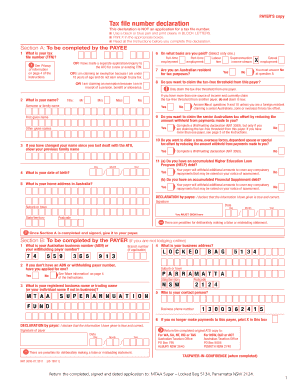

Tax File Number Declaration MTAA Super Form

What is the Tax File Number Declaration?

The Tax File Number Declaration is a form used in the United States to collect essential information regarding an individual's tax file number (TFN). This document is crucial for ensuring that income tax is withheld correctly by employers or financial institutions. It serves as a declaration of the taxpayer's identification, allowing for accurate reporting to the Internal Revenue Service (IRS). The TFN is unique to each taxpayer and is essential for various tax-related processes.

Key Elements of the Tax File Number Declaration

When completing the Tax File Number Declaration, several key elements must be included to ensure its validity:

- Personal Information: This includes the taxpayer's full name, address, and Social Security number.

- Tax File Number: The unique identifier assigned to the taxpayer, which must be accurately recorded.

- Signature: The taxpayer's signature is required to validate the declaration.

- Date: The date of completion must be included to establish the timeline of the declaration.

Steps to Complete the Tax File Number Declaration

Filling out the Tax File Number Declaration involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and TFN.

- Fill in the required fields on the form, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Sign and date the form to confirm its authenticity.

- Submit the completed form to your employer or the relevant financial institution.

IRS Guidelines for the Tax File Number Declaration

The IRS provides specific guidelines regarding the use of the Tax File Number Declaration. It is essential to follow these guidelines to ensure compliance and avoid potential penalties. The form must be submitted accurately and promptly to facilitate proper tax withholding. Additionally, taxpayers should be aware of their rights and responsibilities concerning their TFN, including how to protect their information and what to do in case of loss or theft.

Form Submission Methods

The Tax File Number Declaration can be submitted through various methods:

- Online: Many employers and financial institutions offer digital submission options through secure portals.

- Mail: The completed form can be mailed directly to the employer or institution.

- In-Person: Taxpayers may also choose to deliver the form in person, ensuring immediate processing.

Penalties for Non-Compliance

Failing to submit a Tax File Number Declaration can lead to significant penalties. Employers may be required to withhold taxes at the highest rate if the form is not provided. Additionally, taxpayers may face fines or other consequences from the IRS for non-compliance. It is crucial to complete and submit the declaration in a timely manner to avoid these issues.

Quick guide on how to complete tax file number declaration mtaa super

Complete Tax File Number Declaration MTAA Super effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without complications. Manage Tax File Number Declaration MTAA Super on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign Tax File Number Declaration MTAA Super effortlessly

- Locate Tax File Number Declaration MTAA Super and click Get Form to initiate the process.

- Utilize the tools provided to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tiresome form searching, or mistakes requiring the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Tax File Number Declaration MTAA Super and ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax file number declaration mtaa super

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration sample?

A tax declaration sample is a template or example document that illustrates how to accurately report income, deductions, and credits for tax purposes. Utilizing a tax declaration sample can help streamline the process of filing taxes and ensure compliance with applicable regulations.

-

How can airSlate SignNow assist with tax declaration samples?

airSlate SignNow provides tools that allow you to create, send, and eSign tax declaration samples efficiently. This user-friendly platform simplifies document management and ensures your tax documents are securely handled.

-

What features are included in airSlate SignNow for tax declaration processing?

Key features include customizable templates for tax declaration samples, electronic signatures, secure storage, and real-time collaboration. These tools offer a streamlined way to complete and manage your tax-related documents with ease.

-

Is airSlate SignNow cost-effective for managing tax declarations?

Yes, airSlate SignNow offers a range of pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing tax declarations. With its features and efficiencies, you save time and reduce costs associated with traditional paper-based processes.

-

Can I integrate airSlate SignNow with my accounting software for tax declarations?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software platforms, allowing you to pull in relevant data to create accurate tax declaration samples. This integration enhances productivity and minimizes data entry errors.

-

What are the benefits of using airSlate SignNow for tax declaration samples?

Using airSlate SignNow for tax declaration samples provides signNow benefits such as enhanced security, improved workflow, and easy collaboration. It helps ensure all parties involved can review, edit, and sign documents quickly, getting your tax submissions processed without delay.

-

Are there mobile options available for accessing tax declaration samples?

Yes, airSlate SignNow offers a mobile-friendly platform that allows users to access tax declaration samples on the go. This flexibility lets you manage and sign important tax documents anytime and anywhere, enhancing convenience.

Get more for Tax File Number Declaration MTAA Super

- Ukzn firm offer acceptance form pdf

- Solar site survey checklist pdf form

- Lesson plan evaluation checklist form

- Application for practice certificate renewal cswzim form

- Volleyball scoresheet instructions for uhsaa schools form

- Paratransit certification application city of albuquerque cabq form

- Guest minister form

- 237 coliseum drive macon georgia 31217 form

Find out other Tax File Number Declaration MTAA Super

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word