Nys St 120 1 Form

What is the Nys St 120 1

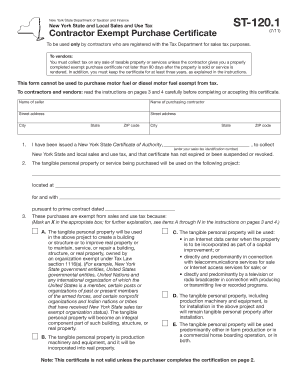

The Nys St 120 1 form is a crucial document used in New York State for the purpose of claiming an exemption from sales and use tax. This form is typically utilized by organizations that qualify for tax-exempt status, allowing them to purchase goods and services without incurring sales tax. Understanding the Nys St 120 1 is essential for businesses and non-profit organizations that wish to ensure compliance with state tax regulations while taking advantage of available exemptions.

How to use the Nys St 120 1

Using the Nys St 120 1 form involves several key steps. First, eligible organizations must complete the form accurately, providing necessary information such as the name, address, and tax identification number. It is important to specify the nature of the exemption being claimed. Once completed, the form should be presented to vendors at the time of purchase to validate the tax-exempt status. This process ensures that the organization does not pay sales tax on qualifying purchases.

Steps to complete the Nys St 120 1

Completing the Nys St 120 1 form requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering the organization’s name and address in the designated fields.

- Provide the tax identification number, ensuring it matches the organization's records.

- Clearly indicate the reason for the tax exemption by selecting the appropriate category.

- Review the form for accuracy before submission to avoid delays or issues.

- Sign and date the form to validate the information provided.

Legal use of the Nys St 120 1

The Nys St 120 1 form is legally binding when used correctly. To ensure its legal standing, organizations must meet the eligibility criteria for tax exemption as outlined by New York State law. It is essential that the form is filled out truthfully and presented to vendors at the time of purchase. Misuse of the form can lead to penalties, including fines or the requirement to pay back taxes. Therefore, understanding the legal implications of using the Nys St 120 1 is vital for compliance.

Required Documents

To successfully complete the Nys St 120 1 form, certain documents may be required. Organizations should prepare the following:

- Proof of tax-exempt status, such as a determination letter from the IRS or state.

- Documentation that verifies the organization’s purpose, such as bylaws or articles of incorporation.

- Any additional records that support the claim for exemption, depending on the nature of the purchases.

Form Submission Methods

The Nys St 120 1 form can be submitted in various ways. Organizations typically present the completed form directly to vendors at the point of sale. In some cases, it may also be submitted electronically if the vendor accepts digital documentation. It is advisable to confirm with the vendor regarding their preferred submission method to ensure smooth processing of the tax-exempt purchase.

Quick guide on how to complete nys st 120 1

Accomplish Nys St 120 1 seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the desired form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle Nys St 120 1 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Nys St 120 1 effortlessly

- Obtain Nys St 120 1 and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional hand-signed signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Nys St 120 1 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys st 120 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys st 120 1 form and how can airSlate SignNow assist?

The nys st 120 1 form is used for signNowing tax-exempt status in New York State. With airSlate SignNow, you can easily eSign and send your nys st 120 1 documents securely, ensuring compliance and streamlined workflows.

-

Is airSlate SignNow suitable for managing the nys st 120 1 form?

Yes, airSlate SignNow is specifically designed to facilitate the management of various forms, including the nys st 120 1. Our platform offers templates and intuitive tools for fast and efficient signing and distribution.

-

How much does it cost to use airSlate SignNow for the nys st 120 1?

airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the plan you choose, you can access tools to manage your nys st 120 1 form and other documents at a cost-effective rate.

-

What features does airSlate SignNow provide for the nys st 120 1 form?

airSlate SignNow provides features like customizable templates, easy eSigning, and document tracking specifically for the nys st 120 1 form. These tools enhance user experience and streamline the documentation process.

-

Does airSlate SignNow integrate with other software for the nys st 120 1 process?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM and accounting software to aid in processing the nys st 120 1. This enhances efficiency and helps keep your documents organized.

-

How secure is airSlate SignNow when handling the nys st 120 1 form?

Security is a top priority for airSlate SignNow. When dealing with the nys st 120 1 form, our platform utilizes advanced encryption and secure authentication methods to protect your sensitive information.

-

Can I use airSlate SignNow on mobile for the nys st 120 1 form?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage and eSign the nys st 120 1 form on-the-go. This mobility ensures that your documentation process remains uninterrupted no matter where you are.

Get more for Nys St 120 1

- Contractor individual form

- Florida corporation llc search form

- Florida deed trust 497302843 form

- Warranty deed two individuals to two individuals florida form

- Limited liability company 497302845 form

- Warranty timeshare form

- Quitclaim deed one individual to three individuals florida form

- Fl warranty form

Find out other Nys St 120 1

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself