Schedule Se Form

What is the Schedule SE Form

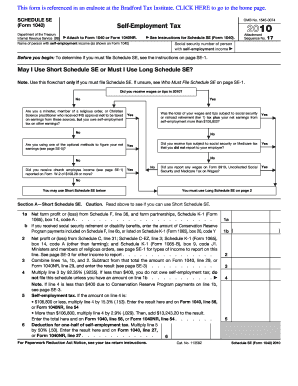

The Schedule SE Form, officially known as the Self-Employment Tax form, is used by individuals who earn income through self-employment. This form allows taxpayers to calculate their self-employment tax, which is comprised of Social Security and Medicare taxes. It is essential for self-employed individuals, including freelancers and independent contractors, to report their earnings accurately to ensure compliance with federal tax obligations.

How to Use the Schedule SE Form

To use the Schedule SE Form, taxpayers must first determine if they are required to file it based on their self-employment income. If an individual's net earnings from self-employment exceed $400, they must complete this form. The form calculates the self-employment tax owed, which is then transferred to the main tax return (Form 1040). It is important to follow the instructions carefully, as errors can lead to penalties or delays in processing.

Steps to Complete the Schedule SE Form

Completing the Schedule SE Form involves several key steps:

- Gather all relevant income documents, including 1099 forms and records of business expenses.

- Calculate your net earnings from self-employment by subtracting business expenses from gross income.

- Fill out Part I of the form to determine your self-employment tax based on your net earnings.

- Complete Part II if you have a church employee income or if you are claiming the optional method for calculating self-employment tax.

- Transfer the calculated self-employment tax to your Form 1040.

Legal Use of the Schedule SE Form

The Schedule SE Form is legally binding when completed accurately and submitted on time. It is crucial for self-employed individuals to file this form to avoid penalties and ensure compliance with IRS regulations. The information provided must be truthful and reflect actual earnings to uphold the integrity of the tax filing process.

IRS Guidelines

The IRS provides specific guidelines for filling out the Schedule SE Form, including eligibility criteria and instructions for various scenarios. Taxpayers should refer to the IRS website or the form's instructions for detailed information on how to report income, calculate taxes, and understand any applicable deductions. Staying informed about IRS updates ensures compliance and helps avoid common pitfalls.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE Form align with the general tax filing deadlines. Typically, self-employed individuals must file their tax returns, including the Schedule SE, by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to keep track of any changes in filing dates to ensure timely submission and avoid penalties.

Required Documents

To complete the Schedule SE Form accurately, taxpayers should gather the following documents:

- Form 1099-NEC or 1099-MISC, if applicable.

- Records of all self-employment income.

- Documentation of business expenses, such as receipts and invoices.

- Any previous tax returns that may provide relevant information.

Quick guide on how to complete schedule se form 6577916

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule Se Form

Create this form in 5 minutes!

How to create an eSignature for the schedule se form 6577916

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule Se Form and how can I use it with airSlate SignNow?

A Schedule Se Form is a tax document used to report income or loss from self-employment. With airSlate SignNow, you can efficiently manage, send, and eSign your Schedule Se Form, ensuring a seamless process for both you and your clients.

-

How much does it cost to use airSlate SignNow for my Schedule Se Form needs?

airSlate SignNow offers flexible pricing plans that cater to various business sizes. You can choose a plan that fits your budget, ensuring that you can easily send and eSign your Schedule Se Form without breaking the bank.

-

What features does airSlate SignNow provide for managing Schedule Se Forms?

airSlate SignNow provides multiple features for managing Schedule Se Forms, including easy document uploads, customizable templates, and electronic signatures. This makes it simple to prepare and sign these forms efficiently, saving you time and reducing paperwork.

-

Can I integrate airSlate SignNow with my accounting software when handling Schedule Se Forms?

Yes, airSlate SignNow offers integrations with various accounting software, allowing you to manage your Schedule Se Form alongside your financial records seamlessly. This streamlines your workflow and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Schedule Se Forms?

Using airSlate SignNow for Schedule Se Forms accelerates the signing process, enhances compliance, and improves record-keeping. Its user-friendly interface and robust features empower you to complete tax-related documents efficiently, making it a valuable tool for any business.

-

Is it secure to send Schedule Se Forms through airSlate SignNow?

Absolutely! airSlate SignNow employs top-notch security protocols, including encryption and secure access controls, to ensure that your Schedule Se Forms are safe. You can confidently send and eSign important documents without concerns about data bsignNowes.

-

How do I get started with airSlate SignNow for my Schedule Se Form needs?

Getting started with airSlate SignNow is easy. Simply sign up for an account, choose the appropriate pricing plan, and start uploading and preparing your Schedule Se Form for eSignature right away!

Get more for Schedule Se Form

Find out other Schedule Se Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement