California Tax Return Form

What is the California Tax Return

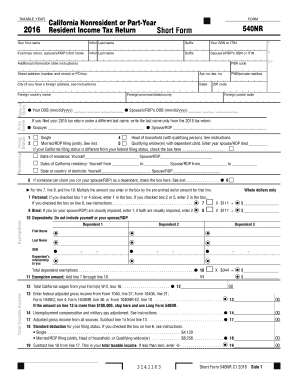

The California tax return is a document that residents of California must file with the state to report their income, deductions, and tax liability for a given tax year. This form is essential for determining how much tax is owed or refunded. The California tax return is typically based on federal tax return information but includes specific state adjustments. It is crucial for individuals and businesses to accurately complete this form to comply with state tax laws.

Steps to complete the California Tax Return

Completing the California tax return involves several key steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and deductions. After that, input your income and deductions into the appropriate sections of the form. Be sure to review all entries for accuracy, as mistakes can lead to delays or penalties. Finally, submit your completed form either electronically or via mail, ensuring it is sent by the filing deadline.

Legal use of the California Tax Return

The California tax return is legally binding when completed and submitted according to state regulations. To ensure its validity, it must include accurate information and be signed by the taxpayer. Electronic signatures are acceptable if they comply with the relevant eSignature laws, such as the ESIGN Act and UETA. It is essential to retain a copy of the filed return for your records, as it may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the California tax return are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request an extension, but it is important to note that this does not extend the time to pay any taxes owed. Keeping track of these important dates can help avoid penalties and interest charges.

Required Documents

To accurately complete the California tax return, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation for deductions, such as mortgage interest statements

- Proof of health insurance coverage

- Any other relevant financial records

Having these documents ready will streamline the filing process and help ensure compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their California tax return. The most common method is electronic filing, which is fast and allows for quicker processing and refunds. Alternatively, individuals can mail their completed forms to the appropriate state tax office. In-person submissions are also accepted at designated locations, though this method is less common. Each method has its own advantages, so choosing the right one may depend on personal preferences or specific circumstances.

Examples of using the California Tax Return

The California tax return can be used in various scenarios, such as:

- Individuals reporting wages from employment

- Freelancers and self-employed individuals declaring business income

- Students claiming education-related deductions

- Families applying for tax credits based on dependents

Understanding these examples can help taxpayers recognize the importance of accurately completing their returns to maximize potential refunds and minimize tax liabilities.

Quick guide on how to complete california tax return 397779762

Finalize California Tax Return effortlessly on any device

Digital document management has become favored among companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Control California Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign California Tax Return seamlessly

- Obtain California Tax Return and then click Get Form to commence.

- Utilize the features we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign California Tax Return and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california tax return 397779762

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a California tax return using airSlate SignNow?

Filing a California tax return with airSlate SignNow is straightforward. You can upload your tax documents, add electronic signatures, and send them securely to the appropriate authorities. The platform ensures compliance and provides tracking options to monitor the progress of your filing.

-

How does airSlate SignNow simplify the California tax return process?

airSlate SignNow simplifies the California tax return process by providing a user-friendly interface for document management. The platform allows users to easily eSign necessary forms and collaborate with tax professionals in real-time, reducing the overall time and effort involved in filing.

-

Are there any costs associated with using airSlate SignNow for California tax returns?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs, including options for individuals and businesses. The costs depend on the features you choose, but all plans include comprehensive tools for managing your California tax return efficiently while keeping your budget in mind.

-

What features does airSlate SignNow offer for managing California tax returns?

airSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage, which are essential for managing your California tax return effectively. These tools help streamline the filing process while ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other tax software for California tax return filing?

Yes, airSlate SignNow offers integrations with popular tax software to enhance the California tax return filing experience. This ensures that users can seamlessly transfer information and documents between platforms, further simplifying the filing process.

-

Is airSlate SignNow secure for handling sensitive California tax return information?

Absolutely! airSlate SignNow prioritizes your privacy and security by implementing advanced encryption and secure channels for document transmission. This means your California tax return information is safe throughout the entire signing and filing process.

-

How do I get started with airSlate SignNow for my California tax return?

To get started with airSlate SignNow for your California tax return, simply sign up for an account on our website. Once registered, you can upload your tax documents, customize them as needed, and use our eSigning features to complete your filing efficiently.

Get more for California Tax Return

- Letter from tenant to landlord about landlord using unlawful self help to gain possession oklahoma form

- Letter from tenant to landlord about illegal entry by landlord oklahoma form

- Letter from landlord to tenant about time of intent to enter premises oklahoma form

- Letter from tenant to landlord containing notice to cease unjustified nonacceptance of rent oklahoma form

- Letter from tenant to landlord about sexual harassment oklahoma form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children oklahoma form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure oklahoma form

- Oklahoma tenant act form

Find out other California Tax Return

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now