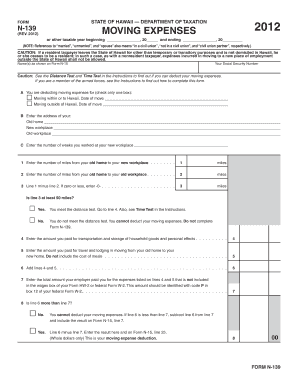

Form N 139

What is the Form N 139

The Form N 139 is a specific document used in the United States for various legal and administrative purposes. It is often required by government agencies and organizations to collect essential information from individuals or businesses. Understanding the purpose and requirements of this form is crucial for compliance and effective communication with relevant authorities. The form may include sections for personal identification, financial details, or other pertinent data depending on its intended use.

How to use the Form N 139

Using the Form N 139 involves several steps to ensure that all information is accurately provided and submitted correctly. First, gather all necessary documentation and information that may be required to complete the form. Next, carefully fill out each section, ensuring that all entries are clear and legible. After completing the form, review it for any errors or omissions before submission. Depending on the requirements, you may need to submit the form electronically or via traditional mail.

Steps to complete the Form N 139

Completing the Form N 139 requires attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents, such as identification and financial records.

- Fill in your personal information, ensuring accuracy in names and addresses.

- Complete any additional sections relevant to your situation.

- Double-check the form for any mistakes or missing information.

- Sign and date the form where required.

- Submit the form according to the specified method, either electronically or by mail.

Legal use of the Form N 139

The Form N 139 is legally binding when completed and submitted in accordance with applicable laws and regulations. To ensure its legality, it is essential to adhere to the guidelines provided by the issuing authority. This includes using a reliable method for signing the form, such as electronic signatures that comply with the ESIGN Act. Proper handling of the form helps maintain its validity and can prevent potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form N 139 can vary based on the specific purpose of the form and the requirements of the issuing agency. It is important to be aware of any important dates associated with the form to avoid penalties or complications. Typically, deadlines may be set for annual submissions, specific events, or other regulatory requirements. Always check the latest information from the relevant authority to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form N 139 can be submitted through various methods, depending on the requirements of the issuing agency. Common submission methods include:

- Online: Many agencies allow electronic submissions through secure portals.

- Mail: You can send a hard copy of the completed form to the designated address.

- In-Person: Some forms may be submitted directly at designated offices or locations.

Choosing the appropriate submission method is essential to ensure that your form is processed efficiently.

Quick guide on how to complete form n 139

Complete Form N 139 effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form N 139 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to adjust and electronically sign Form N 139 without hassle

- Find Form N 139 and click on Get Form to get going.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Form N 139 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 139

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form n 139 and how can airSlate SignNow help with it?

Form n 139 is a document that may be required for various administrative processes. airSlate SignNow simplifies this process by allowing users to fill, sign, and send form n 139 electronically, reducing the time and paperwork involved.

-

How much does it cost to use airSlate SignNow for form n 139?

airSlate SignNow offers a range of pricing plans that cater to individual and business needs. The cost depends on the features you select; however, all plans are designed to provide a cost-effective solution for managing form n 139 and other documents.

-

What features does airSlate SignNow offer for managing form n 139?

With airSlate SignNow, you can easily create, edit, and send form n 139. The platform offers features like document templates, automated reminders, and real-time tracking, making it user-friendly and efficient for any business.

-

Can I integrate airSlate SignNow with other applications to handle form n 139?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to effortlessly manage form n 139 alongside other documents and streamline your workflow.

-

Is eSigning form n 139 secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security by using encryption and secure cloud storage to protect your documents. This ensures that your eSigned form n 139 is safely stored and accessed only by authorized individuals.

-

How can businesses benefit from using airSlate SignNow for form n 139?

Businesses can signNowly enhance their efficiency by using airSlate SignNow for form n 139. The platform reduces the paperwork burden, speeds up the signing process, and improves overall workflow, allowing teams to focus on core tasks.

-

What types of users can benefit from using airSlate SignNow for form n 139?

airSlate SignNow is suitable for a diverse range of users, including freelancers, small businesses, and large corporations. Anyone who frequently handles form n 139 or other documentation will find this tool valuable for streamlining their processes.

Get more for Form N 139

- Legal pleading paper template for word form

- Ucaf 2 0 form

- Paindetect questionnaire pdf form

- Hospital registration certificate download form

- Security guard certificate pdf form

- Denver water backflow assembly test and maintenance report denverwater form

- Transcript requestsstudent records university of winnipeg form

- Kidney patient referral form university of utah health care healthcare utah

Find out other Form N 139

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors