HSA Employer Contribution Form Avidia Bank

What is the HSA Employer Contribution Form Avidia Bank

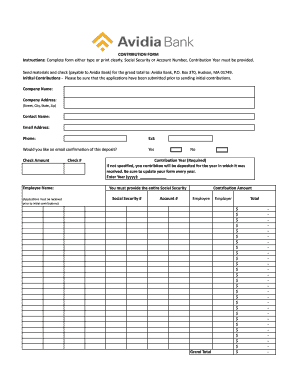

The HSA Employer Contribution Form from Avidia Bank is a document used by employers to report contributions made to employees' Health Savings Accounts (HSAs). This form is essential for accurately documenting the amounts contributed by the employer, which can affect the employee's tax liabilities and eligibility for certain benefits. The form ensures that contributions are compliant with IRS regulations and helps employees track their HSA contributions for tax reporting purposes.

Steps to complete the HSA Employer Contribution Form Avidia Bank

Completing the HSA Employer Contribution Form involves several key steps:

- Gather necessary employee information, including names, Social Security numbers, and HSA account numbers.

- Determine the total contributions made by the employer for each employee during the tax year.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form to Avidia Bank either electronically or by mail, depending on the preferred submission method.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding HSA contributions, including limits on the amount that can be contributed annually. For the current tax year, the contribution limits are subject to change, so it is important to refer to the IRS guidelines to ensure compliance. Employers must also adhere to rules regarding the timing of contributions and reporting requirements to avoid penalties.

Eligibility Criteria

To qualify for HSA contributions, employees must meet certain eligibility criteria. These include being enrolled in a high-deductible health plan (HDHP), not being covered by any other non-HDHP insurance, and not being claimed as a dependent on someone else's tax return. Understanding these criteria helps both employers and employees navigate the benefits of HSAs effectively.

Form Submission Methods (Online / Mail / In-Person)

The HSA Employer Contribution Form can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Many employers opt to submit the form electronically through Avidia Bank's secure portal.

- Mail: The completed form can be printed and sent via postal service to the designated address provided by Avidia Bank.

- In-Person: Some employers may choose to deliver the form in person at a local Avidia Bank branch for immediate processing.

Key elements of the HSA Employer Contribution Form Avidia Bank

Important elements of the HSA Employer Contribution Form include:

- Employee Information: Details such as name, Social Security number, and HSA account number.

- Contribution Amounts: Total contributions made by the employer for each employee.

- Tax Year: The specific tax year for which the contributions are being reported.

- Employer Information: Name and contact information of the employer submitting the form.

Quick guide on how to complete hsa employer contribution form avidia bank

Easily prepare HSA Employer Contribution Form Avidia Bank on any device

The management of documents online has gained signNow popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hindrances. Manage HSA Employer Contribution Form Avidia Bank on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to adjust and eSign HSA Employer Contribution Form Avidia Bank effortlessly

- Obtain HSA Employer Contribution Form Avidia Bank and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign HSA Employer Contribution Form Avidia Bank to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsa employer contribution form avidia bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSA on W2 form?

An HSA on W2 form refers to the Health Savings Account contributions that are reported on your W-2 tax form. This information is crucial when filing taxes as it affects your tax deductions and overall tax liability. Understanding how your HSA is represented on the W2 helps ensure you receive all eligible tax benefits.

-

How does airSlate SignNow handle HSA on W2 form signing?

With airSlate SignNow, you can easily create, send, and eSign documents related to your HSA on W2 form. Our intuitive platform streamlines the document-signing process, allowing you to securely manage your health savings account contributions with just a few clicks. This makes compliance easier and saves valuable time.

-

Can I store my HSA on W2 form documents within airSlate SignNow?

Yes, airSlate SignNow offers secure storage for all your documents, including HSA on W2 form files. You can keep your important documents organized and easily accessible, ensuring you have all the necessary papers at hand for tax season or other financial needs. Our platform prioritizes security to protect your sensitive information.

-

What are the pricing options for airSlate SignNow when managing HSA on W2 form documents?

airSlate SignNow provides cost-effective pricing plans that cater to various business needs, including those handling HSA on W2 form documents. Our plans are flexible, allowing you to choose the features you require without overspending. Contact us to find the best plan that suits your needs.

-

What features does airSlate SignNow offer for HSA on W2 form management?

airSlate SignNow offers a range of features beneficial for managing HSA on W2 form documents, including customizable templates, eSignature functionality, and seamless sharing options. These features allow you to streamline your document workflow and improve overall efficiency in handling important tax-related documents.

-

Does airSlate SignNow integrate with other financial software for HSA on W2 form processing?

Yes, airSlate SignNow integrates smoothly with various financial software and tools, making HSA on W2 form processing more efficient. This allows you to sync your documents and information across platforms, ensuring accuracy and saving you time on data entry. Discover our integration capabilities to optimize your workflow.

-

How can airSlate SignNow benefit my business in managing HSA on W2 form documents?

By using airSlate SignNow, your business can streamline the management of HSA on W2 form documents, enhancing efficiency and reducing manual errors. Our user-friendly interface and reliable eSignature capabilities ensure that you can send and sign documents quickly, signNowly improving your operational workflows and saving costs.

Get more for HSA Employer Contribution Form Avidia Bank

- Utah state tax forms

- Church risk management plan template form

- Handyman application baxmanagement com form

- Fire alarm testing notice template form

- Rabbit club order form 06 ai work and earnings

- Eea efm online form

- Navcruit 113362 navy recruiting command us navy cnrc navy form

- Canara bank account opening form filling sample pdf

Find out other HSA Employer Contribution Form Avidia Bank

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF