Instructions of Where to Mail Gr 1040 Poa Form

What is the Instructions Of Where To Mail Gr 1040 Poa Form

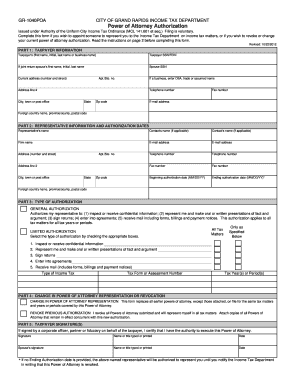

The Instructions of Where to Mail Gr 1040 PoA Form provides essential guidance for individuals who need to submit a Power of Attorney (PoA) form related to their tax filings. This form allows a designated representative to act on behalf of a taxpayer in dealings with the Internal Revenue Service (IRS). Understanding the correct mailing address is crucial to ensure that the form is processed efficiently and without delays. The instructions typically include specific addresses based on the taxpayer's location and the type of tax return being filed.

How to Use the Instructions Of Where To Mail Gr 1040 Poa Form

Using the Instructions of Where to Mail Gr 1040 PoA Form involves several steps. First, ensure that the form is completed accurately, including all required signatures. Next, refer to the mailing instructions to identify the correct address based on your state and the nature of your tax situation. After confirming the address, you can choose to mail the form via standard postal service or expedited delivery, if necessary. It is advisable to keep a copy of the completed form and any mailing receipts for your records.

Steps to Complete the Instructions Of Where To Mail Gr 1040 Poa Form

Completing the Instructions of Where to Mail Gr 1040 PoA Form involves a systematic approach:

- Obtain the Gr 1040 PoA Form from the IRS website or a trusted source.

- Fill out the form with accurate information, including the taxpayer's details and the representative's information.

- Sign the form where indicated, ensuring that all signatures are present.

- Review the instructions carefully to determine the appropriate mailing address.

- Prepare the envelope, including any necessary postage, and send the form to the specified address.

IRS Guidelines

The IRS provides specific guidelines regarding the submission of the Gr 1040 PoA Form. These guidelines outline the required information, the signing process, and the importance of adhering to deadlines. It is essential to follow these guidelines closely to avoid any issues with the processing of the form. The IRS may also update these guidelines periodically, so checking for the latest information is advisable.

Filing Deadlines / Important Dates

Filing deadlines for the Gr 1040 PoA Form are critical to ensure compliance with IRS regulations. Typically, the form must be submitted before the tax return due date for it to be effective for that tax year. Important dates may vary based on individual circumstances, such as extensions or specific state requirements. Keeping track of these dates helps prevent penalties and ensures that the designated representative can act on behalf of the taxpayer without delays.

Required Documents

To successfully submit the Gr 1040 PoA Form, certain documents may be required. These can include:

- Proof of identity for both the taxpayer and the representative.

- Any previous correspondence with the IRS related to the taxpayer's account.

- Additional forms or documentation that may support the authority granted to the representative.

Ensuring that all required documents are included can facilitate a smoother processing experience with the IRS.

Quick guide on how to complete instructions of where to mail gr 1040 poa form

Effortlessly Prepare Instructions Of Where To Mail Gr 1040 Poa Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without any delays. Manage Instructions Of Where To Mail Gr 1040 Poa Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The Simplest Way to Modify and Electronically Sign Instructions Of Where To Mail Gr 1040 Poa Form Effortlessly

- Obtain Instructions Of Where To Mail Gr 1040 Poa Form and click on Obtain Form to initiate.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Signature tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Finish button to save your modifications.

- Choose your preferred method of sharing your form—by email, text message (SMS), invitation link, or download it directly to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Edit and electronically sign Instructions Of Where To Mail Gr 1040 Poa Form and ensure outstanding communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions of where to mail gr 1040 poa form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions of where to mail GR 1040 POA Form?

To find the instructions of where to mail the GR 1040 POA Form, you should refer to the IRS website or official documentation provided with the form. Typically, this form is sent to a specific mailing address based on your location and whether you are including any payment. Ensure you check the most recent guidelines for accurate mailing instructions.

-

How can airSlate SignNow assist with the GR 1040 POA Form process?

airSlate SignNow provides a streamlined solution for managing and signing essential tax documents like the GR 1040 POA Form. Our platform allows you to easily eSign the form and maintain a digital record, ensuring you follow the correct instructions of where to mail the form. This eliminates confusion and enhances your document management.

-

Is there a cost associated with using airSlate SignNow for the GR 1040 POA Form?

Yes, airSlate SignNow operates on a subscription model with affordable pricing options tailored for businesses of all sizes. By using our service, you not only get access to eSigning features but also support in managing documents like the GR 1040 POA Form efficiently. You can start with a free trial to explore the features before committing.

-

Can I integrate airSlate SignNow with other applications for managing the GR 1040 POA Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications including accounting software and CRM tools, making it easier to manage documents like the GR 1040 POA Form within your existing workflows. This ensures you follow the correct instructions of where to mail the form while keeping everything organized.

-

What features does airSlate SignNow offer for eSigning the GR 1040 POA Form?

Our platform provides features such as secure eSigning, document templates, and real-time tracking for your GR 1040 POA Form. These features enhance usability and ensure that you have the correct instructions of where to mail the form. Additionally, you can set reminders for deadlines related to your submissions.

-

How does airSlate SignNow ensure the security of my GR 1040 POA Form?

airSlate SignNow prioritizes your data security. We employ advanced encryption protocols and secure cloud storage to protect your documents, including the GR 1040 POA Form. This gives you peace of mind while following the instructions of where to mail your form and managing sensitive information.

-

Can I track the status of my GR 1040 POA Form once mailed?

Once you send your GR 1040 POA Form via airSlate SignNow, you can track the signing process online. However, tracking the physical mail may depend on your postal service. Using our service allows you to ensure you followed the instructions of where to mail the form correctly, enhancing your overall experience.

Get more for Instructions Of Where To Mail Gr 1040 Poa Form

- Certificate of document preparation oregon form

- Petitioners respondent form

- Oregon request hearing form

- Oregon child support 497323965 form

- Petitioners affidavit in support of motion for order of default oregon 497323966 form

- Affidavit of service regarding various motions orders etc regarding cope oregon form

- Affidavit of service regarding petition and summons oregon form

- Oregon acceptance service 497323969 form

Find out other Instructions Of Where To Mail Gr 1040 Poa Form

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile