Wvtax Form

What is the Wvtax

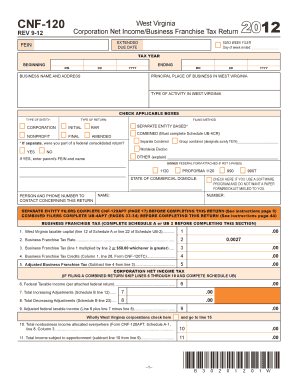

The Wvtax form is a tax document used primarily in the state of West Virginia. It is designed for individuals and businesses to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with state tax regulations and helps facilitate the accurate assessment of taxes owed. Understanding the purpose and requirements of the Wvtax is crucial for taxpayers in West Virginia.

How to use the Wvtax

Using the Wvtax involves several steps to ensure accurate completion and submission. Taxpayers must gather their financial records, including income statements, deductions, and any relevant tax credits. The form can be filled out either digitally or on paper, depending on the taxpayer's preference. Once completed, the Wvtax must be submitted to the appropriate state tax authority, either online or by mail, to ensure compliance with filing deadlines.

Steps to complete the Wvtax

Completing the Wvtax requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the Wvtax

The Wvtax is legally binding when completed accurately and submitted on time. It is essential for taxpayers to understand their obligations under state law to avoid penalties. The form must be signed, either electronically or physically, to validate the information provided. Compliance with state tax laws ensures that taxpayers fulfill their legal responsibilities and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Wvtax are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates, as late submissions can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Wvtax, taxpayers must gather specific documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure accuracy in reporting.

Quick guide on how to complete wvtax

Effortlessly Prepare wvtax on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly. Manage wvtax on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign wvtax with Ease

- Find wvtax and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important portions of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow addresses all your document management needs with a few clicks from any device of your choice. Edit and eSign wvtax to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to wvtax

Create this form in 5 minutes!

How to create an eSignature for the wvtax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask wvtax

-

What is wvtax and how can it benefit my business?

Wvtax is a powerful solution that streamlines the tax document signing process for businesses. By utilizing airSlate SignNow, companies can efficiently manage their tax-related documents, ensuring compliance and reducing paperwork errors. This enhances productivity and allows teams to focus on more critical tasks.

-

How much does it cost to use wvtax with airSlate SignNow?

The pricing for wvtax through airSlate SignNow is competitive and offers several plans to accommodate different business sizes. Each plan includes essential features for document signing and management, allowing businesses to choose the option that best fits their needs and budget. You can find detailed pricing information on our website.

-

What features does wvtax offer for document management?

Wvtax offers a range of features designed for seamless document management, including eSignature, customizable templates, and real-time tracking. Additionally, airSlate SignNow ensures that your tax documents are securely stored and easily accessible, making it a practical choice for businesses handling sensitive information.

-

Can I integrate wvtax with other applications?

Yes, wvtax can be seamlessly integrated with various applications to enhance your workflow. airSlate SignNow supports integrations with popular tools such as Google Drive, Salesforce, and Microsoft Office, ensuring that your document management process is both efficient and cohesive with your existing systems.

-

Is wvtax secure for handling sensitive tax documents?

Absolutely, wvtax prioritizes security by implementing advanced encryption and compliance measures. airSlate SignNow adheres to industry standards, ensuring that your tax documents are protected from unauthorized access while maintaining privacy and confidentiality throughout the signing process.

-

How does wvtax simplify the eSigning process for tax documents?

Wvtax simplifies the eSigning process by allowing users to sign documents electronically without the need for printing or physical signatures. With airSlate SignNow, you can easily send, sign, and store your tax documents in a fraction of the time compared to traditional methods, improving overall efficiency.

-

What are the benefits of using wvtax for remote teams?

Wvtax offers signNow benefits for remote teams, facilitating collaboration across different locations. Thanks to airSlate SignNow's cloud-based platform, team members can access, sign, and manage tax documents from anywhere, ensuring that deadlines are met without hassle or delays.

Get more for wvtax

- Inbjudan pdf form

- D9166 direct order form thickeners d9166 direct order form thickeners

- Repayment assistance plan form

- Access to information and privacy information about

- Loi sur limmigration et la protection des rfugis laws form

- 2019 form canada imm 5257 e fill online printable fillable

- Use of representative form

- Httpsapi15ilovepdfcomv1download pinterest form

Find out other wvtax

- How Can I Sign Arkansas Banking Moving Checklist

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile