Tax Table for 740 Form

What is the Tax Table for 740

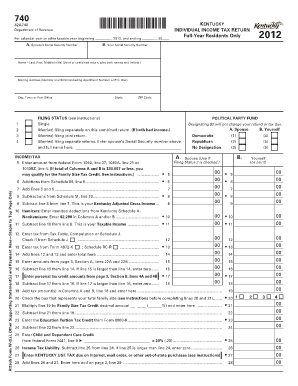

The Tax Table for 740 is a crucial resource for individuals filing their state income tax returns in the United States, specifically for those using the 740 form. This table provides a structured overview of tax rates applicable to different income brackets, allowing taxpayers to determine their tax liability based on their reported income. The 740 form is typically used by residents of states that require a detailed income tax return, and the tax table simplifies the process of calculating the amount owed or refunded.

How to Use the Tax Table for 740

To effectively use the Tax Table for 740, taxpayers should first identify their filing status and total taxable income. The table is organized into income ranges, each corresponding to a specific tax rate. By locating their income within the table, individuals can easily find the applicable tax rate. It is important to ensure that all sources of income are included in the total to accurately reflect the tax obligation. This process helps in understanding how much tax will be owed and aids in planning for any potential payments or refunds.

Steps to Complete the Tax Table for 740

Completing the Tax Table for 740 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Calculate your total taxable income by adding all sources of income.

- Determine your filing status, which may affect the tax rates applied.

- Refer to the Tax Table for 740 and locate your income range to find the corresponding tax rate.

- Apply the tax rate to your total taxable income to calculate your tax liability.

- Complete the 740 form with the calculated tax amount and any other required information.

Legal Use of the Tax Table for 740

The legal use of the Tax Table for 740 is essential for ensuring compliance with state tax laws. When taxpayers utilize the table to calculate their tax obligations, they must ensure that the information entered on the 740 form is accurate and complete. This adherence to legal guidelines helps prevent issues with tax authorities and ensures that individuals fulfill their civic responsibilities. Additionally, using the tax table correctly can help avoid penalties associated with underreporting income or miscalculating tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Table for 740 are critical for taxpayers to observe. Typically, state income tax returns must be filed by April 15 of the following year. However, specific states may have variations in their deadlines, and it is important to check for any extensions or changes. Missing the filing deadline can result in penalties and interest on unpaid taxes. Taxpayers should also be aware of any deadlines for estimated payments if applicable, as these can affect overall tax liability.

Required Documents

To accurately complete the Tax Table for 740, several documents are required:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental income or dividends

- Documentation for deductions or credits, if applicable

- Any prior year tax returns for reference

Having these documents organized and accessible will streamline the process of filling out the 740 form and ensure that all income is accounted for.

Quick guide on how to complete tax table for 740

Effortlessly Prepare Tax Table For 740 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to produce, modify, and eSign your documents quickly and without interruption. Manage Tax Table For 740 on any device via airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign Tax Table For 740 with Ease

- Find Tax Table For 740 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a traditional ink signature.

- Review the information and click the Done button to apply your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Table For 740 to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax table for 740

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the '2015 tax table for 740' and how can it benefit me?

The '2015 tax table for 740' provides detailed information on tax brackets and rates for individuals filing taxes in Kentucky. Understanding this table can help you accurately calculate your tax liabilities and maximize deductions, ultimately saving you money. Using airSlate SignNow, you can easily manage your tax documents and eSign any necessary forms related to your tax filings.

-

How does airSlate SignNow help with the '2015 tax table for 740'?

airSlate SignNow simplifies the process of managing documents related to the '2015 tax table for 740' by allowing users to eSign and send tax forms securely online. With our solution, you can quickly access tax tables, fill out necessary documents, and electronically sign them all in one place. This streamlines your tax preparation process and ensures you remain compliant with state regulations.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your tax documents, including those relevant to the '2015 tax table for 740.' With flexible pricing plans, you can choose the one that best fits your needs, ensuring you get the features you require without overspending. Our platform allows you to save time and money by eliminating the need for printing and mailing physical documents.

-

What features does airSlate SignNow offer for tax preparation?

airSlate SignNow offers a variety of features that are beneficial for tax preparation, including customizable templates, eSignature capabilities, and document sharing. These features enable you to create and send documents related to the '2015 tax table for 740' efficiently. Furthermore, you can track the status of your documents in real time, ensuring that you're always informed about your submissions.

-

Can I store my tax documents securely on airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your tax documents, including those associated with the '2015 tax table for 740.' Our platform employs industry-standard encryption to protect your sensitive information from unauthorized access. This means that you can access your documents anytime, anywhere, with peace of mind regarding their security.

-

Does airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with various software applications, making tax preparation smoother for users referencing the '2015 tax table for 740.' Whether you use accounting software, customer relationship management (CRM) systems, or other business tools, our platform can improve your efficiency by automating document workflows and enhancing collaboration.

-

Is online support available for users needing help with tax documents?

Yes, airSlate SignNow provides comprehensive online support for users needing assistance with tax documents related to the '2015 tax table for 740.' Our support team is available through multiple channels, including chat and email, ready to help you with any questions or issues you encounter while using our platform. We’re dedicated to ensuring you have a smooth experience with our service.

Get more for Tax Table For 740

- Sample corporate records for a missouri professional corporation missouri form

- Missouri a corporation form

- Sample transmittal letter for articles of incorporation missouri form

- New resident guide missouri form

- Satisfaction release or cancellation of deed of trust by corporation missouri form

- Satisfaction release or cancellation of deed of trust by individual missouri form

- Partial release deed form

- Partial release property 497313498 form

Find out other Tax Table For 740

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form