Ct 8379 Form

What is the Ct 8379

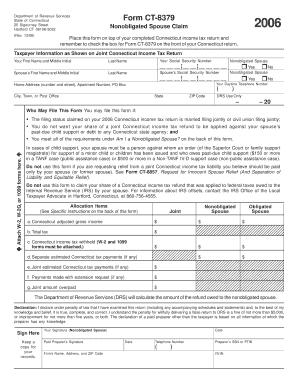

The Ct 8379 form, also known as the "Claim for Refund of Income Tax," is a tax document used by individuals in the United States to request a refund for overpaid income taxes. This form is particularly relevant for taxpayers who have experienced changes in their financial circumstances, such as adjustments in withholding or tax credits that were not initially claimed. Understanding the purpose and function of the Ct 8379 is essential for ensuring accurate tax reporting and maximizing potential refunds.

How to use the Ct 8379

Utilizing the Ct 8379 form involves a straightforward process. First, gather all necessary financial documentation, including W-2 forms, 1099s, and any other relevant tax records. Next, accurately fill out the form by providing personal information, detailing the reasons for the refund request, and calculating the amount owed. It is crucial to double-check all entries for accuracy to avoid delays in processing. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and the specific requirements of the tax authority.

Steps to complete the Ct 8379

Completing the Ct 8379 form requires careful attention to detail. Follow these steps for successful submission:

- Gather all relevant tax documents, including previous tax returns and income statements.

- Download the Ct 8379 form from the official tax authority website or access it through electronic filing software.

- Fill out the personal information section, ensuring that all details match official records.

- Provide a clear explanation for the refund request, including any relevant calculations.

- Review the form for accuracy and completeness, making any necessary corrections.

- Submit the form electronically or print it for mailing, following the specific submission guidelines provided by the tax authority.

Legal use of the Ct 8379

The Ct 8379 form is legally recognized as a valid method for taxpayers to claim refunds for overpaid taxes. To ensure its legal standing, it is essential to comply with all applicable tax laws and regulations. This includes providing truthful information and maintaining accurate records to support the refund claim. Utilizing electronic signature tools can enhance the legal validity of the submission, as they often include features such as authentication and secure data transmission.

Filing Deadlines / Important Dates

Timely filing of the Ct 8379 form is critical to avoid penalties and ensure prompt processing of refund requests. Generally, the deadline for submitting the form aligns with the annual tax filing deadline, which is typically April 15 for individual taxpayers. However, specific circumstances, such as extensions or special situations, may affect these dates. It is advisable to check the official tax authority website for any updates on deadlines and important dates related to the Ct 8379 form.

Required Documents

When filing the Ct 8379 form, certain documents are necessary to support the refund claim. These may include:

- W-2 forms from employers for the relevant tax year.

- 1099 forms for any additional income sources.

- Previous tax returns to establish a basis for the refund request.

- Any documentation related to tax credits or deductions claimed.

Having these documents readily available can streamline the completion process and ensure that the claim is well-supported.

Quick guide on how to complete ct 8379

Compose Ct 8379 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents rapidly without delays. Manage Ct 8379 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Ct 8379 without effort

- Find Ct 8379 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you choose. Edit and eSign Ct 8379 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 8379

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 8379 and how does it work with airSlate SignNow?

CT 8379 is a document that can be easily created, managed, and signed using airSlate SignNow. This platform streamlines the eSigning process, allowing users to send the CT 8379 for signatures quickly and efficiently. With airSlate SignNow, you can track the status of your CT 8379 in real-time, ensuring that your documents are always up to date.

-

How much does it cost to use airSlate SignNow for CT 8379?

The pricing for using airSlate SignNow varies depending on the features you need for managing documents like CT 8379. We offer flexible pricing plans that accommodate businesses of all sizes, allowing for easy budgeting. For a customized quote specific to your needs regarding CT 8379, visit our pricing page.

-

What features does airSlate SignNow offer for managing CT 8379?

airSlate SignNow provides a range of features to manage your CT 8379 seamlessly. You can create templates, collect signatures, and set reminders to follow up on pending signings. Additionally, our secure cloud storage ensures that your CT 8379 is safe and accessible from anywhere at any time.

-

Can airSlate SignNow be integrated with other software to facilitate CT 8379 processes?

Yes, airSlate SignNow can be integrated with various software applications to enhance your CT 8379 processes. This includes integration with CRM, document management systems, and other tools that streamline workflows. These integrations help to automate and simplify the management of your CT 8379 documentation.

-

What are the benefits of using airSlate SignNow for CT 8379?

Using airSlate SignNow for your CT 8379 documents allows for faster processing times and reduces paperwork. You'll benefit from a user-friendly interface that makes it easy to send, sign, and manage your CT 8379. Moreover, our solution is cost-effective, saving your business both time and money in the document management process.

-

Is airSlate SignNow compliant with legal regulations for CT 8379?

Yes, airSlate SignNow is fully compliant with legal regulations for electronic signatures, ensuring that your CT 8379 holds up in court. We adhere to various standards, including eIDAS and ESIGN, which help validate the legality of electronic signatures. You can confidently use airSlate SignNow for all your CT 8379 signing needs.

-

How can I get started with airSlate SignNow for CT 8379?

Getting started with airSlate SignNow for managing your CT 8379 is simple. You can sign up for a free trial on our website to explore all the features available. Once registered, you can easily upload your CT 8379 and begin sending it for signatures right away.

Get more for Ct 8379

Find out other Ct 8379

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple