Osceola County Generic Tourist Development Tax Return Form

What is the Osceola County Generic Tourist Development Tax Return

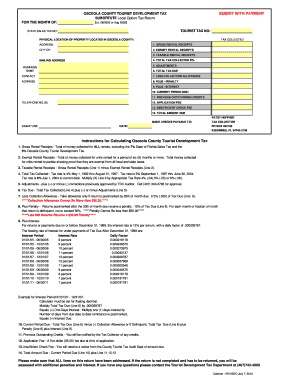

The Osceola County Generic Tourist Development Tax Return is a specific form used by businesses in Osceola County, Florida, to report and remit the tourist development tax. This tax is typically levied on short-term rentals and accommodations, including hotels and vacation rentals, to fund tourism-related projects and initiatives in the area. Understanding this form is crucial for compliance with local tax regulations and to ensure that businesses contribute appropriately to the tourism infrastructure.

How to use the Osceola County Generic Tourist Development Tax Return

Using the Osceola County Generic Tourist Development Tax Return involves several steps. First, businesses must accurately calculate the amount of tax owed based on their rental income. Next, they need to complete the form by providing necessary details such as the business name, address, and tax identification number. Once filled out, the form can be submitted either online or through traditional mail, depending on the preferred submission method. It is essential to keep a copy of the completed form for record-keeping purposes.

Steps to complete the Osceola County Generic Tourist Development Tax Return

Completing the Osceola County Generic Tourist Development Tax Return involves a series of methodical steps:

- Gather all relevant financial records, including rental income statements.

- Calculate the total amount of tourist development tax owed based on applicable rates.

- Fill out the form with accurate business information and tax calculations.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online or via mail.

Legal use of the Osceola County Generic Tourist Development Tax Return

The legal use of the Osceola County Generic Tourist Development Tax Return is governed by local tax laws. Businesses must ensure that the form is completed accurately and submitted on time to avoid penalties. Failure to comply with the regulations surrounding this tax can result in fines or other legal repercussions. It is advisable for businesses to familiarize themselves with the specific legal requirements related to the tourist development tax to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Osceola County Generic Tourist Development Tax Return are crucial for businesses to note. Typically, the return must be filed monthly, with specific due dates set by the county. Businesses should mark their calendars for these deadlines to ensure timely submission and avoid late fees. Keeping track of these dates helps maintain good standing with local tax authorities.

Required Documents

To complete the Osceola County Generic Tourist Development Tax Return, certain documents are required. These may include:

- Financial records detailing rental income.

- Previous tax returns, if applicable.

- Business registration documents.

- Any correspondence from the Osceola County tax office.

Having these documents readily available can streamline the process of completing the tax return.

Penalties for Non-Compliance

Non-compliance with the requirements for the Osceola County Generic Tourist Development Tax Return can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand the implications of failing to file or pay the tourist development tax to mitigate risks and ensure adherence to local tax laws.

Quick guide on how to complete osceola county generic tourist development tax return

Effortlessly Prepare Osceola County Generic Tourist Development Tax Return on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle Osceola County Generic Tourist Development Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any documentation process today.

The Easiest Way to Modify and Electronically Sign Osceola County Generic Tourist Development Tax Return

- Find Osceola County Generic Tourist Development Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Osceola County Generic Tourist Development Tax Return and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the osceola county generic tourist development tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Osceola County Tourist Development Tax?

The Osceola County Tourist Development Tax is a tax applied to short-term rentals and hotels in Osceola County. This tax is used to fund tourism-related activities and promote local attractions. Understanding this tax can help businesses effectively plan their pricing strategies.

-

How does the Osceola County Tourist Development Tax affect rental pricing?

The Osceola County Tourist Development Tax impacts rental pricing by adding an additional charge to the total cost for guests. Property owners must factor in this tax when setting rates to ensure compliance and cover overhead costs. Failing to include this tax can result in financial penalties.

-

Who is responsible for collecting the Osceola County Tourist Development Tax?

Property owners and operators of short-term rentals are responsible for collecting the Osceola County Tourist Development Tax from their guests. It’s essential to register with the county and ensure that this tax is included in the billing process. Non-compliance can lead to fines and legal issues.

-

What are the benefits of using airSlate SignNow for documents related to the Osceola County Tourist Development Tax?

Using airSlate SignNow streamlines the process of signing and managing documents related to the Osceola County Tourist Development Tax. Our platform allows for easy e-signatures and document tracking, making it efficient for property managers. This ensures all tax-related forms are handled smoothly and legally.

-

Can airSlate SignNow integrate with property management systems for tax compliance?

Yes, airSlate SignNow offers integrations with various property management systems, allowing users to manage documents associated with the Osceola County Tourist Development Tax seamlessly. This integration enhances efficiency by automating tasks, reducing manual errors, and ensuring compliance.

-

What types of documents do I need to manage for the Osceola County Tourist Development Tax?

To manage the Osceola County Tourist Development Tax, you will need to keep track of rental agreements, tax registration forms, and guest invoices. airSlate SignNow simplifies document management by providing a secure platform for e-signatures and storage. This ensures that all important documents are easily accessible and organized.

-

Is there a penalty for not complying with the Osceola County Tourist Development Tax?

Yes, failure to comply with the Osceola County Tourist Development Tax can lead to signNow financial penalties and potential legal issues for property owners. It's crucial to understand tax obligations and ensure that they are met to avoid these consequences. Using airSlate SignNow can help keep your documentation in order and compliant.

Get more for Osceola County Generic Tourist Development Tax Return

- Fencing contract for contractor nevada form

- Hvac contract for contractor nevada form

- Landscape contract for contractor nevada form

- Commercial contract for contractor nevada form

- Excavator contract for contractor nevada form

- Renovation contract for contractor nevada form

- Concrete mason contract for contractor nevada form

- Demolition contract for contractor nevada form

Find out other Osceola County Generic Tourist Development Tax Return

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free