Nebraska Form 10 Fillable

What is the Nebraska Form 10 Fillable

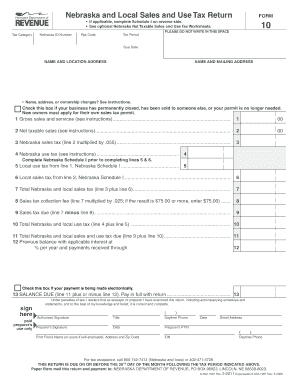

The Nebraska Form 10 Fillable is an essential document used for reporting sales tax in the state of Nebraska. This form is specifically designed for businesses to calculate and remit sales tax collected from customers. The fillable format allows users to complete the form electronically, making it easier to input data accurately and efficiently. By utilizing this form, businesses can ensure compliance with state tax regulations while maintaining organized financial records.

How to use the Nebraska Form 10 Fillable

Using the Nebraska Form 10 Fillable involves several straightforward steps. First, download the form from a reliable source. Once you have the form open on your device, you can begin entering the required information, such as your business details, sales figures, and the amount of sales tax collected. After filling in all necessary fields, review the information for accuracy. Finally, save the completed form and follow the submission instructions to ensure it is filed correctly with the Nebraska Department of Revenue.

Steps to complete the Nebraska Form 10 Fillable

Completing the Nebraska Form 10 Fillable requires careful attention to detail. Here are the steps to follow:

- Download the form from an official source.

- Open the form in a compatible PDF reader or editor.

- Fill in your business name, address, and identification number.

- Input the total sales amount and the sales tax collected.

- Double-check all entries for accuracy.

- Save the completed form to your device.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Nebraska Form 10 Fillable

The Nebraska Form 10 Fillable is legally recognized for sales tax reporting in Nebraska. To ensure its legal validity, businesses must complete the form accurately and submit it by the state’s deadlines. The form must include all required information, and any discrepancies may lead to penalties or audits. Utilizing this fillable form helps businesses maintain compliance with state tax laws, ensuring that they fulfill their legal obligations regarding sales tax collection and remittance.

Form Submission Methods

There are several methods available for submitting the Nebraska Form 10 Fillable. Businesses can choose to file the form online through the Nebraska Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be printed and mailed to the appropriate address. Some businesses may also opt to deliver the form in person at designated state offices. It is important to select the submission method that best fits your business needs while ensuring timely compliance with filing deadlines.

Key elements of the Nebraska Form 10 Fillable

The Nebraska Form 10 Fillable includes several key elements that are crucial for accurate tax reporting. These elements typically consist of:

- Business name and contact information

- Sales tax identification number

- Total sales amount

- Sales tax collected

- Signature and date of submission

Each of these components plays a vital role in ensuring that the form is completed correctly and complies with state regulations.

Quick guide on how to complete nebraska form 10 fillable

Effortlessly Prepare Nebraska Form 10 Fillable on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Nebraska Form 10 Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Alter and eSign Nebraska Form 10 Fillable with Ease

- Locate Nebraska Form 10 Fillable and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your edits.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Nebraska Form 10 Fillable to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 10 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Form 10 fillable document?

The Nebraska Form 10 fillable document is a customizable, electronic version of the official form used for various administrative purposes in Nebraska. With airSlate SignNow, you can easily complete and sign this form digitally, streamlining your workflow and ensuring greater accuracy.

-

How can I access the Nebraska Form 10 fillable?

You can access the Nebraska Form 10 fillable through the airSlate SignNow platform. Simply log in, navigate to the document library, and select the Nebraska Form 10 to start filling it out online or download it for use.

-

Is there a cost associated with using the Nebraska Form 10 fillable?

airSlate SignNow offers a cost-effective solution for document signing, with flexible pricing plans to suit various business needs. Access to the Nebraska Form 10 fillable is included in our subscription, ensuring you can manage your document workflows without additional costs.

-

What features does airSlate SignNow provide for the Nebraska Form 10 fillable?

With airSlate SignNow, the Nebraska Form 10 fillable benefits from advanced features such as customizable templates, electronic signatures, and real-time collaboration. These tools enhance efficiency and make it easier to gather necessary approvals and information.

-

Can I integrate other applications with the Nebraska Form 10 fillable?

Yes, airSlate SignNow allows seamless integration with a variety of applications to enhance your workflow. You can easily connect the Nebraska Form 10 fillable with popular tools like Google Drive, Salesforce, and more to streamline document management and signing processes.

-

What are the benefits of using the Nebraska Form 10 fillable through airSlate SignNow?

Using the Nebraska Form 10 fillable through airSlate SignNow reduces paperwork, saves time, and improves accuracy with its fillable format. Additionally, digital signatures help to expedite the approval process, allowing your business to operate more efficiently.

-

Is the Nebraska Form 10 fillable secure for sensitive information?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your data on the Nebraska Form 10 fillable is protected. The platform utilizes encryption and secure access controls, providing peace of mind when handling sensitive information.

Get more for Nebraska Form 10 Fillable

- Insulation contractor package new jersey form

- Paving contractor package new jersey form

- Site work contractor package new jersey form

- Siding contractor package new jersey form

- Refrigeration contractor package new jersey form

- Drainage contractor package new jersey form

- Tax free exchange package new jersey form

- Nj sublease form

Find out other Nebraska Form 10 Fillable

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement