Rental Property Worksheet Form

What is the Rental Property Worksheet

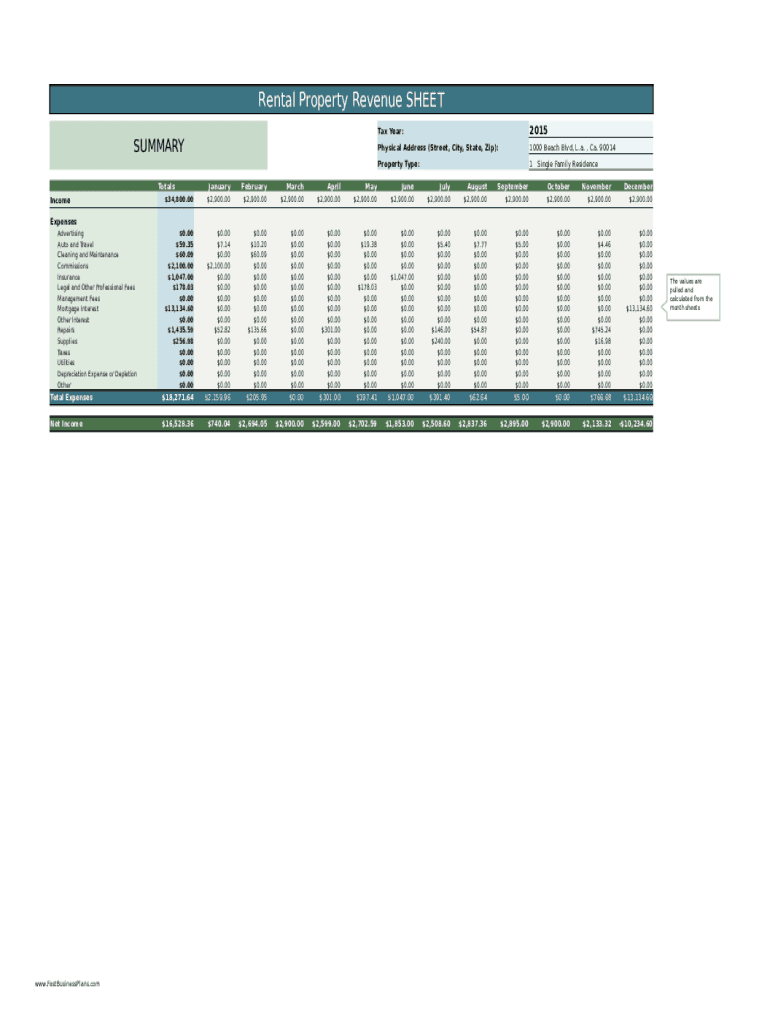

The rental property worksheet is a crucial document used by landlords and property owners to track and report rental income and expenses. This worksheet helps in organizing financial information related to rental properties, making it easier to prepare tax returns and manage finances. It typically includes sections for listing rental income, operating expenses, and deductions, ensuring that all relevant financial details are captured systematically.

How to Use the Rental Property Worksheet

Using the rental property worksheet involves several steps to ensure accurate reporting of income and expenses. Begin by gathering all relevant financial documents, such as lease agreements, receipts for repairs, and utility bills. Next, fill in the worksheet with your rental income, including monthly rent and any additional fees. Document all expenses related to the property, such as maintenance costs, property management fees, and insurance. This organized approach allows for a comprehensive view of your rental property's financial performance.

Steps to Complete the Rental Property Worksheet

Completing the rental property worksheet requires careful attention to detail. Follow these steps:

- Gather Documentation: Collect all financial records related to the property.

- Enter Rental Income: List all sources of rental income, including any additional fees.

- Document Expenses: Record all allowable expenses, such as repairs, maintenance, and utilities.

- Calculate Totals: Sum up the total income and total expenses to determine net income.

- Review for Accuracy: Double-check all entries to ensure accuracy before submission.

Legal Use of the Rental Property Worksheet

The rental property worksheet is legally recognized as a tool for documenting income and expenses related to rental properties. It is essential to maintain accurate records, as these documents may be requested by the IRS during audits or reviews. Ensuring that the worksheet is filled out correctly and comprehensively can help protect landlords from potential legal issues and ensure compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of rental income and expenses. Landlords must adhere to these guidelines to avoid penalties and ensure compliance. Key points include accurately reporting all rental income, maintaining thorough records of expenses, and understanding which deductions are permissible. Familiarizing oneself with IRS regulations can help in effectively using the rental property worksheet and maximizing allowable deductions.

Form Submission Methods

Once the rental property worksheet is completed, it can be submitted through various methods. Landlords can file their taxes online using tax software that supports the rental property worksheet, or they may choose to mail a paper copy to the IRS. In-person submission is also an option, although it is less common. Each method has its own advantages, such as immediate confirmation for online submissions versus the traditional approach of mailing documents.

Quick guide on how to complete rental property worksheet

Effortlessly Prepare Rental Property Worksheet on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Rental Property Worksheet on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Modify and eSign Rental Property Worksheet Hassle-Free

- Find Rental Property Worksheet and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as an original wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Rental Property Worksheet to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rental property worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are rental income expenses that I can deduct?

Rental income expenses typically include costs such as property management fees, maintenance and repairs, property taxes, and insurance. By deducting these expenses, you can effectively lower your taxable rental income, maximizing profit. Using a digital signature solution like airSlate SignNow can streamline documenting these deductions.

-

How can airSlate SignNow help manage rental income expenses?

airSlate SignNow allows you to easily sign and store important documents related to your rental income expenses. This includes lease agreements, receipts, and invoices. By utilizing this efficient cloud-based solution, you can ensure that all your expense documentation is organized and accessible for tax purposes.

-

Are there any features that help track rental income expenses?

Yes, airSlate SignNow includes features that support easy documentation and organization of rental income expenses. You can create templates for expense tracking, ensuring that all needed information is captured efficiently. This creates a streamlined process to keep your records in order when tax season arrives.

-

What integrations does airSlate SignNow have to manage rental income expenses?

airSlate SignNow integrates with various accounting and property management software. This means that you can easily sync your rental income expenses with your financial records, improving accuracy and reducing the likelihood of errors. Such integrations help maintain a robust financial tracking system.

-

Is airSlate SignNow affordable for managing rental income expenses?

Absolutely! airSlate SignNow offers flexible pricing plans designed for businesses of all sizes, making it a cost-effective solution for managing rental income expenses. The value gained from seamless eSigning and document management signNowly outweighs the investment, particularly when it comes to time saved during tax filing.

-

Can I use airSlate SignNow for multiple rental properties?

Yes, airSlate SignNow is versatile and can manage documentation for multiple rental properties simultaneously. This means you can easily track rental income expenses across all your properties without confusion. Each property can have its dedicated templates and files, simplifying your property management process.

-

How does airSlate SignNow ensure the security of my rental income expenses documentation?

AirSlate SignNow employs advanced security features, including encryption and secure cloud storage, to protect your rental income expenses documentation. With user authentication and permission settings, you have complete control over who accesses your files. This ensures your sensitive financial information remains confidential and secure.

Get more for Rental Property Worksheet

- Al widow 497296216 form

- Legal last will and testament form for widow or widower with minor children alabama

- Legal last will form for a widow or widower with no children alabama

- Legal last will and testament form for a widow or widower with adult and minor children alabama

- Legal last will and testament form for divorced and remarried person with mine yours and ours children alabama

- Legal last will and testament form with all property to trust called a pour over will alabama

- Last will and testament for other persons alabama form

- Notice to beneficiaries of being named in will alabama form

Find out other Rental Property Worksheet

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed