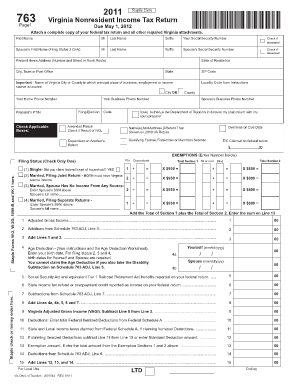

763 Virginia Department of Taxation Tax Virginia Form

What is the 763 Virginia Department Of Taxation Tax Virginia

The 763 Virginia Department Of Taxation Tax Virginia form is a crucial document used for reporting specific tax information to the state of Virginia. This form is typically associated with various tax obligations, including income tax filings for individuals and businesses. Understanding the purpose of this form is essential for compliance with state tax laws.

How to use the 763 Virginia Department Of Taxation Tax Virginia

Using the 763 Virginia Department Of Taxation Tax Virginia form involves several key steps. First, gather all necessary financial documents, such as income statements and deductions. Next, accurately fill out the form, ensuring all information is complete and correct. It is advisable to review the form thoroughly before submission to avoid any errors that could lead to penalties or delays.

Steps to complete the 763 Virginia Department Of Taxation Tax Virginia

Completing the 763 Virginia Department Of Taxation Tax Virginia form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Follow this by reporting your income, deductions, and any applicable credits. After filling out all sections, double-check your calculations and ensure all required signatures are present. Finally, submit the form by the designated deadline.

Legal use of the 763 Virginia Department Of Taxation Tax Virginia

The legal use of the 763 Virginia Department Of Taxation Tax Virginia form is governed by state tax regulations. This form must be completed accurately to ensure compliance with Virginia tax laws. Failure to submit the form correctly or on time can result in penalties, interest, and potential legal action. It is essential to keep a copy of the submitted form for your records in case of future inquiries.

Required Documents

When preparing to complete the 763 Virginia Department Of Taxation Tax Virginia form, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents readily available can streamline the completion process and help ensure accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the 763 Virginia Department Of Taxation Tax Virginia form are critical to adhere to in order to avoid penalties. Typically, the deadline for individual tax returns is May 1st of each year. However, it is important to check for any updates or changes to the deadlines that may occur due to specific circumstances, such as natural disasters or state declarations.

Form Submission Methods (Online / Mail / In-Person)

The 763 Virginia Department Of Taxation Tax Virginia form can be submitted through various methods to accommodate different preferences. Options include:

- Online submission via the Virginia Department of Taxation's website

- Mailing the completed form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the right submission method can help ensure timely processing of your tax return.

Quick guide on how to complete 763 virginia department of taxation tax virginia

Complete 763 Virginia Department Of Taxation Tax Virginia effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and without hassle. Manage 763 Virginia Department Of Taxation Tax Virginia on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign 763 Virginia Department Of Taxation Tax Virginia without a hassle

- Locate 763 Virginia Department Of Taxation Tax Virginia and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and hit the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

No more dealing with lost or misfiled documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign 763 Virginia Department Of Taxation Tax Virginia and ensure excellent communication at any stage of the document creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 763 virginia department of taxation tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 763 Virginia Department Of Taxation Tax Virginia form?

The 763 Virginia Department Of Taxation Tax Virginia form is a tax return for individuals and businesses in Virginia. It is essential for reporting income and ensuring compliance with state tax regulations. Understanding this form helps in effectively managing tax obligations.

-

How can airSlate SignNow help with the 763 Virginia Department Of Taxation Tax Virginia form?

airSlate SignNow simplifies the process of completing and signing the 763 Virginia Department Of Taxation Tax Virginia form. With our intuitive eSigning platform, you can fill out your tax documents digitally, save time, and reduce the risk of errors. Our solution ensures that your tax forms are handled efficiently and securely.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features for managing tax documents, including easy-to-use eSignature tools, templates for various tax forms like the 763 Virginia Department Of Taxation Tax Virginia, and secure cloud storage. These features are designed to make your tax filing process seamless and efficient.

-

Is airSlate SignNow cost-effective for businesses dealing with the 763 Virginia Department Of Taxation Tax Virginia?

Yes, airSlate SignNow offers a cost-effective solution for businesses handling the 763 Virginia Department Of Taxation Tax Virginia forms. Our pricing plans are designed to accommodate various needs and budgets, ensuring that even small businesses can access vital tax document management tools without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for filing my tax forms?

Absolutely! airSlate SignNow can easily integrate with various accounting software, allowing for a smoother workflow when filing the 763 Virginia Department Of Taxation Tax Virginia forms. This integration ensures that all your financial data is synchronized, making tax preparation more straightforward and efficient.

-

How secure is my information when using airSlate SignNow for tax forms?

Your security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your information when filling out and submitting the 763 Virginia Department Of Taxation Tax Virginia forms. This guarantees that your sensitive data stays safe and confidential.

-

What are the benefits of using airSlate SignNow for the 763 Virginia Department Of Taxation Tax Virginia form?

Using airSlate SignNow for the 763 Virginia Department Of Taxation Tax Virginia form streamlines your tax filing process, saves time, and enhances accuracy. Our platform allows for efficient collaboration and ensures that your documents are signed and submitted in a timely manner, reducing stress during tax season.

Get more for 763 Virginia Department Of Taxation Tax Virginia

- Pennsylvania procedures form

- Pa revocation 497324793 form

- Newly divorced individuals package pennsylvania form

- Contractors forms package pennsylvania

- Power of attorney for sale of motor vehicle pennsylvania form

- Wedding planning or consultant package pennsylvania form

- Hunting forms package pennsylvania

- Identity theft recovery package pennsylvania form

Find out other 763 Virginia Department Of Taxation Tax Virginia

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document