Installment Agreement Form Accident Default in Payment California 2006-2026

Understanding the IRS Installment Agreement Form

The IRS installment agreement form is a crucial document for individuals who owe federal taxes and wish to pay their debts over time. This form allows taxpayers to request a payment plan that breaks down their tax liability into manageable monthly installments. It is particularly beneficial for those who cannot pay their tax bill in full by the due date. By submitting this form, taxpayers can avoid penalties and interest that accrue on unpaid balances.

Steps to Complete the IRS Installment Agreement Form

Completing the IRS installment agreement form involves several important steps:

- Gather necessary information: Collect your personal details, including your Social Security number, address, and income information.

- Determine your payment amount: Assess your financial situation to decide how much you can afford to pay monthly.

- Fill out the form: Provide accurate information in all required fields, ensuring that you indicate your preferred payment terms.

- Review the form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Send the completed form to the IRS using your preferred method, whether online, by mail, or in person.

Eligibility Criteria for the IRS Installment Agreement

To qualify for an IRS installment agreement, taxpayers must meet certain eligibility criteria. Generally, individuals must owe less than $50,000 in combined tax, penalties, and interest. They should also have filed all required tax returns. Additionally, taxpayers must demonstrate their ability to make monthly payments based on their financial situation. If you owe more than the threshold, you may need to explore other options, such as a more formal payment plan or an offer in compromise.

Form Submission Methods

There are several methods to submit the IRS installment agreement form:

- Online: Taxpayers can complete and submit the form electronically through the IRS website, which is often the fastest method.

- By mail: You can print the completed form and send it to the appropriate IRS address based on your location.

- In-person: Some individuals may prefer to visit a local IRS office to submit their form directly, although this may require an appointment.

IRS Guidelines for Payment Plans

The IRS provides specific guidelines regarding payment plans through the installment agreement form. Taxpayers should be aware of the following:

- The monthly payment must be made on time to avoid defaulting on the agreement.

- Interest and penalties will continue to accrue on the unpaid balance until it is fully paid.

- Taxpayers may be required to provide updated financial information if their circumstances change during the payment period.

Penalties for Non-Compliance

Failing to comply with the terms of the IRS installment agreement can result in significant penalties. If a taxpayer misses a payment, the IRS may terminate the agreement, leading to immediate collection actions, including wage garnishments or bank levies. Additionally, penalties and interest will continue to accumulate on any unpaid balance, increasing the total amount owed. It is essential to maintain communication with the IRS if financial difficulties arise that may impact payment ability.

