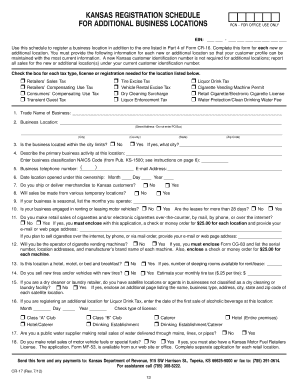

Kansas Cr17 Form

What is the Kansas CR17?

The Kansas CR17, also known as the Kansas Department of Revenue CR 17 form, is a document used primarily for tax purposes. This form is essential for individuals and businesses in Kansas to report specific financial information to the state. It plays a crucial role in ensuring compliance with state tax laws and regulations. Understanding the purpose and requirements of the CR17 is vital for accurate tax reporting and avoiding potential penalties.

How to Use the Kansas CR17

Using the Kansas CR17 involves several important steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It's essential to review the instructions provided with the CR17 to understand the specific requirements for your situation. Once completed, the form can be submitted either online or via mail, depending on your preference and the guidelines set by the Kansas Department of Revenue.

Steps to Complete the Kansas CR17

Completing the Kansas CR17 requires attention to detail. Follow these steps for a successful submission:

- Gather all relevant financial documents.

- Access the Kansas CR17 form through the Kansas Department of Revenue website.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Report your income and any deductions or credits you are eligible for.

- Double-check all entries for accuracy.

- Submit the form online or print it out for mailing.

Legal Use of the Kansas CR17

The Kansas CR17 form is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be filled out with accurate information and submitted within the specified deadlines. Compliance with the legal requirements surrounding the CR17 is crucial for avoiding penalties and ensuring that your tax obligations are met. Understanding the legal implications of the information provided on this form can help taxpayers navigate the complexities of state tax laws.

Key Elements of the Kansas CR17

Several key elements are essential to the Kansas CR17 form. These include:

- Personal Information: Accurate identification details of the taxpayer.

- Income Reporting: Comprehensive disclosure of all sources of income.

- Deductions and Credits: Information on any applicable deductions or tax credits.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas CR17 are critical for compliance. Typically, the form must be submitted by April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in state law. It is advisable to stay updated on any changes to these deadlines to avoid late filing penalties. Marking these important dates on your calendar can help ensure timely submission of the form.

Quick guide on how to complete kansas cr17

Effortlessly Prepare Kansas Cr17 on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Kansas Cr17 on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Kansas Cr17 with Ease

- Obtain Kansas Cr17 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which requires just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, exhausting form searches, or errors that necessitate reprinting new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Kansas Cr17 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kansas cr17

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cr17 feature in airSlate SignNow?

The cr17 feature in airSlate SignNow refers to our robust eSigning capabilities, allowing users to easily sign documents electronically. This feature streamlines the signing process, enabling quick approvals and reducing the time spent on paperwork. With cr17, businesses can make more efficient decisions.

-

How much does airSlate SignNow with cr17 cost?

airSlate SignNow offers various pricing plans that include the cr17 feature, catering to businesses of different sizes and needs. We have competitive pricing structures that ensure you get the best value for your eSigning requirements. You can review our pricing plans on our website.

-

What are the key benefits of using airSlate SignNow's cr17 feature?

Using the cr17 feature in airSlate SignNow provides multiple benefits, including enhanced efficiency, security, and cost savings. It allows users to sign documents anytime and anywhere, leading to faster transaction completions. Furthermore, it reduces the chances of errors compared to traditional methods.

-

Can airSlate SignNow’s cr17 integrate with other applications?

Yes, airSlate SignNow's cr17 feature integrates seamlessly with a variety of applications, enhancing your document workflow. You can connect it with tools like Google Workspace, Salesforce, and more to create a cohesive experience. This integration supports automation and helps streamline your operations.

-

Is the cr17 feature user-friendly for teams?

Absolutely! The cr17 feature in airSlate SignNow is designed for ease of use, making it accessible to users of all technical levels. Teams can quickly learn to navigate the platform, allowing for smooth collaboration and document management. This user-centric approach enhances workplace productivity.

-

What types of documents can I sign using the cr17 feature?

With the cr17 feature, you can sign various types of documents such as contracts, agreements, and forms. airSlate SignNow supports multiple file formats, ensuring ALL your essential documents can be managed within a single platform. This flexibility is invaluable for any business.

-

Is my data secure when using the cr17 feature?

Yes, data security is a top priority when using airSlate SignNow’s cr17 feature. We implement robust encryption and compliance with industry standards to protect sensitive information. You can rest assured that your documents remain secure throughout the signing process.

Get more for Kansas Cr17

- Iowa agreement form

- Idaho agreement for payment of unpaid rent form

- Abandoned property 481373389 form

- Indiana residential or rental lease extension agreement form

- Indiana unpaid form

- Kansas letter from tenant to landlord containing notice of failure to return security deposit and demand for return form

- Ks landlord form

- Ky landlord form

Find out other Kansas Cr17

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe