Nrli Form

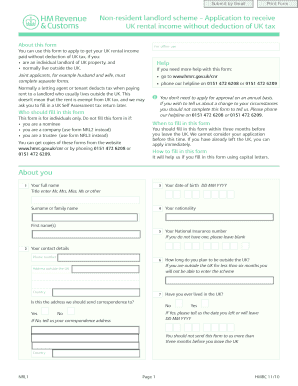

What is the NRL1 Form?

The NRL1 form, also known as the Non-Resident Landlord Scheme application, is a document used by non-resident landlords in the United Kingdom to apply for approval under the HMRC Non-Resident Landlord Scheme. This scheme allows landlords who live outside the UK to receive rental income without having tax deducted at source. The NRL1 form collects essential information about the landlord and the property, ensuring that the correct tax treatment is applied to their rental income.

How to Use the NRL1 Form

Using the NRL1 form involves several steps to ensure that all required information is accurately provided. Landlords must fill out the form with details such as their personal information, property address, and bank account information for payments. Once completed, the form should be submitted to HMRC for processing. It is crucial to ensure that all sections are filled out correctly to avoid delays or complications in the approval process.

Steps to Complete the NRL1 Form

Completing the NRL1 form involves the following steps:

- Gather necessary documents, including proof of identity and property ownership.

- Fill out personal details, including your name, address, and contact information.

- Provide details about the property, such as its address and type of rental.

- Indicate your bank account information for rental income payments.

- Review the form for accuracy before submission.

- Submit the completed form to HMRC, either online or by mail.

Legal Use of the NRL1 Form

The NRL1 form is legally binding once submitted to HMRC. It ensures compliance with UK tax regulations for non-resident landlords. By completing this form, landlords declare their intention to receive rental income without tax deductions, provided they meet the eligibility criteria. It is essential to keep a copy of the submitted form for personal records, as it may be required for future reference or audits.

Eligibility Criteria

To be eligible to use the NRL1 form, landlords must meet specific criteria set by HMRC. These include:

- The landlord must be a non-resident of the UK.

- The property must be rented out in the UK.

- The landlord must not have any tax liabilities in the UK that would require tax deductions from their rental income.

Meeting these criteria is crucial for successful approval under the Non-Resident Landlord Scheme.

Required Documents

When completing the NRL1 form, landlords must provide several supporting documents to verify their identity and property ownership. Required documents may include:

- A valid passport or national identity card.

- Proof of ownership of the rental property, such as a title deed.

- Bank statements or details to confirm the account for rental income payments.

Submitting these documents with the NRL1 form helps streamline the approval process with HMRC.

Quick guide on how to complete nrli form

Complete Nrli Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage Nrli Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Nrli Form with ease

- Obtain Nrli Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, be it via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Nrli Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nrli form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nrl1 form pdf and why is it important?

The nrl1 form pdf is a crucial document for businesses that need to comply with regulatory requirements. It serves as a necessary form for various transactions and applications, making it essential for record-keeping and legal purposes.

-

How can I easily complete and eSign the nrl1 form pdf?

With airSlate SignNow, you can easily fill out and eSign the nrl1 form pdf online. Our platform provides an intuitive interface that allows you to input your details and add your signature quickly, ensuring a smooth process.

-

Is there a cost associated with using airSlate SignNow for the nrl1 form pdf?

AirSlate SignNow offers a variety of pricing plans designed to fit different business needs, including those who need to manage the nrl1 form pdf. By choosing the right plan, you can access a cost-effective solution that saves time and resources.

-

What features does airSlate SignNow offer for managing the nrl1 form pdf?

AirSlate SignNow provides robust features for handling the nrl1 form pdf, including templates, automation, and secure storage. Our platform allows you to create, edit, and share the form with ease while ensuring your documents are safe.

-

Can I integrate airSlate SignNow with other software for nrl1 form pdf management?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the management of the nrl1 form pdf. This connectivity allows you to streamline your workflow effectively by bringing all your tools together.

-

What benefits does airSlate SignNow provide for those frequently using the nrl1 form pdf?

Using airSlate SignNow to handle the nrl1 form pdf brings several benefits, including increased efficiency and reduced turnaround times. The platform is designed to simplify the eSigning process, making document management more streamlined and accessible.

-

Is it safe to store my nrl1 form pdf in airSlate SignNow?

Absolutely! AirSlate SignNow employs advanced security measures to protect your documents, including the nrl1 form pdf. Your data is encrypted and securely stored, ensuring that only authorized individuals can access your sensitive information.

Get more for Nrli Form

Find out other Nrli Form

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast