Form 945

What is the Form 945

The Form 945, officially known as the Annual Return of Withheld Federal Income Tax, is a crucial document used by employers to report federal income tax withheld from non-payroll payments. This form is typically utilized by businesses that make payments such as pensions, annuities, and gambling winnings. Understanding the purpose of Form 945 is essential for compliance with federal tax regulations.

How to use the Form 945

Using Form 945 involves several key steps. First, gather all necessary information regarding the payments made throughout the year that require federal income tax withholding. Next, accurately fill out the form, ensuring that all amounts reported reflect the total withheld. After completing the form, it must be submitted to the Internal Revenue Service (IRS) by the designated deadline to avoid penalties. Proper use of Form 945 helps maintain accurate tax records and ensures compliance with federal tax laws.

Steps to complete the Form 945

Completing Form 945 involves a systematic approach:

- Gather Information: Collect details about all payments made that require withholding.

- Fill Out the Form: Enter the total amounts withheld in the appropriate sections of the form.

- Review for Accuracy: Double-check all entries to ensure correctness.

- Submit the Form: File the completed form with the IRS by the deadline, either electronically or by mail.

Following these steps carefully will help ensure that the form is completed correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for Form 945 are critical for compliance. The form must be filed annually by January 31 of the year following the tax year in which the payments were made. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is essential to mark these dates on your calendar to avoid late filing penalties.

Legal use of the Form 945

The legal use of Form 945 is governed by IRS regulations, which require accurate reporting of federal income tax withheld. Employers must ensure that the form is completed truthfully and submitted on time to avoid legal repercussions. Non-compliance can result in penalties, interest, and additional scrutiny from the IRS. Understanding the legal implications of using Form 945 is vital for any business handling non-payroll payments.

Key elements of the Form 945

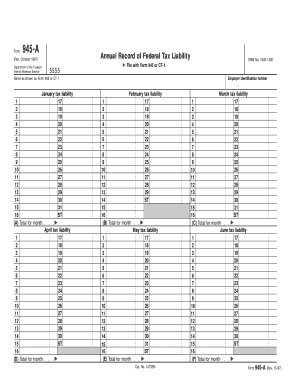

Key elements of Form 945 include:

- Identification Information: The employer's name, address, and Employer Identification Number (EIN).

- Withholding Amounts: Total federal income tax withheld from non-payroll payments.

- Signature: The form must be signed by an authorized representative of the business.

Each of these elements plays a crucial role in ensuring the form is valid and compliant with IRS requirements.

Quick guide on how to complete form 945 1665627

Finish Form 945 effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Handle Form 945 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Form 945 without hassle

- Obtain Form 945 and click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 945 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 945 1665627

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 945 and how does airSlate SignNow help with it?

Form 945 is used by employers to report federal income tax withheld from non-payroll payments. airSlate SignNow streamlines the signing and submission process of Form 945, allowing users to easily send the form for eSignature, ensuring compliance and timely submission.

-

What features does airSlate SignNow offer for managing Form 945?

AirSlate SignNow provides a variety of features tailored for managing Form 945, including custom templates, automated reminders, and integrated workflows. These features simplify the process of collecting signatures and organizing documents, making it easier for businesses to manage their obligations.

-

Is pricing for airSlate SignNow based on usage when handling Form 945?

Yes, airSlate SignNow offers flexible pricing plans based on usage type. Users can select a plan that fits their needs for handling Form 945, ensuring that they only pay for the features they utilize, making it a cost-effective choice.

-

Can I integrate airSlate SignNow with other tools for Form 945?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This integration means that businesses can easily access and manage Form 945 alongside their other workflow tools.

-

How secure is the eSignature process for Form 945 using airSlate SignNow?

AirSlate SignNow uses advanced encryption and security protocols to protect your documents, including Form 945. This ensures that all sensitive data remains secure during the signing process, giving users peace of mind.

-

Can I track the status of Form 945 submissions in airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for all sent documents, including Form 945. Users can easily see who has signed, who needs to sign, and the overall status of their form submissions, enhancing workflow efficiency.

-

What benefits does airSlate SignNow provide for businesses handling Form 945?

Using airSlate SignNow for Form 945 offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Businesses can save time and resources while ensuring they meet their reporting obligations seamlessly.

Get more for Form 945

- Small business accounting package wyoming form

- Company employment policies and procedures package wyoming form

- Revocation of power of attorney for care of child or children wyoming form

- Newly divorced individuals package wyoming form

- Contractors forms package wyoming

- Power of attorney for sale of motor vehicle wyoming form

- Wedding planning or consultant package wyoming form

- Hunting forms package wyoming

Find out other Form 945

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors