Ca Form 100x

What is the CA Form 100X

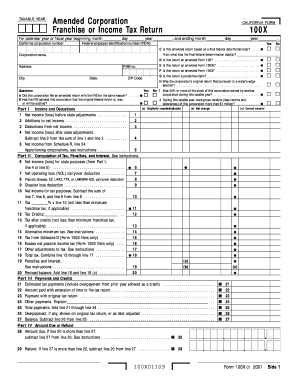

The CA Form 100X is a tax form used by corporations in California to amend their previously filed California corporate income tax returns. This form allows businesses to correct errors, adjust income, or claim deductions that were not included in the original filing. It is essential for ensuring compliance with California tax laws and for accurately reporting a corporation's tax liability.

How to use the CA Form 100X

Using the CA Form 100X involves several steps. First, gather all relevant documents, including the original tax return and any supporting documentation for the changes you are making. Next, fill out the CA Form 100X, providing detailed explanations for each amendment. After completing the form, review it for accuracy. Finally, submit the form to the California Franchise Tax Board, either electronically or by mail, depending on your preference.

Steps to complete the CA Form 100X

Completing the CA Form 100X requires a systematic approach:

- Gather information: Collect your original tax return and any documents related to the changes.

- Fill out the form: Provide the necessary details, including the corporation's name, address, and tax identification number.

- Explain amendments: Clearly describe the reasons for the changes in the designated section.

- Review: Double-check all entries for accuracy and completeness.

- Submit: Send the completed form to the California Franchise Tax Board.

Legal use of the CA Form 100X

The CA Form 100X is legally recognized as a valid method for corporations to amend their tax returns. To ensure that your amendments are accepted, it is crucial to comply with California tax regulations. This includes submitting the form within the designated time frame and providing accurate information. Failure to adhere to these guidelines may result in penalties or delays in processing your amendments.

Filing Deadlines / Important Dates

Filing deadlines for the CA Form 100X are critical for compliance. Generally, the form must be submitted within six months of the original return's due date or the date the original return was filed. It is essential to keep track of these deadlines to avoid penalties and ensure that your amendments are processed in a timely manner.

Required Documents

To complete the CA Form 100X, certain documents are necessary:

- Original California corporate tax return

- Supporting documentation for the changes being made

- Any correspondence from the California Franchise Tax Board related to the original return

Having these documents ready will facilitate a smoother amendment process.

Quick guide on how to complete ca form 100x

Effortlessly Complete Ca Form 100x on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ca Form 100x on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign Ca Form 100x

- Locate Ca Form 100x and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ca Form 100x and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 100x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 100X, and how does it relate to airSlate SignNow?

The CA Form 100X is a critical document used for income tax reporting in California. With airSlate SignNow, you can easily prepare, send, and eSign your CA Form 100X, ensuring compliance and accuracy in your filings.

-

What features does airSlate SignNow offer for handling CA Form 100X?

airSlate SignNow provides features such as document templates, automated workflows, and secure eSigning, all tailored to meet the needs of CA Form 100X users. This streamlined process reduces errors and saves time during tax preparation.

-

Is there a free trial available for using airSlate SignNow for CA Form 100X?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including the efficient handling of CA Form 100X. This risk-free opportunity helps you determine if our solution fits your business needs.

-

How can airSlate SignNow benefit my business when using CA Form 100X?

By using airSlate SignNow for CA Form 100X, your business can enhance its efficiency with seamless document management and electronic signatures. This leads to quicker processing times and improved accuracy in tax filings.

-

What pricing plans does airSlate SignNow offer for CA Form 100X management?

airSlate SignNow offers several pricing plans to suit various business sizes and needs, all optimized for managing documents like CA Form 100X. You can choose a plan that best fits your usage, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with accounting software for CA Form 100X?

Absolutely! airSlate SignNow supports integrations with popular accounting software, making it easy to sync your CA Form 100X seamlessly. This integration enhances workflow efficiency and reduces the risk of errors in your tax processes.

-

Is airSlate SignNow secure for storing CA Form 100X and other documents?

Yes, airSlate SignNow prioritizes security by employing advanced encryption protocols to protect your CA Form 100X and other sensitive documents. You can confidently manage your documents knowing that your information is safeguarded.

Get more for Ca Form 100x

- Legal last will and testament form for widow or widower with minor children colorado

- Legal last will form for a widow or widower with no children colorado

- Legal last will and testament form for a widow or widower with adult and minor children colorado

- Legal last will and testament form for divorced and remarried person with mine yours and ours children colorado

- Legal last will and testament form with all property to trust called a pour over will colorado

- Written revocation of will colorado form

- Last will and testament for other persons colorado form

- Notice to beneficiaries of being named in will colorado form

Find out other Ca Form 100x

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast