Form 590

What is the Form 590

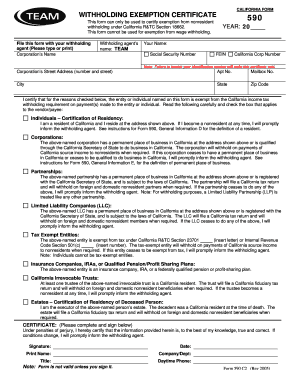

The Form 590 is a tax document used in the United States, specifically for reporting the withholding of California state income tax for certain payments made to non-residents. This form is essential for ensuring compliance with California tax laws and is primarily utilized by payers who are required to withhold taxes on payments made to individuals or entities that do not reside in California. Understanding the purpose and requirements of the Form 590 is crucial for both payers and recipients to avoid potential penalties.

How to use the Form 590

Using the Form 590 involves several steps to ensure accurate completion and compliance with state tax regulations. First, the payer must determine if withholding is necessary based on the type of payment and the residency status of the recipient. Once it is established that the form is required, the payer should fill out the necessary sections, including information about the payment and the recipient. After completing the form, it must be submitted to the California Franchise Tax Board along with any required payments. Proper use of this form helps facilitate the correct withholding of taxes and ensures that all parties meet their tax obligations.

Steps to complete the Form 590

Completing the Form 590 requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect details about the payment, including the amount and purpose, as well as the recipient's information.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy to prevent delays.

- Review the form: Double-check all entries for completeness and correctness before submission.

- Submit the form: Send the completed Form 590 to the California Franchise Tax Board, along with any required payment.

Legal use of the Form 590

The legal use of the Form 590 is governed by California tax laws, which mandate that certain payments to non-residents must have taxes withheld. This form serves as a declaration of the withholding amount and ensures that the payer complies with state regulations. Failure to use the Form 590 correctly can result in penalties for both the payer and the recipient. Therefore, understanding the legal implications and requirements of this form is essential for all parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the Form 590 are critical to ensure compliance with California tax laws. Generally, the form must be submitted by the time the payment is made to the non-resident. It is essential to stay informed about any changes in deadlines, especially during tax season, to avoid late penalties. Keeping track of important dates related to the filing of the Form 590 helps ensure that all tax obligations are met in a timely manner.

Required Documents

To complete the Form 590, certain documents may be needed to provide the necessary information. These documents typically include:

- Payment documentation that details the amount and purpose of the payment.

- Identification information for the recipient, such as their name, address, and taxpayer identification number.

- Any previous correspondence with the California Franchise Tax Board regarding withholding requirements.

Having these documents readily available can streamline the process of completing and submitting the Form 590.

Quick guide on how to complete form 590 38154432

Complete Form 590 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your papers quickly and without delays. Handle Form 590 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 590 with ease

- Locate Form 590 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 590 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590 38154432

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 590 form and why is it important?

The 590 form is used for claiming exemption from withholding for certain types of payments. Understanding the 590 form is critical for businesses to ensure compliance with tax regulations and to avoid unnecessary withholding on payments. It helps streamline the payment process and ensures that funds are not withheld incorrectly.

-

How can airSlate SignNow assist with the 590 form?

airSlate SignNow simplifies the process of signing and sending the 590 form. With its intuitive interface, businesses can easily upload, fill out, and eSign the 590 form, ensuring that all required information is accurately captured. This not only saves time but also enhances the overall efficiency of document management.

-

What are the pricing options for using airSlate SignNow for the 590 form?

airSlate SignNow offers several pricing plans that cater to different business needs, making it cost-effective for handling the 590 form. Whether you're a small business or a large enterprise, you'll find a plan that suits your budget and requirements. Each plan provides access to features that enhance the eSigning process, making it easy to manage the 590 form.

-

Is it secure to use airSlate SignNow for the 590 form?

Yes, airSlate SignNow prioritizes security for all documents, including the 590 form. The platform employs advanced encryption and security protocols to protect your sensitive information during transmission and storage. You can confidently eSign and manage your 590 form knowing that your data is safe and secure.

-

Can I integrate airSlate SignNow with other tools for managing the 590 form?

Absolutely! airSlate SignNow offers seamless integrations with various business tools that enhance your workflow for the 590 form. Whether you need to connect with CRM systems or project management apps, integrating airSlate SignNow allows for a streamlined process, reducing the hassle of handling multiple platforms.

-

What features does airSlate SignNow offer for handling the 590 form?

airSlate SignNow provides several powerful features that enhance the management of the 590 form, including customizable templates, in-app collaboration, and automated reminders. These features help ensure that the form is completed accurately and on time, making it easier for businesses to comply with tax obligations.

-

How does eSigning the 590 form save time for businesses?

eSigning the 590 form with airSlate SignNow saves time by eliminating the need for printing, signing, and scanning documents manually. With a few clicks, users can complete the 590 form digitally, ensuring faster turnaround times and reducing administrative burdens. This streamlined process allows businesses to focus more on their core activities.

Get more for Form 590

- Quitclaim deed trust to husband and wife florida form

- Fl warranty deed 497302744 form

- General power of attorney for property and finances nondurable florida form

- Limited power of attorney florida form

- Florida deed lieu form

- Mortgage note 497302748 form

- Residential rental lease agreement florida form

- Fl note 497302752 form

Find out other Form 590

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy