PTAX 230 Non Farm Property Assessment Complaint Fulton County Form

What is the PTAX 230 Non Farm Property Assessment Complaint Fulton County

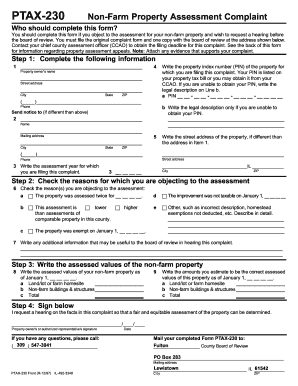

The PTAX 230 Non Farm Property Assessment Complaint is a formal document used by property owners in Fulton County to contest the assessed value of their non-farm properties. This form allows taxpayers to present their case to the local assessment office, arguing that the assessed value does not accurately reflect the property's market value. The form is essential for those seeking to reduce their property tax burden by ensuring that their property is assessed fairly according to current market conditions.

Steps to complete the PTAX 230 Non Farm Property Assessment Complaint Fulton County

Completing the PTAX 230 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your property, including the current assessment, property details, and any supporting documentation that can substantiate your claim. Next, fill out the form carefully, providing all requested details, such as your name, address, and the reasons for your complaint. Once completed, review the form for any errors or omissions. Finally, submit the form by the specified deadline, ensuring you keep a copy for your records.

How to use the PTAX 230 Non Farm Property Assessment Complaint Fulton County

Using the PTAX 230 form effectively requires understanding its purpose and the process involved. Begin by clearly stating your reasons for contesting the assessment, supported by factual evidence such as recent sales of comparable properties or appraisals. It is important to articulate how your property’s assessed value differs from its fair market value. After completing the form, ensure that it is signed and dated, as this validates your submission. Utilizing electronic signature solutions can streamline this process, making it easier to submit your complaint promptly.

Required Documents

When filing the PTAX 230 Non Farm Property Assessment Complaint, certain documents may be required to support your claim. These typically include:

- Current property tax assessment notice

- Evidence of property value, such as recent appraisals or sales data of comparable properties

- Photographs of the property, if applicable

- Any previous correspondence with the assessment office regarding your property

Having these documents ready can enhance the strength of your complaint and facilitate a smoother review process.

Form Submission Methods

The PTAX 230 form can be submitted through various methods, ensuring flexibility for property owners. Options typically include:

- Online submission through the Fulton County assessment office website

- Mailing the completed form to the designated assessment office address

- In-person delivery at the local assessment office

Choosing the method that best suits your needs can help ensure your complaint is filed correctly and on time.

Eligibility Criteria

To file a PTAX 230 Non Farm Property Assessment Complaint, property owners must meet specific eligibility criteria. Primarily, the individual must be the owner of the property in question. Additionally, the complaint must be filed within the designated timeframe established by the Fulton County assessment office. Understanding these criteria is crucial to ensure that your complaint is valid and can be processed without delay.

Quick guide on how to complete ptax 230 non farm property assessment complaint fulton county

Prepare PTAX 230 Non Farm Property Assessment Complaint Fulton County seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides you with all the features you require to create, modify, and eSign your documents swiftly without any hold-ups. Manage PTAX 230 Non Farm Property Assessment Complaint Fulton County on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign PTAX 230 Non Farm Property Assessment Complaint Fulton County with minimal effort

- Access PTAX 230 Non Farm Property Assessment Complaint Fulton County and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign PTAX 230 Non Farm Property Assessment Complaint Fulton County and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 230 non farm property assessment complaint fulton county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

The PTAX 230 Non Farm Property Assessment Complaint is a formal document used by property owners in Fulton County to contest their property assessment. This process allows individuals to challenge the assessed value of their non-farm properties and potentially lower their property taxes.

-

How can airSlate SignNow assist with the PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

airSlate SignNow simplifies the process of eSigning and submitting the PTAX 230 Non Farm Property Assessment Complaint in Fulton County. With our easy-to-use platform, users can quickly prepare, send, and execute their complaints electronically, ensuring a smooth and efficient experience.

-

What are the costs associated with filing a PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

The costs involved with filing a PTAX 230 Non Farm Property Assessment Complaint vary depending on the specifics of your property and the services used. Utilizing airSlate SignNow can help reduce costs related to paper and administrative fees, as our eSigning platform is a cost-effective solution for seamless document management.

-

What features does airSlate SignNow offer for handling the PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

airSlate SignNow offers a range of features for managing the PTAX 230 Non Farm Property Assessment Complaint. These include customizable templates, bulk sending capabilities, secure cloud storage, and real-time tracking of document status, which streamline the complaint process for users.

-

Can I integrate airSlate SignNow with other tools to manage my PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

Yes, airSlate SignNow seamlessly integrates with various third-party tools and applications to enhance your experience with the PTAX 230 Non Farm Property Assessment Complaint in Fulton County. This integration allows for improved workflow management and data transfer between systems, ensuring efficiency.

-

What benefits can I expect when using airSlate SignNow for my PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

Using airSlate SignNow for your PTAX 230 Non Farm Property Assessment Complaint in Fulton County provides numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. Our platform is designed to empower users by making the eSigning process simple and effective.

-

Is airSlate SignNow compliant with legal standards for the PTAX 230 Non Farm Property Assessment Complaint in Fulton County?

Absolutely, airSlate SignNow adheres to all legal standards for document eSigning, including those relevant to the PTAX 230 Non Farm Property Assessment Complaint in Fulton County. Our commitment to compliance ensures that your documents are legally binding and secure.

Get more for PTAX 230 Non Farm Property Assessment Complaint Fulton County

- Washington waiver 497429464 form

- Quitclaim deed from husband and wife to llc washington form

- Wa llc company form

- Washington petition 497429467 form

- Motion summary judgment 497429468 form

- Wpf ps 040100 motion and declaration for temporary order mtaf washington form

- Washington support form

- Order show cause 497429471 form

Find out other PTAX 230 Non Farm Property Assessment Complaint Fulton County

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form