SANTANDER SCRIP DIVIDEND SCHEME Form

What is the Santander Scrip Dividend Scheme

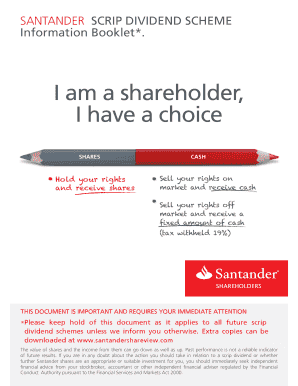

The Santander Scrip Dividend Scheme allows shareholders to receive their dividends in the form of additional shares instead of cash. This option can be appealing for investors who prefer to reinvest their earnings rather than receive immediate cash payments. By choosing this scheme, shareholders can potentially increase their investment in the company over time, benefiting from compound growth. The scheme is designed to provide flexibility and can be particularly advantageous in a growing market.

How to use the Santander Scrip Dividend Scheme

To utilize the Santander Scrip Dividend Scheme, shareholders must first confirm their eligibility. They can typically do this by accessing their account through the Santander online portal or contacting customer service. Once eligibility is confirmed, shareholders can select the scrip dividend option during the dividend payment period. This selection allows them to receive additional shares instead of cash. It is essential to keep track of the deadlines for opting into the scheme, as these can vary based on the dividend declaration dates.

Steps to complete the Santander Scrip Dividend Scheme

Completing the Santander Scrip Dividend Scheme involves several key steps:

- Log into your Santander account or contact customer service for assistance.

- Review the details of the upcoming dividend, including the declaration date and payment options.

- Select the option to receive dividends in shares instead of cash.

- Submit your choice before the specified deadline.

- Confirm your selection and monitor your account for the updated share balance after the dividend payment date.

Legal use of the Santander Scrip Dividend Scheme

Using the Santander Scrip Dividend Scheme is legal and compliant with relevant financial regulations. Shareholders must ensure they are aware of the terms and conditions associated with the scheme, including any tax implications. The scheme is governed by corporate policies and must adhere to securities laws. It is advisable for shareholders to consult with a financial advisor or tax professional to understand how participating in the scheme may affect their overall financial situation.

Eligibility Criteria

Eligibility for the Santander Scrip Dividend Scheme typically requires shareholders to be registered owners of shares as of the record date established by the company. Shareholders must also not be subject to any restrictions that would prevent them from receiving additional shares, such as certain regulatory limitations. It is important to review the specific eligibility requirements outlined in the company’s dividend announcement or shareholder communications.

Required Documents

To participate in the Santander Scrip Dividend Scheme, shareholders may need to provide specific documentation. This can include:

- Proof of share ownership, such as a recent account statement.

- Completed forms indicating the choice to opt into the scrip dividend scheme.

- Any additional documentation requested by Santander to verify identity or eligibility.

Ensuring that all required documents are submitted accurately and on time is crucial for successful participation in the scheme.

Quick guide on how to complete santander scrip dividend scheme

Easily Prepare SANTANDER SCRIP DIVIDEND SCHEME on Any Device

Managing documents online has gained signNow popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides all the essential tools required to create, modify, and eSign your documents quickly and without interruptions. Handle SANTANDER SCRIP DIVIDEND SCHEME on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly Modify and eSign SANTANDER SCRIP DIVIDEND SCHEME

- Find SANTANDER SCRIP DIVIDEND SCHEME and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign SANTANDER SCRIP DIVIDEND SCHEME and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the santander scrip dividend scheme

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SANTANDER SCRIP DIVIDEND SCHEME?

The SANTANDER SCRIP DIVIDEND SCHEME allows shareholders to receive new shares instead of cash dividends. This scheme provides an opportunity for shareholders to increase their investment in Santander while maintaining ownership in the company. It’s an appealing option for those looking to reinvest their dividends.

-

How does the SANTANDER SCRIP DIVIDEND SCHEME work?

Under the SANTANDER SCRIP DIVIDEND SCHEME, eligible shareholders can opt to receive additional shares rather than cash payouts. When dividends are declared, shareholders have the choice to enroll in the scheme and receive new shares proportionate to their holdings. This can enhance long-term investment potential.

-

What are the benefits of the SANTANDER SCRIP DIVIDEND SCHEME?

The SANTANDER SCRIP DIVIDEND SCHEME offers several benefits, including the ability to compound investment growth by acquiring additional shares. Shareholders also avoid capital gains tax on these shares until they are sold. Additionally, this scheme reinforces your stake in a company that shows growth potential.

-

Are there any costs associated with the SANTANDER SCRIP DIVIDEND SCHEME?

Generally, there are no fees for participating in the SANTANDER SCRIP DIVIDEND SCHEME. However, you should review your brokerage's policy for any transaction fees that may apply when new shares are issued. It's advisable to consult with your financial advisor for personalized guidance.

-

Who is eligible to participate in the SANTANDER SCRIP DIVIDEND SCHEME?

All registered shareholders of Santander can typically participate in the SANTANDER SCRIP DIVIDEND SCHEME. It's important to ensure that your shares are registered in your name, as this usually qualifies you for the benefits of the scheme. Check with your broker for specific enrollment details.

-

How do I enroll in the SANTANDER SCRIP DIVIDEND SCHEME?

Enrolling in the SANTANDER SCRIP DIVIDEND SCHEME is usually simple and can be done by notifying your broker or directly through your online shareholder account. You'll need to express your preference for shares over cash dividends when dividends are declared. Make sure to review any deadlines for enrollment.

-

Can I opt out of the SANTANDER SCRIP DIVIDEND SCHEME?

Yes, you can opt out of the SANTANDER SCRIP DIVIDEND SCHEME at any time, allowing you to receive cash dividends instead. If you choose to opt-out, simply inform your broker or update your preferences in your shareholder account. It's crucial to do this ahead of the dividend declaration dates.

Get more for SANTANDER SCRIP DIVIDEND SCHEME

- Gordon conwell theological seminary schorlaship form

- Petition small claims court 7th judicial circuit court of missouri circuit7 form

- Three theories of the solar system answer key form

- Verse a thon form

- Dvd order form template 12751898

- Form illinois

- Records and identification division form

- Print an order form positive promotions

Find out other SANTANDER SCRIP DIVIDEND SCHEME

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement