within a few clicks from any device you choose. Modify and eSign Hsbc Fatca Declaration Form and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc fatca declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FATCA and how does it relate to HSBC?

FATCA, or the Foreign Account Tax Compliance Act, requires financial institutions like HSBC to report certain information about U.S. account holders. By using 'fatca hsbc com or mail fatca hsbc com,' you can access essential resources to ensure compliance with these regulations. This ensures that you are aware of your obligations and can manage your tax responsibilities effectively.

-

How can I initiate communication regarding FATCA with HSBC?

To signNow out regarding FATCA inquiries, you can either visit 'fatca hsbc com or mail fatca hsbc com' for specific guidance. This page offers easy contact information and a straightforward process for submitting your questions. Following the provided instructions will ensure your inquiry is handled efficiently.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a user-friendly platform for sending and eSigning documents securely. With robust features like customizable templates and cloud storage integration, it simplifies the signing process. By utilizing this tool, you can enhance your document management while ensuring compliance with important regulations such as FATCA.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, small businesses can easily manage their eSigning needs without breaking the bank. This makes it a popular choice for those looking to streamline their document processes while remaining compliant with regulations like those found at 'fatca hsbc com or mail fatca hsbc com.'

-

Can airSlate SignNow integrate with other business applications?

Absolutely, airSlate SignNow offers integration capabilities with a variety of business applications, enhancing workflow efficiency. Whether you are using CRM systems or project management tools, you can seamlessly incorporate eSigning functionalities. This integration supports your compliance efforts when dealing with documentation related to 'fatca hsbc com or mail fatca hsbc com.'

-

What security features does airSlate SignNow provide?

Security is a top priority for airSlate SignNow, which includes encryption and secure storage for your documents. This ensures that sensitive information remains protected throughout the signing process. Such security measures are crucial for businesses dealing with compliance-related documents, including those pertaining to 'fatca hsbc com or mail fatca hsbc com.'

-

How does airSlate SignNow streamline the signing process?

airSlate SignNow simplifies the signing process by allowing users to send documents electronically and track their status in real-time. This not only saves time but also reduces the chances of document misplacement. By incorporating this solution, businesses can more effectively manage their compliance requirements linked to 'fatca hsbc com or mail fatca hsbc com.'

Get more for Hsbc Fatca Declaration Form

Find out other Hsbc Fatca Declaration Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document