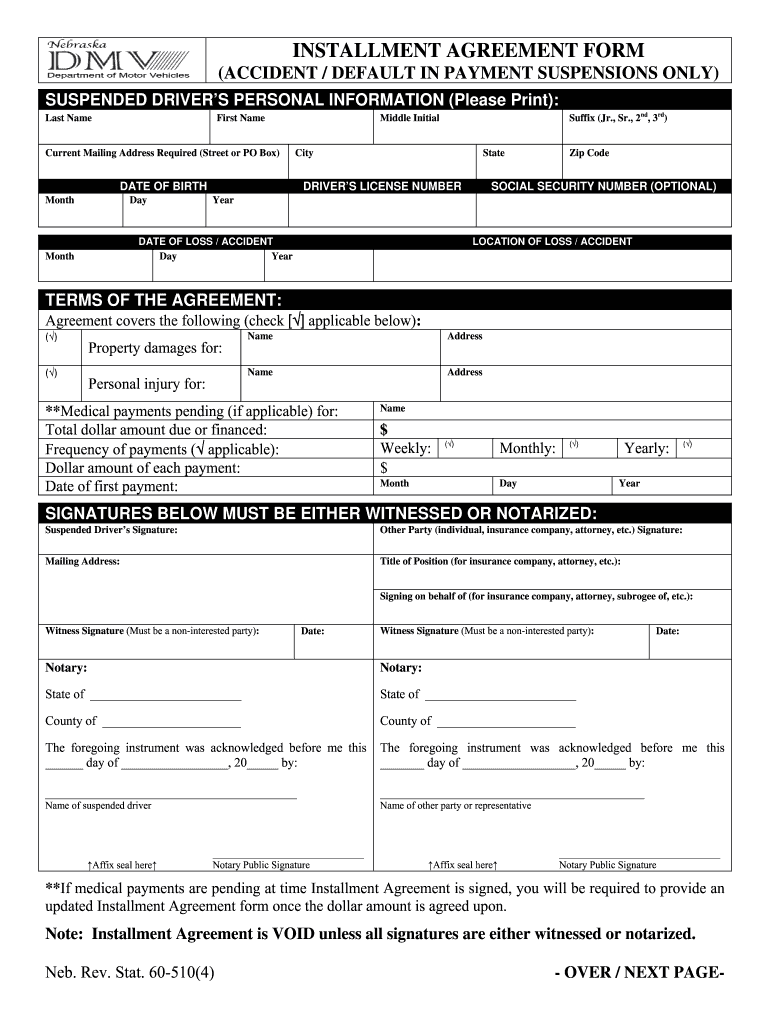

Quick guide on how to complete installment agreement form accident default in payment california

Simplify your existence by signNowing Installment Agreement Form Accident Default In Payment California form with airSlate SignNow

Whether you need to register a new vehicle, apply for a driver’s license, transfer ownership, or carry out any other task related to automobiles, managing such RMV forms as Installment Agreement Form Accident Default In Payment California is an unavoidable necessity.

There are several avenues through which you can obtain them: by mail, at the RMV service center, or by accessing them online via your local RMV website and printing them out. Each of these options consumes valuable time. If you’re seeking a quicker method to complete and endorse them with a legally-binding eSignature, airSlate SignNow is your optimal choice.

How to fill out Installment Agreement Form Accident Default In Payment California with ease

- Click Show details to view a brief overview of the document you are interested in.

- Select Get document to initiate and open the form.

- Follow the green marker indicating the required fields if applicable.

- Utilize the top toolbar and employ our advanced features to modify, annotate, and enhance your form.

- Add text, your initials, shapes and images, and other elements.

- Click Sign in in the same toolbar to create a legally-binding eSignature.

- Examine the form text to ensure there are no mistakes or inconsistencies.

- Click Done to complete the form process.

Using our platform to fill out your Installment Agreement Form Accident Default In Payment California and other related forms will save you a signNow amount of time and frustration. Optimize your RMV document processing from the beginning!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Applying for PayPal adaptive payments, how to fill in the form?

Adaptive Accounts: is an API that allows you to provision creation of PayPal accounts through your application. You could collect all the user's profile information, call Adaptive Accounts API to create a PayPal account, and redirect the user to PayPal for them to setup their password and security information. Usually this API is highly vetted since you'll be collecting user's pii information. So unless you really need it don't select. 3rd Party Permissions - Request users grant you permission to make API calls on their behalf.: 3rd party permissions are when you need to do something on behalf of some one else. Collecting payments doesn't need 3rd party permissions since the end user explicitly approves the pre-approval in your case. But if you have a use case for your app to be able to issue refunds on behalf of your sellers, them yes you would need to use the permissions service to obtain approval from your sellers to issue refunds from their accounts.Testing Information: Basically the application review team wants to make sure they can verify the money flow. So if you can provide any information on how they can act both as a seller and also as a buyer that would help. It doesn't need to be in live - sandbox env should be more than enough. I've helped several go through this process - it's actually not that bad. But it could get frustrating when there is lack of complete information. So the more information you provide - presentations, mocks, flows, testing env/app, etc.. the better it would help the app review team understand what you're trying to use payments for. Money Aggregation and laundering are the biggest concerns they watch out for - so the more transparent your money trail is the better and quicker the process would be. Good luck!

