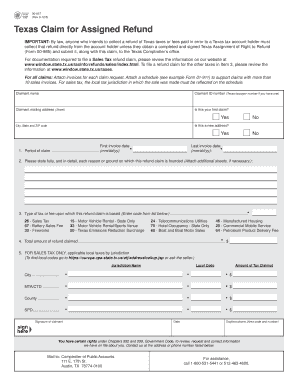

Texas Claim for Refund Form

What is the Texas Claim For Refund

The Texas Claim For Refund, often referred to as form 00 985, is a document utilized by taxpayers in Texas to request a refund of overpaid taxes. This form is essential for individuals and businesses that have paid more tax than they owe, allowing them to reclaim the excess amount. The form must be filled out accurately to ensure a smooth processing of the refund request.

Steps to Complete the Texas Claim For Refund

Completing the Texas Claim For Refund involves several key steps:

- Gather necessary documentation, including proof of payment and any relevant tax returns.

- Fill out the form 00 985 with accurate personal and financial information.

- Clearly specify the amount you are claiming for a refund.

- Review the form for completeness and accuracy to avoid delays.

- Submit the completed form to the appropriate Texas tax authority.

Legal Use of the Texas Claim For Refund

The Texas Claim For Refund is legally binding when completed correctly. It is important to adhere to state regulations regarding tax refunds to avoid potential penalties. Submitting this form signifies that the taxpayer is entitled to the refund claimed and that all information provided is true and accurate. Compliance with the relevant tax laws ensures that the refund process is conducted smoothly and legally.

Required Documents

To successfully file the Texas Claim For Refund, certain documents are required:

- Proof of tax payment, such as receipts or bank statements.

- Copies of relevant tax returns for the years in question.

- Any correspondence with the Texas Comptroller's office regarding the tax payment.

Having these documents ready will facilitate the refund process and help substantiate the claim.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Texas Claim For Refund. Generally, claims must be submitted within four years from the date the tax was paid. Missing this deadline can result in the forfeiture of the right to claim a refund. Taxpayers should also keep track of any changes in legislation that may affect these deadlines.

Who Issues the Form

The Texas Claim For Refund is issued by the Texas Comptroller of Public Accounts. This office is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers should refer to the Comptroller's website or office for any updates or additional information regarding the form and the refund process.

Quick guide on how to complete texas claim for refund

Effortlessly Prepare Texas Claim For Refund on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Texas Claim For Refund on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Texas Claim For Refund with Ease

- Obtain Texas Claim For Refund and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and eSign Texas Claim For Refund and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 00 985 and how is it used?

Form 00 985 is a crucial document used in various business and legal processes. It typically requires signatures from multiple parties, making it essential for efficient workflow management. airSlate SignNow simplifies the process of preparing, sending, and eSigning form 00 985, streamlining your operations.

-

How does airSlate SignNow enhance the completion of form 00 985?

airSlate SignNow enhances the completion of form 00 985 by providing a user-friendly platform for document signing. The service allows you to upload the form, add signature fields, and send it to signers seamlessly. This leads to faster processing times and reduces the risk of errors associated with manual signatures.

-

Is there a cost associated with using airSlate SignNow for form 00 985?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing plans vary based on features, but they are generally affordable, especially compared to the costs of printing and mailing physical documents like form 00 985.

-

What features does airSlate SignNow offer for managing form 00 985?

airSlate SignNow offers a range of features for managing form 00 985, including customizable templates, advanced tracking, and automated reminders. These features ensure that you can send, sign, and store the document efficiently. Additionally, the platform supports multiple signers, making collaboration easy.

-

Can I integrate airSlate SignNow with other applications while handling form 00 985?

Absolutely! airSlate SignNow integrates with numerous applications such as Google Drive, Salesforce, and Dropbox. This means you can easily manage form 00 985 alongside your existing tools, enhancing productivity and ensuring all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for form 00 985?

Using airSlate SignNow for form 00 985 provides numerous benefits, including increased efficiency, reduced turnaround time, and the elimination of paper-based workflows. Businesses can also ensure compliance and improve record-keeping, making it a smart choice for document management.

-

Is airSlate SignNow secure for signing sensitive documents like form 00 985?

Yes, airSlate SignNow implements robust security measures to protect sensitive documents, including form 00 985. The platform features end-to-end encryption, secure storage, and audit trails to ensure that all signers' information remains confidential and protected.

Get more for Texas Claim For Refund

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property alaska form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential alaska form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property alaska form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property alaska form

- Response to subcontractors request by corporation or llc alaska form

- Lenders response to stop lending notice individual alaska form

- Agreed written termination of lease by landlord and tenant alaska form

- Lenders response to stop lending notice corporation or llc alaska form

Find out other Texas Claim For Refund

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later