Utah Nonresident Affidavit for Sales Tax Exemption, TC 583 Tax Utah Form

What is the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

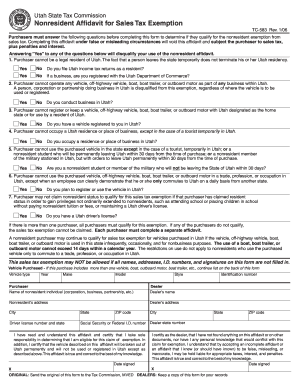

The Utah Nonresident Affidavit For Sales Tax Exemption, commonly known as TC 583, is a legal document that allows nonresidents of Utah to claim an exemption from sales tax when purchasing tangible personal property or services in the state. This affidavit is particularly useful for individuals or businesses that are not based in Utah but need to acquire goods or services without incurring additional tax costs. The form serves as a declaration that the purchaser meets specific criteria set forth by the state, ensuring compliance with Utah tax regulations.

How to use the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

To effectively use the TC 583 form, nonresidents should first verify their eligibility for the sales tax exemption. Once eligibility is confirmed, the affidavit must be filled out accurately, providing necessary details such as the buyer's information, the seller's information, and a description of the items being purchased. After completing the form, it should be presented to the seller at the time of purchase to validate the exemption. This process ensures that the transaction is recorded correctly and that the seller is aware of the tax-exempt status of the buyer.

Steps to complete the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

Completing the TC 583 form involves several key steps:

- Obtain the TC 583 form from the appropriate state tax authority or online resources.

- Fill in the required information, including the name and address of the buyer and seller.

- Provide a detailed description of the items being purchased.

- Sign and date the affidavit to confirm that the information provided is accurate.

- Present the completed form to the seller during the transaction.

Legal use of the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

The TC 583 form is legally binding when filled out correctly and used in accordance with Utah tax laws. It is essential to ensure that all information is truthful and that the buyer qualifies for the exemption. Misuse of the affidavit can result in penalties, including fines or back taxes owed. Therefore, understanding the legal implications of the form is critical for both buyers and sellers to avoid potential legal issues.

Eligibility Criteria

To qualify for the sales tax exemption using the TC 583 form, the buyer must meet specific eligibility criteria. Generally, nonresidents must demonstrate that the purchased items will be used outside of Utah. This may include proof of residency in another state or documentation showing that the items are intended for use in a different location. Additionally, certain types of purchases may be exempt, while others may not qualify, making it important to review the guidelines provided by the Utah State Tax Commission.

Form Submission Methods (Online / Mail / In-Person)

The TC 583 form can be submitted in various ways, depending on the seller's preferences. Typically, the completed affidavit is presented in person at the time of purchase. However, some sellers may allow for electronic submission if they have the necessary systems in place. It is advisable to check with the seller regarding their preferred method for accepting the form to ensure compliance and proper processing of the sales tax exemption.

Quick guide on how to complete utah nonresident affidavit for sales tax exemption tc 583 tax utah

Easily Prepare Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah on Any Device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides all the necessary resources to create, modify, and electronically sign your documents swiftly without any delays. Manage Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah Effortlessly

- Obtain Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah and click on Obtain Form to start.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Finished button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah nonresident affidavit for sales tax exemption tc 583 tax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah?

The Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah, is a form that allows nonresidents of Utah to claim a sales tax exemption on qualifying purchases. This affidavit must be completed accurately to ensure compliance with Utah tax regulations and can save businesses signNow amounts in sales tax.

-

How can I complete the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah on airSlate SignNow?

To complete the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah on airSlate SignNow, you can easily access our platform, fill in the required fields, and electronically sign. Our user-friendly interface ensures that you can complete the process quickly, eliminating any hassle.

-

What are the benefits of using airSlate SignNow for the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah?

Using airSlate SignNow for the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah streamlines the document sending and signing process. You can efficiently manage your forms, track their status, and ensure secure storage, making it easier to access important tax documents at any time.

-

Is there a cost associated with filing the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah through airSlate SignNow?

Yes, while filing the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah through airSlate SignNow is efficient, there is a subscription fee for using our platform. However, our pricing is competitive and provides great value for the wide range of documents you can manage.

-

Can I integrate airSlate SignNow with other software for managing the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah?

Absolutely! airSlate SignNow offers integrations with various software applications that can help you manage the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah seamlessly. This allows you to streamline your workflow and ensure all your documents are handled in one place.

-

How can I ensure my information is secure when submitting the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah?

Security is a top priority at airSlate SignNow. All submissions, including the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah, are encrypted and stored securely, ensuring that your personal and financial data is protected against unauthorized access.

-

What support options are available if I have questions about the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah?

If you have questions regarding the Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah, airSlate SignNow offers robust customer support options. You can signNow out via email, chat, or our help center, where you'll find resources and FAQs addressing common concerns.

Get more for Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

Find out other Utah Nonresident Affidavit For Sales Tax Exemption, TC 583 Tax Utah

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later