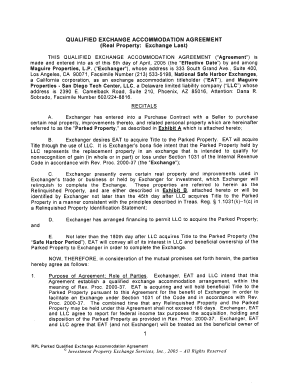

Qualified Exchange Accommodation Agreement Form

What is the qualified exchange accommodation agreement?

The qualified exchange accommodation agreement is a legal document that facilitates a 1031 exchange, allowing property owners to defer capital gains taxes when selling and purchasing investment properties. This agreement outlines the responsibilities of the parties involved, including the accommodator, who holds the title of the property being acquired. It ensures compliance with IRS regulations, making it a crucial component for investors looking to maximize their tax benefits while adhering to legal requirements.

How to use the qualified exchange accommodation agreement

Using the qualified exchange accommodation agreement involves several steps. First, the property owner must identify a qualified intermediary or accommodator. Next, both parties will execute the agreement, detailing the terms of the exchange and the specific properties involved. The accommodator will then acquire the replacement property on behalf of the seller, allowing the seller to complete the transaction without taking direct ownership of the new property. This process helps maintain the integrity of the 1031 exchange.

Steps to complete the qualified exchange accommodation agreement

Completing the qualified exchange accommodation agreement requires careful attention to detail. The following steps outline the process:

- Identify a qualified intermediary or accommodator.

- Gather necessary documentation related to the properties involved.

- Draft the agreement, including all pertinent details such as timelines and property descriptions.

- Both parties should review and sign the agreement, ensuring all terms are clear and agreed upon.

- Submit the signed agreement to the accommodator and ensure compliance with IRS guidelines.

Key elements of the qualified exchange accommodation agreement

The qualified exchange accommodation agreement includes several key elements that are essential for its validity. These elements typically encompass:

- Identification of the parties involved, including the seller and the accommodator.

- Detailed descriptions of the relinquished and replacement properties.

- Timelines for the exchange process, including deadlines for identifying and acquiring properties.

- Terms regarding the handling of funds and any fees associated with the transaction.

- Compliance clauses ensuring adherence to IRS regulations.

Legal use of the qualified exchange accommodation agreement

The legal use of the qualified exchange accommodation agreement is governed by IRS regulations under Section 1031. To ensure its legal validity, the agreement must be executed before the sale of the relinquished property. It must also clearly define the roles and responsibilities of all parties involved. Adhering to these legal requirements helps protect the interests of the property owner and ensures that the tax deferral benefits are maintained.

Examples of using the qualified exchange accommodation agreement

Examples of using the qualified exchange accommodation agreement can illustrate its practical application. For instance, a property owner selling a commercial building may enter into this agreement to defer taxes while acquiring a new office space. Another example could involve a residential property owner selling their rental home and using the agreement to purchase a multi-family unit. These scenarios highlight the versatility of the agreement in various real estate transactions.

Quick guide on how to complete qualified exchange accommodation agreement

Effortlessly Prepare Qualified Exchange Accommodation Agreement on Any Device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to easily locate the correct form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Qualified Exchange Accommodation Agreement on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Qualified Exchange Accommodation Agreement Seamlessly

- Find Qualified Exchange Accommodation Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Qualified Exchange Accommodation Agreement and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qualified exchange accommodation agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a qualified exchange accommodation agreement?

A qualified exchange accommodation agreement is a legal document used in 1031 exchanges to facilitate the sale and acquisition of replacement properties. This agreement allows parties to defer capital gains taxes while ensuring compliance with IRS regulations. Understanding this agreement is essential for anyone looking to optimize taxes on real estate investments.

-

How does airSlate SignNow support the qualified exchange accommodation agreement process?

airSlate SignNow simplifies the process of creating and signing a qualified exchange accommodation agreement by providing an intuitive electronic signature platform. Users can easily upload, edit, and manage their documents, ensuring a seamless experience. Additionally, the solution enhances compliance by maintaining a secure and organized document trail.

-

What are the costs associated with using airSlate SignNow for qualified exchange accommodation agreements?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses working with qualified exchange accommodation agreements. Users can choose from monthly or annual subscriptions, each designed to deliver cost-effective solutions for electronic signing and document management. Get started with a free trial to explore the features without any commitment.

-

Can I integrate airSlate SignNow with other tools for managing qualified exchange accommodation agreements?

Yes, airSlate SignNow offers seamless integrations with various business tools to enhance workflow efficiency when managing qualified exchange accommodation agreements. Connect with popular applications like Google Drive, Salesforce, and more to streamline your document processes. This interoperability helps ensure your agreements are handled with ease and precision.

-

What features of airSlate SignNow can enhance the creation of a qualified exchange accommodation agreement?

The robust features of airSlate SignNow include customizable templates, advanced editing tools, and an intuitive user interface that make crafting a qualified exchange accommodation agreement efficient. Users benefit from real-time collaboration, secure storage, and automated reminders for document signing, ensuring all parties are aligned throughout the process.

-

What benefits does using airSlate SignNow provide for qualified exchange accommodation agreements?

Utilizing airSlate SignNow for qualified exchange accommodation agreements streamlines the entire documentation process, saving time and resources. The platform enhances security, offers a user-friendly experience, and provides legal compliance through its secure digital signature process. As a result, businesses can focus more on their transactions and less on paperwork.

-

Is airSlate SignNow compliant with regulations concerning qualified exchange accommodation agreements?

Absolutely, airSlate SignNow is designed to comply with all applicable regulations regarding qualified exchange accommodation agreements. This includes adhering to e-signature laws, ensuring that all electronic signatures meet strict legal standards. Users can confidently rely on airSlate SignNow for safe and compliant document execution throughout the exchange process.

Get more for Qualified Exchange Accommodation Agreement

- Quitclaim deed from individual to llc new mexico form

- Warranty deed from individual to llc new mexico form

- Conditional lien waiver form

- New mexico deed 497319938 form

- Warranty deed from husband and wife to corporation new mexico form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new mexico

- Unconditional lien final payment form

- Quitclaim deed from husband and wife to llc new mexico form

Find out other Qualified Exchange Accommodation Agreement

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple