TC 72H Utah State Tax Commission Utah Gov Tax Utah Form

What is the TC 72H Utah State Tax Commission Utah gov Tax Utah

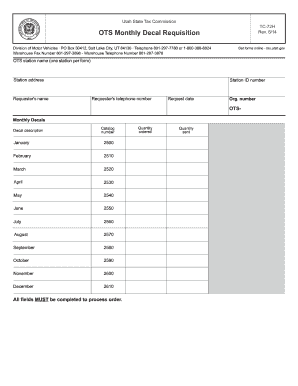

The TC 72H form is a specific document issued by the Utah State Tax Commission, primarily used for tax purposes within the state of Utah. This form is essential for taxpayers who need to report certain financial information to the state government. It serves as a means for individuals and businesses to comply with state tax regulations, ensuring that all necessary data is accurately submitted for assessment. Understanding the purpose and requirements of the TC 72H is crucial for maintaining compliance and avoiding potential penalties.

How to use the TC 72H Utah State Tax Commission Utah gov Tax Utah

Using the TC 72H form involves several straightforward steps to ensure accurate completion and submission. First, gather all necessary financial documents and information required for the form. This may include income statements, deductions, and other relevant data. Next, fill out the form carefully, ensuring that all sections are completed as per the instructions provided by the Utah State Tax Commission. Once the form is filled out, it can be submitted online, by mail, or in person, depending on the preferences and requirements of the taxpayer.

Steps to complete the TC 72H Utah State Tax Commission Utah gov Tax Utah

Completing the TC 72H form requires attention to detail and adherence to specific guidelines. Follow these steps for effective completion:

- Gather necessary documents, including previous tax returns and financial statements.

- Review the instructions provided with the TC 72H form to understand each section's requirements.

- Fill out the form accurately, ensuring that all information is current and correctly entered.

- Double-check for any errors or omissions before finalizing the form.

- Choose your preferred submission method: online, by mail, or in person.

Legal use of the TC 72H Utah State Tax Commission Utah gov Tax Utah

The TC 72H form must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. The form is considered legally binding when completed correctly and submitted to the appropriate authorities. Taxpayers should be aware of the implications of submitting false information, which can lead to penalties or legal repercussions.

Key elements of the TC 72H Utah State Tax Commission Utah gov Tax Utah

Several key elements define the TC 72H form, making it essential for tax compliance in Utah. These elements include:

- Identification information for the taxpayer, such as name, address, and Social Security number or EIN.

- Financial data relevant to the tax year, including income and deductions.

- Signature line for the taxpayer, indicating the accuracy of the information provided.

- Instructions for submission, detailing how and when to submit the form.

Filing Deadlines / Important Dates

Filing deadlines for the TC 72H form are critical to ensure compliance with state tax regulations. Typically, the form must be submitted by the annual tax deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary. Missing these deadlines can result in penalties or interest on unpaid taxes, making it essential to stay informed about important dates related to the TC 72H form.

Quick guide on how to complete tc 72h utah state tax commission utah gov tax utah

Effortlessly Prepare TC 72H Utah State Tax Commission Utah gov Tax Utah on Any Device

Managing documents online has become increasingly prevalent among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and securely save them online. airSlate SignNow provides all the resources necessary for you to create, edit, and electronically sign your documents swiftly without any holdups. Handle TC 72H Utah State Tax Commission Utah gov Tax Utah on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related processes today.

The Easiest Way to Revise and Electronically Sign TC 72H Utah State Tax Commission Utah gov Tax Utah Effortlessly

- Obtain TC 72H Utah State Tax Commission Utah gov Tax Utah and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form searching, or mistakes that require printing new document versions. airSlate SignNow covers all your document management needs in just a few clicks from any device you choose. Modify and electronically sign TC 72H Utah State Tax Commission Utah gov Tax Utah while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 72h utah state tax commission utah gov tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TC 72H form for the Utah State Tax Commission?

The TC 72H form is a document required by the Utah State Tax Commission used to report certain tax information. By utilizing this form correctly, you can ensure compliance with Utah tax regulations. It is crucial for businesses operating in Utah to understand how to fill out and submit the TC 72H form to avoid penalties.

-

How can airSlate SignNow help with TC 72H forms?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending TC 72H forms. Our features streamline the process of preparing and submitting documents to the Utah State Tax Commission, ensuring you meet necessary deadlines. Enhanced security and compliance features help protect your sensitive tax information during the eSigning process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring that you can find a solution that fits your budget. Different tiers provide various features to assist with managing TC 72H and other documents efficiently. You can leverage our affordable pricing while benefiting from seamless eSignature capabilities that simplify your Utah tax processes.

-

What are the key features of airSlate SignNow for tax forms?

Our platform includes customizable templates, real-time collaboration, and secure eSigning, all designed to enhance your experience when handling TC 72H and other tax-related documents. With automatic reminders and tracking, you can stay organized and ensure timely submissions to the Utah State Tax Commission. These features not only save time but also improve overall document management.

-

Is airSlate SignNow compliant with Utah State Tax Commission regulations?

Yes, airSlate SignNow is compliant with regulations set by the Utah State Tax Commission, ensuring your signed documents meet all necessary legal requirements. Our platform adheres to the highest security standards to protect user data, especially when handling sensitive information related to TC 72H and Utah tax filings. Trust airSlate SignNow to maintain compliance while handling your tax-related documents.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM tools, document management systems, and accounting software. This flexibility allows you to incorporate TC 72H form handling into your existing workflows, improving efficiency and simplifying tax compliance processes in Utah.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents like the TC 72H simplifies the signing process, saving you time and resources. Our user-friendly interface allows for quick document preparation and reduces the likelihood of errors in submissions to the Utah State Tax Commission. Additionally, our comprehensive audit trail keeps your records organized and facilitates compliance.

Get more for TC 72H Utah State Tax Commission Utah gov Tax Utah

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497317687 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497317688 form

- North dakota dissolution form

- Living trust for husband and wife with no children north dakota form

- Living trust for individual who is single divorced or widow or widower with no children north dakota form

- Living trust for individual who is single divorced or widow or widower with children north dakota form

- Living trust for husband and wife with one child north dakota form

- Living trust for husband and wife with minor and or adult children north dakota form

Find out other TC 72H Utah State Tax Commission Utah gov Tax Utah

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors