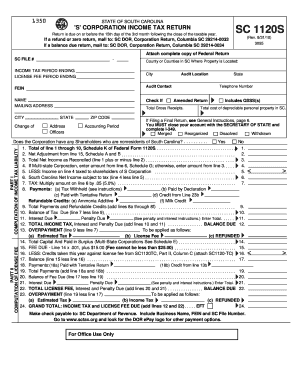

Sc 1120s Form

What is the SC 1120S?

The SC 1120S is a tax form used by S corporations in South Carolina to report income, deductions, and credits to the state. This form is specifically designed for businesses that have elected to be taxed as S corporations, allowing them to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Understanding the SC 1120S is crucial for compliance with state tax regulations and for ensuring that the S corporation meets its filing obligations.

How to Use the SC 1120S

Using the SC 1120S involves several steps to ensure accurate reporting. First, gather all necessary financial information, including income statements, balance sheets, and records of deductions. Next, complete the form by entering the required information, such as total income, deductions, and credits. It is important to review the form for accuracy before submission. The completed SC 1120S must be filed with the South Carolina Department of Revenue by the designated deadline to avoid penalties.

Steps to Complete the SC 1120S

Completing the SC 1120S requires careful attention to detail. Follow these steps:

- Gather financial documents, including income statements and expense records.

- Fill out the form, starting with basic information about the corporation, such as name, address, and federal employer identification number (EIN).

- Report total income and allowable deductions accurately.

- Calculate the tax credits applicable to the corporation.

- Review all entries for accuracy and completeness.

- Submit the form by the filing deadline, either electronically or via mail.

Legal Use of the SC 1120S

The SC 1120S is a legally binding document that must be completed accurately to comply with state tax laws. Proper use of this form ensures that the S corporation meets its legal obligations and avoids potential penalties. It is essential to adhere to the guidelines set forth by the South Carolina Department of Revenue when completing and submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the SC 1120S are crucial for compliance. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the due date is March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to mark these dates on your calendar to ensure timely filing.

Required Documents

To complete the SC 1120S, several documents are necessary. These typically include:

- Financial statements, including profit and loss statements.

- Balance sheets detailing assets and liabilities.

- Records of all income and expenses incurred during the tax year.

- Documentation for any tax credits being claimed.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete sc 1120s

Complete Sc 1120s effortlessly on any device

Digital document management has gained traction among both businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to draft, modify, and eSign your documents swiftly without hold-ups. Manage Sc 1120s on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Sc 1120s with ease

- Obtain Sc 1120s and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent portions of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from a device of your selection. Modify and eSign Sc 1120s and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc 1120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sc 1120s form and why is it important?

The Sc 1120s form is a vital document for S corporations in the United States, serving as a tax return for these entities. It is important because it allows S corporations to report income, deductions, and credits to the IRS while providing shareholders with essential information for their tax filings.

-

How does airSlate SignNow streamline the signing of Sc 1120s documents?

airSlate SignNow simplifies the process of signing Sc 1120s documents by enabling electronic signatures, which eliminate the need for physical paperwork. With its easy-to-use interface, users can quickly get documents signed, saving time and ensuring compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing Sc 1120s forms?

airSlate SignNow provides robust features for managing Sc 1120s forms, such as customizable templates, secure cloud storage, and real-time tracking of document status. These features enable businesses to efficiently handle their tax documents while maintaining full compliance.

-

Is airSlate SignNow cost-effective for handling Sc 1120s documents?

Yes, airSlate SignNow offers a cost-effective solution for businesses managing Sc 1120s documents. Its pricing plans are designed to fit various business sizes and needs, providing excellent value with features aimed at simplifying document management.

-

Can I integrate airSlate SignNow with accounting software for Sc 1120s filing?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to prepare and file Sc 1120s forms. This integration allows for a more streamlined workflow by syncing data directly from your accounting system.

-

What benefits does airSlate SignNow provide when managing Sc 1120s documents?

airSlate SignNow offers numerous benefits, including enhanced security, increased efficiency, and improved collaboration among team members when managing Sc 1120s documents. These benefits help ensure that your tax processes are handled professionally and securely.

-

Is airSlate SignNow user-friendly for those unfamiliar with Sc 1120s forms?

Yes, airSlate SignNow is designed to be user-friendly, even for those unfamiliar with Sc 1120s forms. Its intuitive interface with guided workflows makes it easy for anyone to upload, send, and sign tax documents quickly and confidently.

Get more for Sc 1120s

- Landlord tenant use 497320667 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497320668 form

- Letter tenant notice template 497320669 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497320670 form

- Nv violation form

- Letter tenant rent sample 497320672 form

- Tenant notice increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase nevada form

Find out other Sc 1120s

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure