Form 479

What is the Form 479

The Form 479, officially known as the "Form 479: Tax on Unrelated Business Income of Exempt Organizations," is a tax form used by organizations that are exempt from federal income tax under section 501(a) of the Internal Revenue Code. This form is specifically designed for reporting unrelated business income, which is income generated from activities not substantially related to the organization’s exempt purpose. Understanding the nuances of this form is essential for maintaining compliance with IRS regulations and ensuring that tax obligations are met accurately.

How to use the Form 479

Using the Form 479 involves several important steps to ensure that all unrelated business income is reported correctly. First, organizations must gather all relevant financial information related to their unrelated business activities. This includes revenue generated from these activities and any associated expenses. Next, the organization must complete the form by accurately filling out the required sections, which detail the income and deductions related to the unrelated business activities. Finally, the completed form should be submitted along with the organization's annual tax return, typically Form 990 or 990-EZ, to the IRS.

Steps to complete the Form 479

Completing the Form 479 requires careful attention to detail. Follow these steps for accurate completion:

- Collect financial records related to unrelated business income.

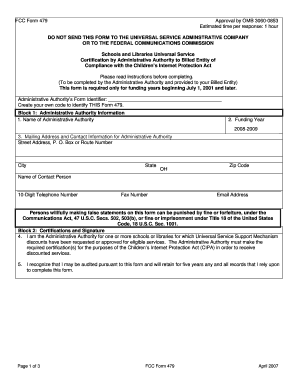

- Fill in the organization’s name, address, and EIN at the top of the form.

- Report the total unrelated business income in the designated section.

- List allowable deductions associated with generating that income.

- Calculate the net unrelated business taxable income.

- Sign and date the form before submission.

Legal use of the Form 479

The legal use of the Form 479 is governed by IRS regulations. Organizations must ensure that they are compliant with the requirements set forth in the Internal Revenue Code. This includes accurately reporting unrelated business income and paying any taxes owed. Failure to comply can result in penalties, including the potential loss of tax-exempt status. Organizations should maintain thorough records to support the information reported on the form, as this may be required in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 479 align with the organization’s tax return deadlines. Typically, the form must be filed by the 15th day of the fifth month after the end of the organization’s tax year. For example, if the organization operates on a calendar year basis, the form would be due on May 15 of the following year. It is crucial to be aware of these deadlines to avoid late filing penalties and to ensure compliance with IRS regulations.

Who Issues the Form

The Form 479 is issued by the Internal Revenue Service (IRS). Organizations seeking to report unrelated business income must obtain the form directly from the IRS website or through authorized tax preparation software. It is important for organizations to use the most current version of the form to ensure compliance with any updates or changes in tax law.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 479 can lead to significant penalties. Organizations that fail to file the form or inaccurately report unrelated business income may face fines and additional taxes owed. In severe cases, repeated non-compliance can jeopardize an organization’s tax-exempt status, leading to further financial implications. Organizations should prioritize accurate reporting and timely submission to mitigate these risks.

Quick guide on how to complete form 479

Complete Form 479 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Form 479 on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 479 with ease

- Find Form 479 and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign Form 479 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 479

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 479 and why is it important?

Form 479, also known as the 'Form to Report Information on the Special Rule for Certain Transfers of Property,' is crucial for businesses to comply with IRS regulations. By accurately completing Form 479, you ensure proper reporting of certain transactions, avoiding potential penalties and maintaining compliance.

-

How can airSlate SignNow help with completing Form 479?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out Form 479. With its template feature, users can easily create, edit, and electronically sign the form, making document management quick and efficient.

-

Is there a cost associated with using airSlate SignNow for Form 479?

Yes, airSlate SignNow has affordable pricing plans tailored for different business needs, which include features for managing Form 479 and other documents. The cost-effectiveness of our solution ensures that you get great value without compromising on functionality.

-

Are there any integration options available for Form 479?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to access Form 479 easily alongside your other business tools. This integration enhances workflow efficiency and ensures that all documents can be managed from a single platform.

-

What are the key features of airSlate SignNow related to Form 479?

Key features related to Form 479 in airSlate SignNow include customizable templates, electronic signatures, and real-time tracking. These functionalities streamline the document management process, making it easier for businesses to handle important forms like Form 479.

-

Can I track my Form 479 submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking functionality that allows you to monitor the status of your Form 479 submissions. You'll receive notifications on completion and can easily access submitted forms, ensuring you stay organized.

-

Is eSigning Form 479 secure with airSlate SignNow?

Absolutely! eSigning Form 479 with airSlate SignNow is highly secure. We use advanced encryption and security protocols to ensure that your sensitive information remains protected throughout the signing process.

Get more for Form 479

Find out other Form 479

- Sign Alaska Banking Purchase Order Template Myself

- Help Me With Sign Alaska Banking Lease Agreement Template

- Sign Alabama Banking Quitclaim Deed Computer

- Sign Alabama Banking Quitclaim Deed Now

- How Can I Sign Arkansas Banking Moving Checklist

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe