Penalty Waiver Request Form

What is the penalty waiver request?

The penalty waiver request is a formal application submitted to a governing body, typically the IRS or a state tax authority, seeking relief from penalties imposed for late filing or payment of taxes. This request is essential for taxpayers who have valid reasons for their inability to comply with tax obligations on time. It allows individuals and businesses to explain their circumstances and potentially avoid additional financial burdens.

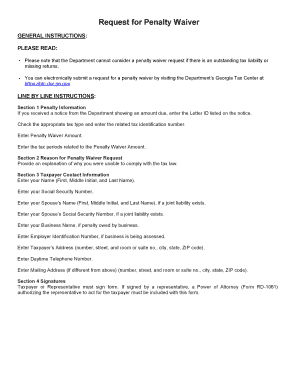

Steps to complete the penalty waiver request

Completing a penalty waiver request involves several key steps to ensure that the application is thorough and meets all necessary requirements. Here’s a streamlined approach:

- Gather relevant documents: Collect any supporting documents that demonstrate your circumstances, such as medical records or financial statements.

- Fill out the application form: Provide accurate information, including your personal details, tax identification number, and the specific penalties you are contesting.

- Explain your circumstances: Clearly articulate the reasons for your late filing or payment. Be honest and concise.

- Review your application: Ensure all information is correct and all necessary documentation is attached.

- Submit the request: Follow the submission guidelines, whether online, by mail, or in person, as specified by the relevant authority.

Eligibility criteria

To qualify for a penalty waiver, applicants must meet specific eligibility criteria set by the tax authority. Common factors include:

- Demonstrating reasonable cause for the failure to file or pay on time, such as illness or natural disasters.

- Having a history of compliance, with no prior penalties for the same issue.

- Submitting the request within a specified timeframe after the penalty notice.

Understanding these criteria is crucial for a successful application.

Required documents

When submitting a penalty waiver request, it is important to include all necessary documentation to support your case. Required documents may include:

- Proof of timely tax payments or filings for previous years.

- Any correspondence with the tax authority regarding the penalties.

- Documentation supporting your claim of reasonable cause, such as medical records or financial statements.

Providing comprehensive documentation can strengthen your request and improve the likelihood of approval.

Form submission methods

The penalty waiver request can typically be submitted through various methods, depending on the governing body’s guidelines. Common submission methods include:

- Online submission through the tax authority’s official website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can affect the processing time of your request.

Legal use of the penalty waiver request

The penalty waiver request is legally recognized as a formal appeal against imposed penalties. To ensure its legal validity, it must comply with the regulations set forth by the relevant tax authority. This includes adhering to submission deadlines, providing accurate information, and including all required documentation. Failure to meet these legal standards may result in rejection of the request.

Quick guide on how to complete penalty waiver request

Complete Penalty Waiver Request effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Penalty Waiver Request on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to alter and eSign Penalty Waiver Request with ease

- Locate Penalty Waiver Request and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal standing as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Alter and eSign Penalty Waiver Request and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the penalty waiver request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for waiver of penalty?

The application for waiver of penalty is a formal request submitted to seek relief from penalties imposed for various reasons. It is crucial for businesses looking to maintain compliance and mitigate unexpected costs. airSlate SignNow simplifies the process by allowing you to eSign and submit your application swiftly.

-

How can airSlate SignNow assist with my application for waiver of penalty?

airSlate SignNow streamlines the application for waiver of penalty by enabling users to create, sign, and send documents electronically. Its user-friendly interface makes it easy to customize forms and include necessary details. This efficiency reduces the time spent on paperwork and ensures timely submission.

-

What features does airSlate SignNow offer for managing my application for waiver of penalty?

AirSlate SignNow offers numerous features including customizable templates for the application for waiver of penalty, automated reminders, and document tracking. With these tools, you can keep track of submission statuses and manage responses efficiently. These features enhance productivity and ensure compliance with relevant laws.

-

Is there a cost associated with using airSlate SignNow for my application for waiver of penalty?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs when submitting an application for waiver of penalty. These plans are designed to be cost-effective and provide maximum value through efficient document management. You can choose a plan that best suits your volume of document handling.

-

Can I integrate airSlate SignNow with other tools for my application for waiver of penalty?

Absolutely! airSlate SignNow integrates seamlessly with many popular business applications such as Google Drive, Salesforce, and Microsoft Office. This capability enhances your workflow and allows you to manage your application for waiver of penalty alongside other critical documents and tasks.

-

What are the benefits of using airSlate SignNow for my application for waiver of penalty?

Using airSlate SignNow for your application for waiver of penalty offers numerous benefits, such as increased efficiency, reduced paper waste, and compliance assurance. The electronic signing feature speedily finalizes documents, allowing you to meet deadlines without unnecessary delays. Additionally, you can store and access your documents securely online.

-

What types of businesses can benefit from the application for waiver of penalty through airSlate SignNow?

Any business that may face penalties, whether due to late submissions or compliance issues, can benefit from the application for waiver of penalty. Small businesses, corporations, and non-profits alike can utilize airSlate SignNow to streamline their processes. This versatility makes it an invaluable tool across various industries.

Get more for Penalty Waiver Request

- Missouri property owner form

- Mo contractor form

- 10 day notice to pay rent or lease terminated missouri form

- Mo business llc form

- Business credit application missouri form

- Individual credit application missouri form

- Interrogatories to plaintiff for motor vehicle occurrence missouri form

- Interrogatories to defendant for motor vehicle accident missouri form

Find out other Penalty Waiver Request

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template