Virginia Form 500v

What is the Virginia Form 500v

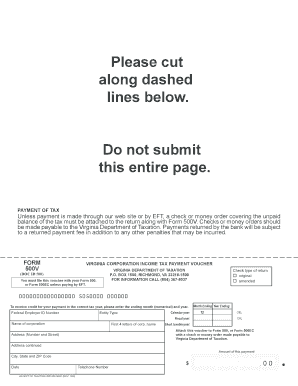

The Virginia Form 500v is a tax form used by individuals and businesses in Virginia to report and pay their state income tax liabilities. This form is specifically designed for taxpayers who owe tax payments to the Virginia Department of Taxation. It serves as a remittance document that accompanies the payment of taxes owed, ensuring that the state can accurately process and apply the payment to the taxpayer's account.

How to use the Virginia Form 500v

To effectively use the Virginia Form 500v, taxpayers must first determine their total tax liability for the year. Once the amount owed is calculated, the form should be filled out with the necessary information, including the taxpayer's name, address, and Social Security number or Employer Identification Number (EIN). The form should then be submitted along with the payment, either electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Virginia Form 500v

Completing the Virginia Form 500v involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Calculate your total tax liability based on your income and applicable deductions.

- Fill out the form accurately, ensuring all personal and financial information is correct.

- Review the form for any errors or omissions before submission.

- Submit the form along with your payment to the Virginia Department of Taxation.

Legal use of the Virginia Form 500v

The Virginia Form 500v is legally binding when completed and submitted according to state regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes meeting filing deadlines and providing accurate information. Failure to comply with these regulations can result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines associated with the Virginia Form 500v. Typically, the form is due on May 1 for individual taxpayers. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these dates to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Virginia Form 500v can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Taxpayers can submit the form electronically through the Virginia Department of Taxation's website.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person: Some taxpayers may choose to deliver the form directly to a local tax office for processing.

Quick guide on how to complete virginia form 500v

Complete Virginia Form 500v effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Virginia Form 500v on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Virginia Form 500v effortlessly

- Obtain Virginia Form 500v and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign Virginia Form 500v and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia form 500v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Virginia Form 500v?

Virginia Form 500v is a form used for filing Virginia state taxes, specifically designed for certain individuals and businesses. It provides essential information that helps ensure accurate tax processing. Utilizing airSlate SignNow can streamline the submission process for Virginia Form 500v, making it easier and quicker.

-

How can airSlate SignNow help me with Virginia Form 500v?

airSlate SignNow simplifies the process of preparing and submitting Virginia Form 500v through electronic signatures and document management. With our platform, you can easily create, sign, and send the form securely. This allows for a more efficient workflow and helps avoid any potential delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate different business needs, starting from a basic plan that includes essential features for managing documents like Virginia Form 500v. Each plan is competitively priced to provide a cost-effective solution for eSigning and document management. You can choose a plan that best fits your volume of use and feature requirements.

-

Is airSlate SignNow secure for submitting Virginia Form 500v?

Yes, airSlate SignNow uses advanced security features, including encryption and multi-factor authentication, ensuring that your Virginia Form 500v and other sensitive documents are protected. We prioritize security and compliance with industry standards to give you peace of mind when managing your documents.

-

Can I integrate airSlate SignNow with other software for handling Virginia Form 500v?

Absolutely! airSlate SignNow offers integrations with a variety of applications, allowing you to easily work with other platforms and enhance your document workflow. You can connect tools such as CRM systems and email services to streamline the gathering of information for Virginia Form 500v.

-

What features does airSlate SignNow offer for managing Virginia Form 500v?

airSlate SignNow provides features such as customizable templates, automatic reminders, and real-time notifications, all tailored to help you effectively manage Virginia Form 500v. These features enhance your efficiency and ensure that deadlines are met without hassle. Additionally, you can access a detailed audit trail for tracking the status of your forms.

-

How does eSigning Virginia Form 500v work with airSlate SignNow?

With airSlate SignNow, eSigning Virginia Form 500v is fast and convenient. You simply upload the form, add the necessary signers, and send it out for signatures. The eSigning process is straightforward, and signers receive an email prompt to complete their part securely.

Get more for Virginia Form 500v

Find out other Virginia Form 500v

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document