PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn Form

What is the PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State MN

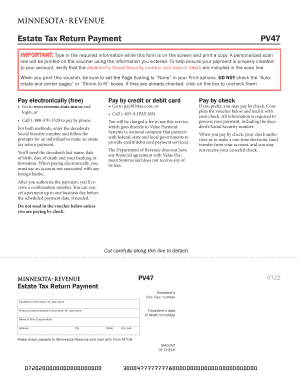

The PV47 is a specific form used in Minnesota for the estate tax return payment. This document serves as a payment voucher that allows individuals or representatives of estates to submit payments associated with the Minnesota estate tax. The form is essential for ensuring that the state receives the necessary funds from the estate of a deceased individual, in accordance with Minnesota tax laws. It is important to understand that the estate tax applies to the total value of the estate, including real estate, personal property, and other assets, exceeding a certain threshold set by the state.

Steps to complete the PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State MN

Completing the PV47 form requires careful attention to detail to ensure compliance with Minnesota tax regulations. Here are the steps to follow:

- Gather necessary information: Collect all relevant details about the estate, including the total value and the names of beneficiaries.

- Fill out the form: Enter the required information accurately, ensuring that all fields are completed as instructed.

- Calculate the tax: Determine the estate tax owed based on the value of the estate and applicable rates.

- Include payment: Attach a check or money order for the amount due, made payable to the Minnesota Department of Revenue.

- Review the form: Double-check all entries for accuracy to avoid delays in processing.

- Submit the form: Send the completed PV47 form along with the payment to the designated address provided by the Minnesota Department of Revenue.

Legal use of the PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State MN

The PV47 form is legally binding when completed and submitted according to Minnesota state laws. This means that the information provided must be accurate and truthful, as any discrepancies can lead to penalties or legal issues. The form must be signed by the executor or administrator of the estate, affirming that the details are correct and that the payment is being made in compliance with the estate tax requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the PV47 form to avoid penalties. Typically, the estate tax return, along with the PV47 payment voucher, must be filed within nine months of the date of death of the individual whose estate is being taxed. Extensions may be available, but they must be applied for in advance. Keeping track of these deadlines ensures that the estate remains in good standing with the Minnesota Department of Revenue.

Required Documents

When submitting the PV47 form, several documents may be required to support the estate tax return. These documents typically include:

- The completed estate tax return (Form M-706).

- Documentation of the estate's assets and liabilities.

- Any relevant appraisals or valuations of property.

- Proof of payment, if applicable.

Ensuring that all required documents are included can facilitate a smoother review process by the Minnesota Department of Revenue.

Penalties for Non-Compliance

Failure to comply with the Minnesota estate tax requirements, including the timely submission of the PV47 form, can result in significant penalties. These penalties may include fines and interest on unpaid taxes. Additionally, the estate may face delays in the distribution of assets to beneficiaries until all tax obligations are resolved. Understanding these potential consequences underscores the importance of timely and accurate filings.

Quick guide on how to complete pv47 estate tax return payment voucher minnesota department revenue state mn

Manage PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn conveniently on any device

Digital document organization has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional prints and signatures, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to adjust and electronically sign PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn effortlessly

- Find PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn and then click Get Form to begin.

- Make use of the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of sharing your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and electronically sign PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pv47 estate tax return payment voucher minnesota department revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota estate tax and how does it work?

The Minnesota estate tax is a tax imposed on the transfer of estates valued over a certain threshold at the time of a person's death. It is calculated based on the total value of the estate, including real estate, bank accounts, and other assets. Understanding the Minnesota estate tax is crucial for estate planning to ensure that heirs receive their intended inheritance.

-

How can airSlate SignNow help with Minnesota estate tax documentation?

airSlate SignNow provides an efficient platform for creating and signing estate planning documents, aiding users in managing their Minnesota estate tax obligations. With customizable templates, users can easily draft wills, trusts, and other necessary paperwork while ensuring compliance with Minnesota laws. This makes handling Minnesota estate tax documentation simpler and more streamlined.

-

What are the benefits of using airSlate SignNow for estate planning in Minnesota?

Using airSlate SignNow for estate planning in Minnesota offers convenience and legality in managing your documents. The platform ensures that all forms are securely eSigned, reducing the risk of errors and enhancing compliance with Minnesota estate tax requirements. Additionally, it facilitates quick access and collaboration among family members or legal advisors.

-

Is there a cost associated with using airSlate SignNow for Minnesota estate tax documents?

Yes, airSlate SignNow has a subscription model that provides various pricing tiers tailored to the needs of individuals or businesses preparing Minnesota estate tax documents. This allows users to choose a plan that fits their budget while still gaining access to powerful tools and features. Investing in airSlate SignNow can ultimately save time and reduce complications in managing Minnesota estate tax documentation.

-

What features does airSlate SignNow offer for handling Minnesota estate tax forms?

airSlate SignNow offers a range of features to efficiently handle Minnesota estate tax forms, including customizable templates, collaboration tools, and secure cloud storage. The platform also supports multiple file formats and integrates smoothly with various other applications. These features collectively streamline the process of preparing and signing necessary documents.

-

Can airSlate SignNow integrate with other software for Minnesota estate planning?

Yes, airSlate SignNow easily integrates with a variety of software applications, enhancing your Minnesota estate planning process. These integrations can help streamline data entry and improve workflow efficiency, making it easier to manage estate tax documents alongside other relevant files and applications. This ensures a more cohesive approach to managing your estate.

-

What types of documents can I create for Minnesota estate tax with airSlate SignNow?

With airSlate SignNow, you can create a wide range of documents pertinent to Minnesota estate tax, including wills, power of attorney, trusts, and other essential estate planning documents. The platform offers templates specifically designed to comply with Minnesota regulations, making it easier to ensure that all your paperwork meets the necessary legal standards. This versatility can greatly assist in managing your estate effectively.

Get more for PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn

Find out other PV47, Estate Tax Return Payment Voucher Minnesota Department Revenue State Mn

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word