Tt 141a Form

What is the Tt 141a Form

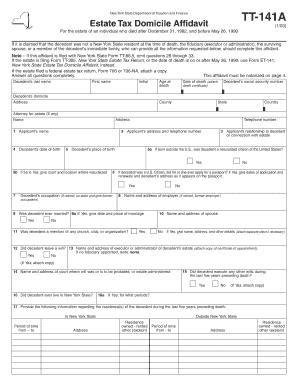

The Tt 141a Form is a specific document used in various administrative processes, particularly in the context of tax reporting and compliance. This form is essential for individuals and businesses to provide necessary information to the relevant authorities. It serves as a formal declaration of certain details that may affect tax obligations or eligibility for specific benefits. Understanding the purpose and requirements of the Tt 141a Form is crucial for ensuring accurate and timely submissions.

How to use the Tt 141a Form

Using the Tt 141a Form involves several straightforward steps. First, gather all required information, including personal identification details and any financial data relevant to the form. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays or complications. Once completed, review the form for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery, depending on the requirements set by the issuing authority.

Steps to complete the Tt 141a Form

Completing the Tt 141a Form involves a systematic approach to ensure all necessary information is accurately provided. Follow these steps:

- Gather all required documentation, such as identification and financial records.

- Read the instructions carefully to understand each section of the form.

- Fill out the form completely, ensuring all fields are addressed.

- Double-check for accuracy, including spelling and numerical entries.

- Sign and date the form where required.

- Submit the form through the appropriate channel as directed.

Legal use of the Tt 141a Form

The legal use of the Tt 141a Form is governed by specific regulations that dictate how it should be filled out and submitted. To ensure the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Compliance with applicable laws and regulations is essential, as failure to adhere to these guidelines can result in penalties or legal complications. Understanding these legal requirements helps individuals and businesses navigate the process effectively.

Key elements of the Tt 141a Form

The Tt 141a Form comprises several key elements that are vital for its completion. These elements typically include:

- Identification information, such as name and address.

- Financial details relevant to the form's purpose.

- Signature and date fields to validate the submission.

- Any additional information required by the issuing authority.

Each element plays a crucial role in ensuring the form serves its intended purpose and meets legal requirements.

Form Submission Methods

The Tt 141a Form can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission via designated platforms.

- Mailing the completed form to the appropriate address.

- In-person delivery at specified locations.

Choosing the correct submission method is important for ensuring timely processing and compliance with regulations.

Quick guide on how to complete tt 141a form

Complete Tt 141a Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can find the correct form and safely store it online. airSlate SignNow equips you with all the tools required to create, adjust, and eSign your documents swiftly without any holdups. Manage Tt 141a Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Tt 141a Form with ease

- Find Tt 141a Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Tt 141a Form to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tt 141a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tt 141a Form and why is it important?

The Tt 141a Form is a specific document used for tax purposes, which must be completed and submitted accurately to ensure compliance with local regulations. It helps businesses keep track of financial transactions and is crucial for tax reporting. Understanding the Tt 141a Form is essential for any organization to avoid penalties and ensure smooth financial operations.

-

How can airSlate SignNow help with the Tt 141a Form?

AirSlate SignNow streamlines the process of completing and signing the Tt 141a Form by providing an easy-to-use platform. Users can fill out the form electronically, add signatures, and send it securely. This not only saves time but also reduces the chances of errors typically associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for Tt 141a Form?

While airSlate SignNow offers a free trial, there is a subscription fee for continued access to all its features, including those necessary for managing the Tt 141a Form. The pricing is designed to be cost-effective, catering to businesses of all sizes. You can choose the plan that best fits your needs and budget.

-

Are there any integrations available for handling the Tt 141a Form?

Yes, airSlate SignNow provides various integrations that facilitate the management of the Tt 141a Form. You can connect it with popular applications like Google Drive, Dropbox, and many others. These integrations enhance workflow efficiency and ensure your documents are securely stored and easily accessible.

-

Can I legally sign the Tt 141a Form with airSlate SignNow?

Absolutely! airSlate SignNow is compliant with eSignature laws, which means you can legally sign the Tt 141a Form electronically. This feature allows for quicker processing and eliminates the need for printing and scanning. Be assured that your electronic signatures are valid and secure.

-

What features does airSlate SignNow offer for the Tt 141a Form?

AirSlate SignNow offers a range of features for handling the Tt 141a Form, including customizable templates, secure storage, and automated reminders for signatures. These tools simplify the document management process and enhance collaboration among team members. With these features, managing your Tt 141a Form becomes more efficient and user-friendly.

-

How can airSlate SignNow improve my efficiency with the Tt 141a Form?

By using airSlate SignNow, your workflow for the Tt 141a Form becomes signNowly more efficient. The platform automates many repetitive tasks, allowing you to focus on what matters most—your business. Additionally, features like document tracking and instant notifications keep you updated throughout the process.

Get more for Tt 141a Form

- Personal representatives deed of distribution of mineral rights new mexico form

- Warranty deed from a trust to a trust new mexico form

- New mexico limited form

- Deed of sale personal representative to one or more individuals new mexico form

- New mexico corporation form

- Nm interest form

- Claim of lien by individual new mexico form

- Quitclaim deed by two individuals to llc new mexico form

Find out other Tt 141a Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement