Cra File Gst Hst Return Form

What is the CRA file GST HST return?

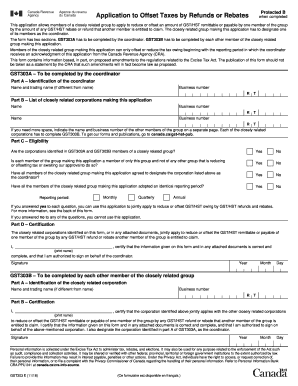

The CRA file GST HST return is a crucial document for businesses in Canada that are registered for Goods and Services Tax (GST) or Harmonized Sales Tax (HST). This form is used to report the amount of GST or HST collected from customers and the amount of input tax credits claimed on purchases. Completing this return accurately ensures compliance with tax regulations and helps businesses manage their tax obligations effectively.

Steps to complete the CRA file GST HST return

Completing the CRA file GST HST return involves several key steps:

- Gather all relevant financial records, including sales invoices and receipts.

- Calculate the total GST or HST collected from sales during the reporting period.

- Determine the total input tax credits you are eligible to claim for purchases made.

- Complete the GST HST return form with the calculated figures.

- Review the form for accuracy before submission.

These steps help ensure that the return is filled out correctly, minimizing the risk of errors that could lead to penalties.

Legal use of the CRA file GST HST return

The CRA file GST HST return is legally binding, meaning it must be completed and submitted in accordance with the regulations set forth by the Canada Revenue Agency. To ensure its legal validity, businesses must adhere to the guidelines regarding the collection and reporting of GST and HST. This includes maintaining accurate records and submitting the return by the specified deadlines.

Filing deadlines / Important dates

Filing deadlines for the CRA file GST HST return vary depending on the reporting period of the business. Generally, businesses must file their returns quarterly or annually. It is important to be aware of these deadlines to avoid late fees and penalties. Key dates include:

- Quarterly return due dates: typically one month after the end of each quarter.

- Annual return due date: usually due three months after the end of the fiscal year.

Staying informed about these deadlines helps ensure timely compliance with tax obligations.

Required documents

To complete the CRA file GST HST return, several documents are necessary. These include:

- Sales invoices that show the GST or HST collected from customers.

- Receipts for purchases that include GST or HST, which can be used to claim input tax credits.

- Previous GST HST returns for reference and accuracy checks.

Having these documents organized and accessible facilitates a smoother filing process.

Form submission methods (Online / Mail / In-Person)

The CRA file GST HST return can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the CRA's secure portal, which is often the fastest method.

- Mailing a paper version of the return to the designated CRA office.

- In-person submission at a local CRA office, if preferred.

Choosing the right submission method can enhance efficiency and ensure compliance with filing requirements.

Quick guide on how to complete gst hst return form

Effortlessly prepare gst hst return form on any device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the required format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without any delays. Handle gst return form pdf on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign gst return form effortlessly

- Find cra gst return form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important areas of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign gst return form cra and ensure superior communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to file a gst return

Create this form in 5 minutes!

How to create an eSignature for the file gst

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask gst return form pdf

-

What is the CRA GST return form and why is it important?

The CRA GST return form is a key document that businesses in Canada must file to report the Goods and Services Tax (GST) they have collected and paid. Filing this form accurately is crucial for compliance with tax regulations, helping businesses avoid penalties and maintain good standing with the Canada Revenue Agency (CRA).

-

How can airSlate SignNow help with the CRA GST return form?

airSlate SignNow simplifies the process of managing and signing your CRA GST return form. Our platform allows you to fill out the form electronically, request signatures, and send it securely, making the entire workflow more efficient and reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the CRA GST return form?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Each plan provides access to features that streamline the filing of your CRA GST return form while keeping costs manageable, ensuring you get value for your investment.

-

What features does airSlate SignNow provide for eSigning the CRA GST return form?

With airSlate SignNow, you can easily eSign your CRA GST return form using our user-friendly interface. Features such as templates, audit trails, and customizable fields enhance your document management process, ensuring compliance and security while you manage your tax returns.

-

Can airSlate SignNow integrate with my accounting software for preparing the CRA GST return form?

Absolutely! airSlate SignNow offers integrations with various accounting software applications, which can facilitate the preparation and filing of your CRA GST return form. By linking these systems, you can streamline data transfer and minimize manual entry, making tax season less stressful.

-

What are the benefits of using airSlate SignNow for managing the CRA GST return form?

Using airSlate SignNow to manage your CRA GST return form provides you with enhanced efficiency, compliance, and security. Our platform minimizes errors and saves time by allowing you to track the signing process in real-time, enabling faster approvals and ensuring timely submissions to the CRA.

-

How secure is airSlate SignNow for handling sensitive documents like the CRA GST return form?

airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and secure storage practices to protect sensitive documents like the CRA GST return form. Our platform is designed to meet industry security standards, ensuring that your financial information is always safeguarded.

Get more for gst return form

- Portalctgov drs drs formsdrs forms ctgov connecticuts official state website

- Form drs ewvr ctgov

- Form 1 ampquotwisconsin income taxampquot wisconsin templateroller

- The document you are trying to load requires adobe reader 8 or higher form

- Download ilovepdf 3220 for windows filehippocomdownload ilovepdf for windows free 3220 digital trendsdownload ilovepdf for form

- Form ct 1120da ctgov

- Wisconsin homestead credit form 2021

- Portalctgov mediaform ct 706 nt ext connecticut

Find out other cra gst return form

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History