1040cr Forms

What is the 1040cr Forms

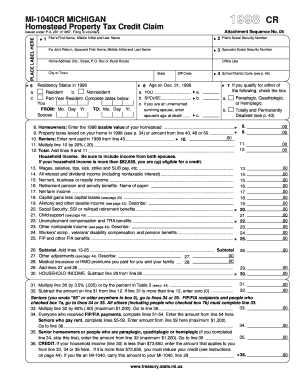

The 1040cr forms, officially known as the 1040 Credit form, is a tax document used by residents of the United States to claim certain credits and deductions on their federal income tax returns. This form is primarily utilized to report various tax credits that may reduce the overall tax liability of an individual. It is essential for taxpayers who qualify for credits such as the Earned Income Tax Credit or the Child Tax Credit, as it allows them to receive the benefits to which they are entitled.

How to use the 1040cr Forms

Using the 1040cr forms involves a few straightforward steps. First, ensure you have all necessary financial documents, such as W-2s and 1099s, which provide details on your income. Next, gather information regarding any credits you may qualify for. After that, fill out the form accurately, ensuring that all figures are correct and that you have included all applicable credits. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to complete the 1040cr Forms

Completing the 1040cr forms requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant tax documents, including income statements and any previous tax returns.

- Identify the tax credits you are eligible for and review the instructions for the 1040cr forms.

- Fill out the form, ensuring that you enter your personal information, income details, and credit claims accurately.

- Double-check your calculations and ensure all required fields are completed.

- Submit your completed form electronically through an e-filing system or print and mail it to the appropriate IRS address.

Legal use of the 1040cr Forms

The 1040cr forms are legally binding documents when completed and submitted according to IRS guidelines. To ensure their legal validity, it is crucial to provide accurate information and to sign the form where required. Electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which recognizes electronic signatures as valid. This means that using a secure platform for e-signatures can enhance the legal standing of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1040cr forms align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, especially during tax season, to avoid penalties for late filing.

Required Documents

To successfully complete the 1040cr forms, you will need several key documents:

- W-2 forms from employers that detail your annual income.

- 1099 forms for any freelance or contract work.

- Documentation of any tax credits you are claiming, such as proof of dependent care expenses.

- Previous year's tax return for reference.

Who Issues the Form

The 1040cr forms are issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers have the resources they need to file accurately and on time. It is advisable to refer to the IRS website or official publications for the most current version of the form and any updates regarding its use.

Quick guide on how to complete 1040cr forms

Complete 1040cr Forms effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your paperwork swiftly without delays. Handle 1040cr Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign 1040cr Forms with ease

- Locate 1040cr Forms and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 1040cr Forms and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040cr forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 1040cr Forms and why are they important?

1040cr Forms are tax documents used for claiming corrections and adjustments on your income tax return in certain states. They are essential for ensuring your tax filings are accurate and up-to-date, potentially resulting in refunds or reduced liabilities. Using airSlate SignNow, you can easily manage and eSign 1040cr Forms, streamlining your tax processes.

-

How can airSlate SignNow help with 1040cr Forms?

airSlate SignNow provides a user-friendly platform that allows you to prepare, send, and eSign 1040cr Forms effortlessly. With its intuitive interface, you can quickly fill out forms and ensure compliance with state regulations. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for 1040cr Forms?

Yes, there is a subscription cost for accessing airSlate SignNow's features, which include handling 1040cr Forms. However, the pricing is competitive and offers excellent value through features like unlimited document signing and powerful integrations. Furthermore, the efficiency gained can lead to long-term savings on your tax preparation processes.

-

Can I integrate airSlate SignNow with other software for handling 1040cr Forms?

Absolutely! airSlate SignNow allows seamless integrations with various accounting and tax software, making it easier to manage 1040cr Forms alongside your other business tools. This connectivity simplifies the workflow by allowing data to be shared across platforms without manual entry, saving you time and reducing errors.

-

What features does airSlate SignNow offer for managing 1040cr Forms?

airSlate SignNow offers features such as templates for 1040cr Forms, advanced eSigning capabilities, and automated workflows that enhance your document management processes. The platform is designed to simplify the creation, verification, and submission of these important tax forms. Additionally, robust security measures ensure your information is protected.

-

Can I track the status of my 1040cr Forms using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your 1040cr Forms throughout the signing and submission process. You will receive notifications when the forms are opened, signed, or completed. This ensures that you stay informed and can manage your tax documentation effectively.

-

What benefits do businesses gain from using airSlate SignNow for 1040cr Forms?

Using airSlate SignNow for 1040cr Forms allows businesses to signNowly reduce administrative burdens and improve turnaround times on tax documents. The platform’s ease of use leads to enhanced compliance and accuracy, which can result in better financial outcomes. Moreover, the ability to track and manage documents digitally leads to increased efficiency in business operations.

Get more for 1040cr Forms

Find out other 1040cr Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors