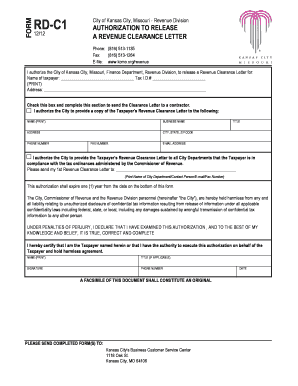

AUTHORIZATION to RELEASE FORM a REVENUE CLEARANCE

What is the authorization to release form a revenue clearance

The authorization to release form a revenue clearance is a legal document that allows individuals or businesses to grant permission for the disclosure of their financial information to a designated third party. This form is often used in situations where a taxpayer needs to provide access to their tax records, account information, or other financial documents to facilitate processes such as loan applications, audits, or financial assessments. By completing this form, the individual or entity authorizes the relevant tax authority or financial institution to share specific information with the appointed representative.

Key elements of the authorization to release form a revenue clearance

Understanding the key elements of the authorization to release form a revenue clearance is essential for ensuring its validity. The primary components typically include:

- Taxpayer Information: This section requires the full name, address, and taxpayer identification number of the individual or business authorizing the release.

- Authorized Representative Details: The form must specify the name and contact information of the person or entity authorized to receive the information.

- Scope of Authorization: This outlines what specific information can be disclosed and for what purpose, ensuring clarity on the extent of access granted.

- Signature and Date: The form must be signed and dated by the taxpayer to validate the authorization, confirming that the request is made willingly.

Steps to complete the authorization to release form a revenue clearance

Completing the authorization to release form a revenue clearance involves several straightforward steps:

- Obtain the Form: Access the form from the relevant tax authority or financial institution's website.

- Fill in Taxpayer Information: Provide accurate details about the individual or business granting authorization.

- Enter Authorized Representative Information: Clearly state the name and contact information of the individual or entity receiving the information.

- Define the Scope: Specify the type of information that can be released and the purpose for which it will be used.

- Sign and Date: Ensure the form is signed and dated by the taxpayer to finalize the authorization.

Legal use of the authorization to release form a revenue clearance

The legal use of the authorization to release form a revenue clearance is governed by various regulations that ensure the protection of taxpayer information. It is essential for the form to comply with federal and state laws regarding privacy and data security. This includes adherence to the Internal Revenue Service (IRS) guidelines, which stipulate that the authorization must be explicit and informed. Additionally, the form must be properly executed to be considered legally binding, meaning it should include all necessary signatures and details to prevent any misuse of the granted authorization.

How to use the authorization to release form a revenue clearance

Using the authorization to release form a revenue clearance effectively involves understanding its application in various scenarios. Once completed, the form can be submitted to the relevant tax authority or financial institution, allowing the designated representative to access the specified financial information. It is crucial to ensure that the form is submitted to the correct entity and that all information is accurate to avoid delays or complications. This form is particularly useful in situations such as applying for loans, undergoing audits, or seeking professional financial advice, where third-party access to financial records is necessary.

Examples of using the authorization to release form a revenue clearance

There are several practical examples of when the authorization to release form a revenue clearance may be utilized:

- Loan Applications: When applying for a mortgage or business loan, lenders may require access to the applicant's tax records to assess financial stability.

- Tax Preparation: A taxpayer may authorize their accountant to obtain tax documents directly from the IRS to ensure accurate filing.

- Financial Audits: During an audit, a taxpayer may need to allow an auditor to access specific financial information to facilitate the review process.

Quick guide on how to complete authorization to release form a revenue clearance

Prepare AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest method to modify and eSign AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE effortlessly

- Find AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization to release form a revenue clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE?

An AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE is a document that enables individuals or businesses to authorize the release of financial information necessary for tax or revenue clearance. This form is crucial when dealing with governmental agencies that require documentation of financial standing or compliance.

-

How does airSlate SignNow facilitate the completion of the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE?

airSlate SignNow streamlines the process of completing the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE by providing an easy-to-use e-signature platform. Users can quickly fill out the required fields, sign the document electronically, and send it to relevant parties without any hassle.

-

Is airSlate SignNow affordable for businesses of all sizes?

Yes, airSlate SignNow offers a cost-effective solution that is affordable for businesses of all sizes. Our pricing plans cater to different business needs, ensuring that you can access features that streamline processes like completing the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE without breaking the bank.

-

What features does airSlate SignNow offer for managing AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure cloud storage to help you manage your AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE efficiently. These tools enhance collaboration and ensure that your documents are completed and stored securely.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM systems and cloud storage solutions. This integration allows users to efficiently manage the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE alongside their other business processes.

-

What are the benefits of using airSlate SignNow for the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE?

Using airSlate SignNow for the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE can signNowly reduce processing time and improve accuracy. Electronic signatures enhance the security of the document, ensuring that your authorization is both valid and trustworthy.

-

How secure is my information when using airSlate SignNow for the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE?

airSlate SignNow prioritizes user security by implementing encryption and compliance with industry standards to protect your sensitive information while completing the AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE. You can use our platform confidently, knowing that your data is safeguarded.

Get more for AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE

- Colorado protective form

- Colorado protective orders form

- Colorado sworn statement form

- Certificate of registration and recognition of guardianship order from other states guardian of adult colorado form

- Instructions for probate with a will colorado form

- Instructions for probate without a will colorado form

- Application probate personal form

- Nomination personal form

Find out other AUTHORIZATION TO RELEASE FORM A REVENUE CLEARANCE

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later