Form 1120 and Partnership Form 1065 City of Big Rapids Ci Big Rapids Mi

What is the Form 1120 and Partnership Form 1065 in the City of Big Rapids, MI?

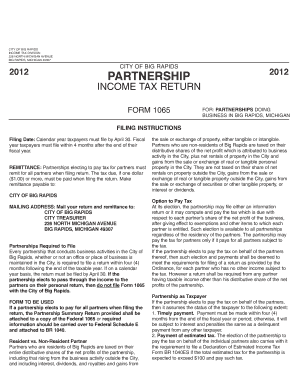

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. In contrast, the Partnership Form 1065 is utilized by partnerships to report their income, deductions, gains, and losses, as well as to provide information about each partner’s share of the partnership’s income. Both forms are essential for tax compliance and are required by the Internal Revenue Service (IRS) for entities operating in the City of Big Rapids, Michigan.

Steps to Complete the Form 1120 and Partnership Form 1065

Completing the Form 1120 and Partnership Form 1065 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Fill out the identification section, providing the entity's name, address, and Employer Identification Number (EIN).

- Report income and deductions accurately, ensuring all figures are supported by documentation.

- Complete the tax computation section, applying the appropriate tax rates for corporations or partnerships.

- Review the form for accuracy and completeness before submission.

Legal Use of the Form 1120 and Partnership Form 1065

Both the Form 1120 and Partnership Form 1065 must be filed in accordance with IRS regulations to ensure legal compliance. These forms serve as official records of the entity's financial activities and tax obligations. Proper filing is crucial to avoid penalties and to maintain good standing with the IRS. Additionally, using a reliable eSignature solution can enhance the legal validity of these forms by ensuring that signatures are securely captured and stored.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 and Partnership Form 1065 are critical for compliance. Generally, the Form 1120 is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For partnerships, the Form 1065 is typically due on the fifteenth day of the third month after the end of the partnership's tax year. It is essential to be aware of these dates to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Entities can submit the Form 1120 and Partnership Form 1065 through various methods. The IRS allows for electronic filing, which is often faster and more secure. Alternatively, forms can be mailed to the appropriate IRS address based on the entity's location. In-person submission is generally not available, but certain tax offices may offer assistance for filing these forms.

Key Elements of the Form 1120 and Partnership Form 1065

Understanding the key elements of both forms is vital for accurate completion. For Form 1120, essential components include gross receipts, cost of goods sold, and various deductions. The Partnership Form 1065 requires details on each partner's share of income, deductions, and credits. Both forms must include signatures and dates to validate the submission.

Quick guide on how to complete form 1120 and partnership form 1065 city of big rapids ci big rapids mi

Effortlessly Prepare Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi on Any Device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documentation, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any holdups. Manage Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi across any platform through airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to Modify and eSign Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi with Ease

- Obtain Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the woes of lost or misplaced documents, tedious form hunts, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi and guarantee excellent communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 and partnership form 1065 city of big rapids ci big rapids mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Form 1120 and Partnership Form 1065 for the City of Big Rapids?

Form 1120 is the U.S. Corporation Income Tax Return, while Partnership Form 1065 is used by partnerships to report income, deductions, gains, and losses. For businesses operating in the City of Big Rapids, filed properly, these forms ensure compliance with federal tax regulations.

-

How does airSlate SignNow streamline the filing of Form 1120 and Partnership Form 1065 in the City of Big Rapids?

airSlate SignNow provides a user-friendly interface that allows businesses in Big Rapids to easily fill out and eSign Form 1120 and Partnership Form 1065. By simplifying document management, SignNow reduces the risk of errors and helps ensure timely submissions.

-

What is the pricing structure for using airSlate SignNow for filing Form 1120 and Partnership Form 1065 in the City of Big Rapids?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for startups and established companies. These plans include features for collaborating on Form 1120 and Partnership Form 1065 effectively at a cost-effective rate.

-

Can airSlate SignNow help with integrations for Form 1120 and Partnership Form 1065 in the City of Big Rapids?

Yes, airSlate SignNow easily integrates with various applications and software, ensuring that businesses in the City of Big Rapids can effectively manage their Form 1120 and Partnership Form 1065 filings alongside their other tools.

-

What are the benefits of eSigning Form 1120 and Partnership Form 1065 with airSlate SignNow in the City of Big Rapids?

Using airSlate SignNow for eSigning Form 1120 and Partnership Form 1065 provides convenience and security for businesses. The platform allows you to sign documents from anywhere and track their status, which is especially beneficial for timely tax submissions.

-

Is airSlate SignNow secure for filing Form 1120 and Partnership Form 1065 in the City of Big Rapids?

Absolutely, airSlate SignNow employs advanced encryption technologies to ensure the security and confidentiality of your documents. This security is vital for sensitive forms like Form 1120 and Partnership Form 1065 in the City of Big Rapids.

-

Does airSlate SignNow offer support for questions related to Form 1120 and Partnership Form 1065 in the City of Big Rapids?

Yes, airSlate SignNow provides dedicated customer support that can assist users with any queries related to Form 1120 and Partnership Form 1065. Whether you need help with features or have specific filing questions, their team is ready to assist.

Get more for Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi

- Pediatric mock code toolkit loyola medicine form

- Conduit body chart form

- Makundi ya watoto wenye mahitaji maalumu form

- Antrag auf erteilung eines aufenthaltstitels in den sprachen deutsch englisch franzsisch italienisch schnell helfen form

- Ifa online application form

- Osha forms 300 300a and 301 cottingham amp butler

- Tube diy asylum oh no yawe91b300ba yet another we 91b 300b amplifier thorsten january 19 at 11 form

- Xethru module communication protocol form

Find out other Form 1120 And Partnership Form 1065 City Of Big Rapids Ci Big rapids Mi

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document