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

How do I fill out a Form 10BA if I lived in two rented homes during the previous year as per the rent agreement? Which address and landlord should I mention in the form?

you should fill out the FORM 10BA, with detail of the rented house, for which you are paying more rent than other.To claim Section 80GG deduction, the following conditions must be fulfilled by the taxpayer:HRA Not Received from Employer:- The taxpayer must not have received any house rent allowance (HRA) from the employer.Not a Home Owner:- The taxpayer or spouse or minor child must not own a house property. In case of a Hindu Undivided Family (HUF), the HUF must not own a house property where the taxpayer resides.Form 10BA Declaration:- The taxpayer must file a declaration in Form 10BA that he/she has taken a residence on rent in the previous year and that he/she has no other residence.format of form-10BA:-https://www.webtel.in/Image/Form...Amount of Deduction under Section 80GG:-Maximum deduction under Section 80GG is capped at Rs.60,000. Normally, the deduction under Section 80GG is the lower of the following three amounts :-25% of Adjusted Total IncomeRent Paid minus 10% of Adjusted Total IncomeRs.5000 per Month

-

If we fill out all the details in the IBPS Clerk form and want to do the payment section the next day, can it happen?

Yeah ,you can do payment not only in the next day ,it is enough to pay at the last date (I am not telling to do so)but you have time upto the last date ,once u enter the basic details ,in the first page your login id will be created ,you can also enter those details after few days also… ALL THE BEST

Create this form in 5 minutes!

How to create an eSignature for the installment agreement form accident default in payment california

How to generate an electronic signature for the Installment Agreement Form Accident Default In Payment California in the online mode

How to create an electronic signature for your Installment Agreement Form Accident Default In Payment California in Chrome

How to create an electronic signature for putting it on the Installment Agreement Form Accident Default In Payment California in Gmail

How to make an electronic signature for the Installment Agreement Form Accident Default In Payment California right from your smartphone

How to generate an electronic signature for the Installment Agreement Form Accident Default In Payment California on iOS devices

How to create an electronic signature for the Installment Agreement Form Accident Default In Payment California on Android

People also ask

-

What is an IRS installment agreement form?

The IRS installment agreement form allows taxpayers to set up a plan to pay their tax debts in manageable monthly payments. This form is essential for those who cannot afford to pay their tax liability in full. By using the IRS installment agreement form, you can avoid penalties and keep your financial situation in check.

-

How can airSlate SignNow help with the IRS installment agreement form?

airSlate SignNow provides an easy-to-use platform for preparing and signing the IRS installment agreement form electronically. This solution streamlines the process, ensuring that your form is filled out correctly and submitted promptly. Utilizing airSlate SignNow allows you to eSign and send your IRS installment agreement form with ease.

-

Are there any costs associated with using airSlate SignNow for the IRS installment agreement form?

While airSlate SignNow offers a range of subscription plans, there are no additional costs for using it specifically for the IRS installment agreement form. It provides a cost-effective solution for businesses and individuals looking to manage their tax forms efficiently. Check our pricing page for detailed information on plans that fit your needs.

-

Is it secure to use airSlate SignNow for my IRS installment agreement form?

Yes, using airSlate SignNow for your IRS installment agreement form is secure. We implement advanced security measures, including encryption and secure cloud storage, to protect your sensitive information. You can confidently prepare, eSign, and store your IRS installment agreement form without compromising on data security.

-

Can I track the status of my IRS installment agreement form submission with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your IRS installment agreement form submission. You'll receive notifications when your document is viewed, signed, or completed, giving you peace of mind during the process. Stay informed every step of the way.

-

What devices can I use to fill out the IRS installment agreement form with airSlate SignNow?

You can use airSlate SignNow on various devices, including desktops, laptops, tablets, and smartphones. This versatility ensures you can fill out and sign your IRS installment agreement form from anywhere, at any time. Whether you're in the office or on the go, we've got you covered.

-

Does airSlate SignNow integrate with other applications to manage my IRS installment agreement form?

Yes, airSlate SignNow offers integrations with various applications to simplify managing your IRS installment agreement form. Connect with popular tools like Google Drive, Dropbox, and others to streamline document management and storage. These integrations enhance your workflow and improve overall efficiency.

Get more for Installment Agreement Form Accident Default In Payment California

Find out other Installment Agreement Form Accident Default In Payment California

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online