Otsego County Bed Tax 2008-2026

Understanding the Otsego County Bed Tax

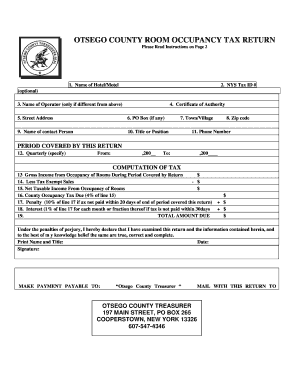

The Otsego County Bed Tax is a specific tax levied on accommodations within Otsego County, New York. This tax is typically applied to short-term lodging, such as hotels, motels, and rental properties. The revenue generated from this tax is often used to promote tourism and support local infrastructure. Understanding this tax is essential for property owners and businesses that provide lodging services, as it directly impacts pricing and compliance.

Steps to Complete the Otsego County Bed Tax Return

Completing the Otsego County Bed Tax return involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including sales records and occupancy data. Next, fill out the appropriate New York tax return form, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form either online or via mail, depending on your preference and the guidelines provided by the county.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for compliance with the Otsego County Bed Tax. Typically, returns are due quarterly, with specific dates set by the county. Failing to meet these deadlines can result in penalties or interest charges. It is advisable to mark these dates on your calendar and prepare your documentation in advance to avoid any last-minute issues.

Required Documents for Submission

To successfully file the Otsego County Bed Tax return, certain documents are required. These may include:

- Sales records for the lodging services provided.

- Occupancy reports detailing the number of guests and nights stayed.

- The completed New York tax return form specific to the bed tax.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with local regulations.

Legal Use of the Otsego County Bed Tax

The legal framework surrounding the Otsego County Bed Tax is established by state and local laws. It is important for lodging providers to understand their obligations under these laws to avoid non-compliance. This includes accurately calculating the tax owed and submitting the required forms by the specified deadlines. Familiarity with these legal requirements helps protect businesses from potential penalties.

Who Issues the Otsego County Bed Tax Form

The Otsego County Bed Tax form is issued by the local tax authority responsible for collecting the bed tax. This authority provides the necessary forms and instructions for filing. It is essential to obtain the correct form to ensure compliance with local regulations, as using an outdated or incorrect form may lead to filing issues.

Quick guide on how to complete otsego county bed tax

Effortlessly Prepare Otsego County Bed Tax on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Otsego County Bed Tax on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Otsego County Bed Tax with Ease

- Locate Otsego County Bed Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method for submitting your form: by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious document searches, or mistakes that necessitate reprinting copies. airSlate SignNow addresses all your document management needs in mere clicks from any device you choose. Edit and eSign Otsego County Bed Tax and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otsego county bed tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a New York tax return using airSlate SignNow?

Filing your New York tax return with airSlate SignNow is simple and efficient. First, create or upload your tax documents to the platform. Then, use our eSignature features to sign and send your New York tax return electronically, ensuring compliance with state regulations.

-

How much does it cost to eSign a New York tax return with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for eSigning your New York tax return. We provide free trials and monthly subscriptions, allowing you to select a plan that works within your budget while ensuring your tax documents are securely signed.

-

What features does airSlate SignNow offer for tax documents like the New York tax return?

Our platform includes essential features for handling your New York tax return, such as customizable templates, automated reminders, and secure storage. These tools streamline the signing process, reducing the time and effort needed to manage your tax documents effectively.

-

Is airSlate SignNow compliant with New York tax regulations when it comes to eSigning documents?

Yes, airSlate SignNow is fully compliant with New York tax regulations regarding eSigning documents. Our platform adheres to the Electronic Signatures in Global and National Commerce Act (ESIGN), ensuring that your electronic signatures on New York tax returns are legally valid and recognized.

-

Can I integrate airSlate SignNow with other accounting software for my New York tax return?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, simplifying the process of managing your New York tax return. This integration allows for streamlined data transfer and document management, making tax season less stressful for your business.

-

What benefits does using airSlate SignNow provide for managing my New York tax return?

By using airSlate SignNow for your New York tax return, you benefit from faster processing times, reduced paperwork, and enhanced security. Our platform ensures your documents are signed quickly and saved securely, improving overall efficiency during tax season.

-

How does airSlate SignNow ensure the security of my New York tax return documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption methods and secure cloud storage to protect your New York tax return documents from unauthorized access, giving you peace of mind while managing sensitive information.

Get more for Otsego County Bed Tax

- Assignment of mortgage package new hampshire form

- Assignment of lease package new hampshire form

- Lease purchase agreements package new hampshire form

- Satisfaction cancellation or release of mortgage package new hampshire form

- Premarital agreements package new hampshire form

- Painting contractor package new hampshire form

- Framing contractor package new hampshire form

- Foundation contractor package new hampshire form

Find out other Otsego County Bed Tax

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free