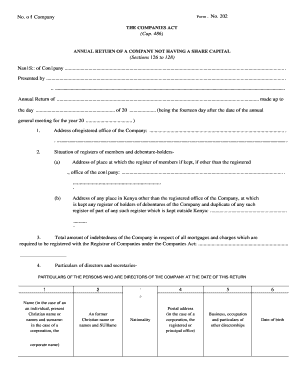

Form 202 Annual Return for Company Not Having Share Capital

What is the Form 202 Annual Return For Company Not Having Share Capital

The Form 202 Annual Return for a company not having share capital is a legal document required for certain types of organizations in the United States. This form serves to provide essential information about the company's activities, structure, and financial status to the relevant state authorities. Unlike companies with share capital, these entities may include non-profits, limited liability companies, or other forms of organizations that do not issue shares. Completing this form accurately is crucial for maintaining compliance with state regulations.

Steps to complete the Form 202 Annual Return For Company Not Having Share Capital

Completing the Form 202 requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary information about the organization, including its legal name, address, and the names of key officers or members.

- Review the specific requirements set by the state where the organization is registered, as these can vary.

- Fill out the form, ensuring all sections are completed accurately. Pay special attention to any financial information that may be required.

- Sign and date the form. If the organization has multiple officers, ensure that all required signatures are obtained.

- Submit the form by the designated deadline, either online or via mail, depending on the state’s requirements.

Legal use of the Form 202 Annual Return For Company Not Having Share Capital

The legal use of the Form 202 Annual Return is critical for compliance with state laws. This form must be filed annually to maintain good standing with the state. Failure to file can result in penalties, including fines or the potential dissolution of the organization. The form also serves as a public record, providing transparency about the organization’s activities and governance. It is essential to ensure that all information provided is accurate and truthful, as discrepancies can lead to legal complications.

How to obtain the Form 202 Annual Return For Company Not Having Share Capital

The Form 202 can typically be obtained from the website of the state agency responsible for business registrations. Most states provide downloadable versions of the form in PDF format. Additionally, some states may offer an online portal where organizations can complete and submit the form electronically. It is advisable to check the specific state requirements to ensure the correct version of the form is being used.

Filing Deadlines / Important Dates

Filing deadlines for the Form 202 Annual Return vary by state, but most require submission on an annual basis. Organizations should be aware of their specific due dates to avoid late fees or penalties. It is common for states to set deadlines based on the anniversary of the organization’s formation or registration. Keeping a calendar of important dates can help ensure timely compliance.

Required Documents

When completing the Form 202 Annual Return, organizations may need to provide additional documentation. Common requirements include:

- Financial statements or summaries, if applicable.

- List of current officers or members.

- Any amendments to the organization’s bylaws or articles of incorporation.

It is essential to review the specific requirements for the state to ensure all necessary documents are included with the submission.

Quick guide on how to complete form 202 annual return for company not having share capital

Complete Form 202 Annual Return For Company Not Having Share Capital effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 202 Annual Return For Company Not Having Share Capital on any device with the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign Form 202 Annual Return For Company Not Having Share Capital without breaking a sweat

- Find Form 202 Annual Return For Company Not Having Share Capital and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 202 Annual Return For Company Not Having Share Capital and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 202 annual return for company not having share capital

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 202 Annual Return For Company Not Having Share Capital?

The Form 202 Annual Return For Company Not Having Share Capital is a crucial document that must be filed by certain companies to report their financial standing and other relevant information to the authorities. This form helps maintain transparency and compliance with regulatory obligations. Submitting this return is essential for companies without share capital to avoid penalties.

-

How can airSlate SignNow help with submitting the Form 202 Annual Return?

airSlate SignNow simplifies the process of submitting the Form 202 Annual Return For Company Not Having Share Capital by providing an efficient platform for e-signature and document management. Users can easily create, send, and track their forms digitally, ensuring all submissions are timely and properly executed. This reduces the hassle of paperwork and enhances overall compliance efforts.

-

What are the pricing options for airSlate SignNow when filing the Form 202 Annual Return?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including features tailored for filing the Form 202 Annual Return For Company Not Having Share Capital. Plans start with a basic option for small businesses and scale up to advanced solutions for larger enterprises. Each tier includes essential features, allowing you to choose a solution that fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for managing the Form 202 Annual Return?

Yes, airSlate SignNow supports various integrations that enhance functionality when managing the Form 202 Annual Return For Company Not Having Share Capital. These integrations allow seamless connectivity with CRM systems, cloud storage platforms, and accounting software, streamlining the entire process from document preparation to submission. This ensures that your workflow remains efficient and organized.

-

What benefits does airSlate SignNow provide for businesses filing the Form 202 Annual Return?

Using airSlate SignNow for submitting the Form 202 Annual Return For Company Not Having Share Capital comes with numerous benefits, including improved efficiency and reduced turnaround time for document processing. The platform's e-signature feature ensures that documents are signed quickly, without the delays associated with traditional methods. Additionally, it offers enhanced security for sensitive information.

-

Is technical support available for users filing the Form 202 Annual Return with airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive technical support for users navigating the submission of the Form 202 Annual Return For Company Not Having Share Capital. Support is available through various channels, including email and live chat, ensuring that any questions or issues are promptly addressed. Our dedicated team is committed to helping you succeed.

-

Can I customize my documents for the Form 202 Annual Return in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their documents tailored specifically for the Form 202 Annual Return For Company Not Having Share Capital. This includes adding your company logo, changing templates, and including specific fields to gather pertinent information. Customization ensures that the form meets your business needs while maintaining compliance with regulatory standards.

Get more for Form 202 Annual Return For Company Not Having Share Capital

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase new hampshire form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant new hampshire form

- New hampshire landlord notice form

- New hampshire letter 497318659 form

- Temporary lease agreement to prospective buyer of residence prior to closing new hampshire form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction new form

- Letter from landlord to tenant returning security deposit less deductions new hampshire form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return new hampshire form

Find out other Form 202 Annual Return For Company Not Having Share Capital

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed