California Enterprise Zone Hiring Tax Credit Voucher Application Form

What is the California Enterprise Zone Hiring Tax Credit Voucher Application Form

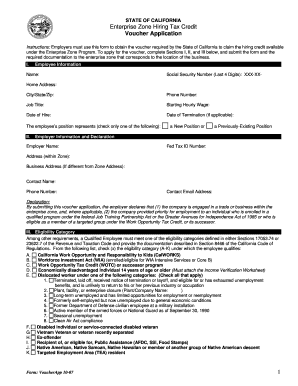

The California Enterprise Zone Hiring Tax Credit Voucher Application Form is a document used by employers to apply for tax credits when hiring individuals from specific target groups. This program is designed to encourage businesses to hire individuals who may face barriers to employment, such as the long-term unemployed or veterans. By completing this form, employers can access financial incentives that help reduce their overall tax burden while also contributing to workforce development in their communities.

Steps to complete the California Enterprise Zone Hiring Tax Credit Voucher Application Form

Completing the California Enterprise Zone Hiring Tax Credit Voucher Application Form involves several key steps:

- Gather necessary information about the employee, including their Social Security number and employment start date.

- Ensure that the employee qualifies for the tax credit by reviewing eligibility criteria related to their background and employment status.

- Fill out the application form accurately, providing all required details and signatures.

- Submit the completed form to the appropriate state agency within the specified timeframe to ensure eligibility for the tax credit.

Eligibility Criteria

To qualify for the California Enterprise Zone Hiring Tax Credit, both the employer and the employee must meet specific criteria. Employers must be located within designated enterprise zones, while employees must belong to targeted groups such as veterans, individuals receiving public assistance, or those facing long-term unemployment. It is essential to review these criteria carefully to ensure that both parties are eligible before submitting the application.

Legal use of the California Enterprise Zone Hiring Tax Credit Voucher Application Form

The California Enterprise Zone Hiring Tax Credit Voucher Application Form is legally binding when completed and submitted in accordance with state regulations. To ensure its legal standing, employers must adhere to the guidelines set forth by the California Department of Tax and Fee Administration. This includes accurate completion of the form and timely submission, as well as compliance with any additional documentation requirements.

Form Submission Methods

Employers can submit the California Enterprise Zone Hiring Tax Credit Voucher Application Form through various methods. Options typically include:

- Online submission via the state’s designated portal.

- Mailing a physical copy of the completed form to the appropriate agency.

- In-person submission at designated state offices, if applicable.

Key elements of the California Enterprise Zone Hiring Tax Credit Voucher Application Form

The form contains several key elements that must be completed for a successful application. These include:

- Employer information, including name, address, and tax identification number.

- Employee details, such as name, Social Security number, and employment start date.

- Certification of the employee's eligibility for the tax credit.

- Signatures from both the employer and the employee, confirming the accuracy of the information provided.

Quick guide on how to complete california enterprise zone hiring tax credit voucher application form

Effortlessly prepare California Enterprise Zone Hiring Tax Credit Voucher Application Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary template and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage California Enterprise Zone Hiring Tax Credit Voucher Application Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign California Enterprise Zone Hiring Tax Credit Voucher Application Form effortlessly

- Obtain California Enterprise Zone Hiring Tax Credit Voucher Application Form and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign California Enterprise Zone Hiring Tax Credit Voucher Application Form and maintain excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california enterprise zone hiring tax credit voucher application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Enterprise Zone Hiring Tax Credit Voucher Application Form?

The California Enterprise Zone Hiring Tax Credit Voucher Application Form is a document used by businesses to apply for tax credits when hiring employees from designated enterprise zones. By completing this form, businesses can access valuable incentives that help reduce their tax liability and promote local employment.

-

How do I complete the California Enterprise Zone Hiring Tax Credit Voucher Application Form?

To complete the California Enterprise Zone Hiring Tax Credit Voucher Application Form, gather the required employee and business information, and follow the guided instructions. Ensure all details are accurate and submit the form through the appropriate channels to facilitate tax credit processing.

-

What are the eligibility requirements for the California Enterprise Zone Hiring Tax Credit?

Eligibility for the California Enterprise Zone Hiring Tax Credit includes hiring employees from designated groups, such as veterans or individuals receiving public assistance. Each applicant must verify their standing within the enterprise zone and complete the California Enterprise Zone Hiring Tax Credit Voucher Application Form accurately.

-

How much can businesses save with the California Enterprise Zone Hiring Tax Credit?

The amount businesses can save with the California Enterprise Zone Hiring Tax Credit varies, but it can provide a signNow savings opportunity. Benefits include tax credits worth thousands of dollars depending on the number of qualifying employees hired, making the California Enterprise Zone Hiring Tax Credit Voucher Application Form a crucial document for maximizing financial incentives.

-

Is there a fee to submit the California Enterprise Zone Hiring Tax Credit Voucher Application Form?

There is no fee for submitting the California Enterprise Zone Hiring Tax Credit Voucher Application Form. However, businesses may incur costs associated with administrative or legal assistance if they choose to seek professional help while navigating the application process.

-

Can I integrate airSlate SignNow with the California Enterprise Zone Hiring Tax Credit Voucher Application Form?

Yes, businesses can seamlessly integrate airSlate SignNow with the California Enterprise Zone Hiring Tax Credit Voucher Application Form to streamline signing and document processing. This integration allows for efficient eSigning and enhanced document management, improving workflow and productivity.

-

What features does airSlate SignNow offer for managing the California Enterprise Zone Hiring Tax Credit Voucher Application Form?

airSlate SignNow offers a variety of features for managing the California Enterprise Zone Hiring Tax Credit Voucher Application Form, including secure e-signature capabilities, customizable templates, and automated workflows. These features ensure that your application process is smooth and that all documents are securely stored.

Get more for California Enterprise Zone Hiring Tax Credit Voucher Application Form

- Lcr form 102

- Ministry of education solomon islands past exam papers form

- Memorial hermann doctors note form

- Vanguard com organization resolution form

- Florida federation of fairs convention fun shoot may 11th form

- Wood door order form graham wood doors

- Transcriptletter of graduation request form

- Approvals cmbfhlmhclthe chapel of four chaplai form

Find out other California Enterprise Zone Hiring Tax Credit Voucher Application Form

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile