1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

What is the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

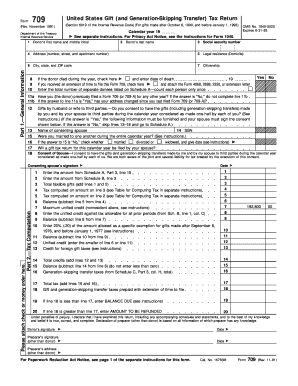

The 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return is a tax form used by individuals to report gifts made during the tax year that exceed the annual exclusion limit. This form is essential for those who may be subject to the federal gift tax. It also addresses generation-skipping transfers, which involve transferring assets to beneficiaries who are at least two generations younger than the donor. Understanding this form is crucial for compliance with U.S. tax laws and for effective estate planning.

Steps to complete the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

Completing the 1191 Form 709 involves several key steps:

- Gather necessary information: Collect details about the gifts made, including the recipient's information and the fair market value of each gift.

- Determine exclusions: Identify any gifts that qualify for the annual exclusion and any applicable deductions.

- Fill out the form: Complete all sections of the form accurately, ensuring that all required information is provided.

- Review for accuracy: Double-check all entries for correctness to avoid potential issues with the IRS.

- Sign and date the form: Ensure that the form is signed by the donor, as this is a legal requirement.

How to obtain the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

The 1191 Form 709 can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out by hand or completed electronically. Additionally, tax preparation software may include this form, allowing users to fill it out digitally. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Legal use of the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

The legal use of the 1191 Form 709 is critical for ensuring compliance with federal tax law. This form must be filed by individuals who make gifts exceeding the annual exclusion limit. Failure to file the form when required can result in penalties and interest on unpaid taxes. The form serves as a formal declaration of gifts and generation-skipping transfers, and it is essential for accurately reporting taxable gifts to the IRS.

Key elements of the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

Key elements of the 1191 Form 709 include:

- Donor information: Details about the individual making the gifts.

- Recipient information: Names and relationships of the individuals receiving the gifts.

- Gift descriptions: A thorough description of each gift, including its value and date of transfer.

- Exclusions and deductions: Information on any applicable exclusions or deductions that affect the taxable amount.

- Signature: The form must be signed by the donor to validate the information provided.

Filing Deadlines / Important Dates

The deadline for filing the 1191 Form 709 is typically April 15 of the year following the tax year in which the gifts were made. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is essential to keep track of these dates to avoid late filing penalties. Additionally, if an extension is filed for your income tax return, it may also extend the deadline for filing the gift tax return.

Quick guide on how to complete 1191 form 709 united states gift and generation skipping transfer tax return

Prepare 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return without effort

- Locate 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1191 form 709 united states gift and generation skipping transfer tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return?

The 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return is a tax form used to report gifts to individuals and certain transfers that fall under the generation-skipping transfer tax provisions. It helps individuals comply with tax regulations regarding signNow gifts and generational wealth transfers.

-

How can airSlate SignNow assist with filing the 1191 Form 709?

airSlate SignNow offers an easy-to-use platform that enables users to complete and eSign the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return efficiently. With our electronic signature capabilities, you can ensure that your forms are properly signed and submitted in a timely manner.

-

Is there a cost associated with using airSlate SignNow to prepare the 1191 Form 709?

Yes, airSlate SignNow provides cost-effective pricing plans tailored to meet your business needs. You can explore various subscription options that offer features for preparing and signing the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return without breaking the bank.

-

What features does airSlate SignNow offer for managing documents like the 1191 Form 709?

airSlate SignNow includes features such as customizable templates, secure document storage, and integration with popular apps. These tools streamline the process of preparing the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return and ensure that you can manage all related documents efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software to handle the 1191 Form 709?

Absolutely! airSlate SignNow integrates smoothly with many accounting software platforms. This allows you to manage the financial aspects related to the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return seamlessly within your existing workflows.

-

What are the benefits of using airSlate SignNow for the 1191 Form 709?

Using airSlate SignNow for the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return offers efficiency, security, and convenience. Our platform enables easy access to documents and helps ensure compliance with tax regulations through proper documentation and electronic signatures.

-

How secure is the airSlate SignNow platform for handling sensitive documents like the 1191 Form 709?

AirSlate SignNow prioritizes security with features such as bank-level encryption and secure access controls. When you manage the 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return on our platform, you can rest assured that your sensitive information is well-protected.

Get more for 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497320641 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair nevada form

- Letter tenant landlord form

- Nevada broken form

- Nevada demand form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497320646 form

- Nv tenant landlord form

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings nevada form

Find out other 1191 Form 709 United States Gift and Generation Skipping Transfer Tax Return

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free