Farmers Certificate for Wholesale Purchases Form

What is the Farmers Certificate For Wholesale Purchases

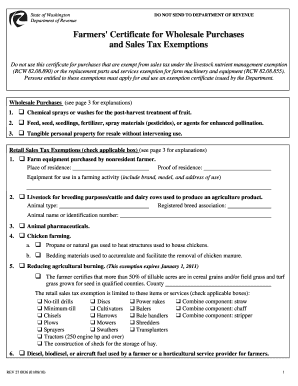

The farmers certificate for wholesale purchases is a legal document that allows eligible farmers and agricultural producers to make tax-exempt purchases of goods and services necessary for their farming operations. This certificate is crucial for those engaged in agriculture, as it helps reduce costs by exempting certain purchases from sales tax. It typically includes information about the farmer's business, such as their name, address, and tax identification number, along with a declaration of the intended use of the purchased items.

How to Obtain the Farmers Certificate For Wholesale Purchases

To obtain the farmers certificate for wholesale purchases, individuals must first confirm their eligibility as a farmer or agricultural producer. This often involves filling out an application form provided by the state’s revenue department or agricultural agency. The application may require documentation such as proof of farming operations, tax identification numbers, and any relevant business licenses. Once submitted, the application will be reviewed, and upon approval, the certificate will be issued.

Steps to Complete the Farmers Certificate For Wholesale Purchases

Completing the farmers certificate for wholesale purchases involves several key steps:

- Gather necessary documentation, including proof of farming operations and tax identification numbers.

- Fill out the certificate form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state agency, either online or via mail.

- Keep a copy of the submitted certificate for your records.

Legal Use of the Farmers Certificate For Wholesale Purchases

The legal use of the farmers certificate for wholesale purchases is governed by state regulations. This certificate must be used solely for tax-exempt purchases related to agricultural activities. Misuse of the certificate, such as using it for personal purchases or non-agricultural goods, can lead to penalties, including fines and potential loss of tax-exempt status. It is essential for users to understand the legal implications and ensure compliance with all relevant laws.

Key Elements of the Farmers Certificate For Wholesale Purchases

Key elements of the farmers certificate for wholesale purchases include:

- Farmer's Information: Name, address, and tax identification number.

- Declaration of Use: A statement confirming that the purchases will be used for farming purposes.

- Signature: The signature of the farmer or authorized representative, affirming the accuracy of the information provided.

State-Specific Rules for the Farmers Certificate For Wholesale Purchases

Each state in the United States may have specific rules and requirements regarding the farmers certificate for wholesale purchases. These rules can include eligibility criteria, the application process, and the types of purchases that qualify for tax exemption. It is important for farmers to consult their state’s revenue department or agricultural agency to understand the specific regulations that apply to their situation.

Quick guide on how to complete farmers certificate for wholesale purchases

Complete Farmers Certificate For Wholesale Purchases with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your files quickly and without delays. Manage Farmers Certificate For Wholesale Purchases on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Farmers Certificate For Wholesale Purchases effortlessly

- Locate Farmers Certificate For Wholesale Purchases and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Edit and electronically sign Farmers Certificate For Wholesale Purchases and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the farmers certificate for wholesale purchases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a farmers certificate for wholesale purchases?

A farmers certificate for wholesale purchases is a document that allows farmers to buy goods and services at wholesale prices without paying sales tax. This certificate is essential for farmers who want to maximize their savings on agricultural supplies and equipment, thereby enhancing their profit margins.

-

How can I obtain a farmers certificate for wholesale purchases?

To obtain a farmers certificate for wholesale purchases, you need to apply through your state's agricultural department. This typically involves providing proof of your farming operation, such as tax returns or business registrations, to verify that you qualify for wholesale purchasing.

-

What are the benefits of using a farmers certificate for wholesale purchases?

Using a farmers certificate for wholesale purchases signNowly reduces the cost of goods, allowing farmers to invest more in their operations. Additionally, it helps streamline the purchasing process by eliminating the need to handle sales tax on each transaction.

-

Does airSlate SignNow assist in managing farmers certificates for wholesale purchases?

Yes, airSlate SignNow provides features that streamline the management of farmers certificates for wholesale purchases. You can easily send, sign, and store documents securely, ensuring that all necessary paperwork is readily accessible for audits and tax purposes.

-

Are there any costs associated with obtaining a farmers certificate for wholesale purchases?

While obtaining a farmers certificate for wholesale purchases is usually free, some states may charge a nominal fee for processing. It's also important to consider potential costs related to compliance and renewal of the certificate to keep it valid.

-

What features does airSlate SignNow offer for agricultural businesses?

airSlate SignNow offers a range of features tailored for agricultural businesses, including eSignature capabilities, document templates specific to farming, and tracking tools for managing farmers certificates for wholesale purchases. These features make it easier for farmers to handle paperwork efficiently.

-

Can I integrate airSlate SignNow with other tools I use for my farming operations?

Yes, airSlate SignNow offers integration capabilities with various tools that farmers may use, such as accounting software and inventory management systems. This ensures that managing farmers certificates for wholesale purchases fits seamlessly into your existing workflows.

Get more for Farmers Certificate For Wholesale Purchases

- Woodside sports complex online waiver form

- Liability child form

- Waiver and release from liability for adult for parachuting form

- Release minor child form 497427143

- Waiver basketball form

- Waiver basketball form 497427145

- Waiver and release from liability for adult for baseball stadium form

- Waiver and release from liability for minor child for baseball stadium form

Find out other Farmers Certificate For Wholesale Purchases

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online