In 111 Vermont Form

What is the In 111 Vermont

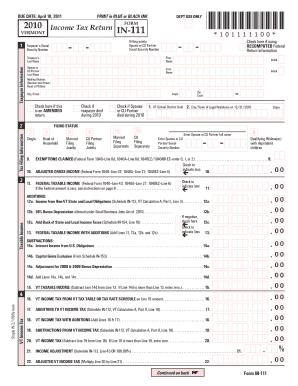

The In 111 Vermont is a tax form used by residents of Vermont to report income and calculate their state tax liability. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It captures various income sources, deductions, and credits that may apply to the taxpayer's situation. Understanding the purpose and requirements of the In 111 is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the In 111 Vermont

Completing the In 111 Vermont involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Review the instructions for the form to understand what information is required.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate your total tax liability or refund based on the information provided.

- Sign and date the form to validate your submission.

Legal use of the In 111 Vermont

The In 111 Vermont is legally recognized as a valid document for tax reporting in the state. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. Compliance with state tax laws is essential to avoid penalties and interest on unpaid taxes. Additionally, electronic signatures are accepted, provided they meet the requirements set forth by state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the In 111 Vermont are crucial for taxpayers to observe. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, which can provide additional time for filing under specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the In 111 Vermont. The form can be filed electronically through approved e-filing systems, which often provide a streamlined and efficient process. Alternatively, individuals may choose to mail a paper version of the form to the appropriate state tax office. In-person submissions are also possible at designated tax offices, allowing for direct assistance if needed.

Required Documents

To complete the In 111 Vermont, taxpayers must gather several key documents:

- W-2 forms from employers detailing annual wages.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, if applicable.

- Any other relevant tax documents that report income or provide deductions.

IRS Guidelines

While the In 111 Vermont is a state-specific form, it is essential to align its completion with IRS guidelines. Taxpayers should ensure that their reported income matches federal filings and that any deductions claimed are also permissible under federal tax law. This alignment helps prevent discrepancies that could lead to audits or penalties from either the state or federal tax authorities.

Quick guide on how to complete in 111 vermont

Complete In 111 Vermont effortlessly on any device

Web-based document handling has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage In 111 Vermont on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign In 111 Vermont with ease

- Obtain In 111 Vermont and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from your selected device. Modify and eSign In 111 Vermont and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the in 111 vermont

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form in 111 and how can it benefit my business?

A form in 111 is a digital document designed to streamline your workflows and improve efficiency. By utilizing airSlate SignNow, your business can easily create, send, and eSign these forms, ensuring that your processes are not only faster but also more secure. This form-centric approach helps in maintaining organization while reducing manual errors.

-

How much does it cost to use airSlate SignNow for creating a form in 111?

Pricing for using airSlate SignNow begins with a free trial, allowing you to explore creating forms in 111 without commitment. Subscription plans are competitively priced and tailored to accommodate different business sizes and needs. Each plan provides various features to enhance your experience with digital forms.

-

What features does airSlate SignNow offer for a form in 111?

airSlate SignNow offers a robust set of features for your form in 111, including customizable templates, document analytics, and seamless eSignature capabilities. Additionally, you can automate workflows, collaborate in real-time, and access forms from any device, enhancing productivity across your team.

-

Can I integrate airSlate SignNow with other software for managing a form in 111?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enabling you to manage your form in 111 alongside other business tools. Popular integrations include CRM systems, cloud storage solutions, and productivity apps, which help in centralizing your operations and ensuring a smooth workflow.

-

Is it easy to create a form in 111 using airSlate SignNow?

Absolutely! Creating a form in 111 with airSlate SignNow is designed to be user-friendly, allowing even those with minimal technical skills to quickly set up documents. The intuitive drag-and-drop interface makes it simple to add fields and customize your form according to your business requirements.

-

What security measures are in place for a form in 111?

airSlate SignNow takes security seriously, implementing robust measures to protect your data when handling a form in 111. Features such as encryption, secure storage, and advanced authentication options ensure that your documents are safe from unauthorized access while maintaining compliance with industry standards.

-

How can airSlate SignNow improve my workflow when using a form in 111?

By using airSlate SignNow, your workflow with a form in 111 can be signNowly improved through automation and streamlined processes. The platform allows for easy sharing, tracking, and signing, which speeds up turnaround times and reduces the hassles typically associated with document management.

Get more for In 111 Vermont

Find out other In 111 Vermont

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile