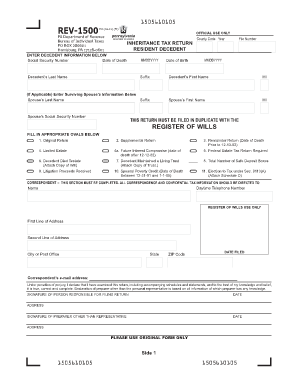

REV 1500 Department of Revenue Form

What is the REV 1500 Department Of Revenue

The REV 1500 Department Of Revenue form is a crucial document used by businesses and individuals to report certain tax-related information to state revenue departments. This form is primarily utilized for tax compliance, ensuring that all necessary financial data is accurately reported. It plays a significant role in the assessment of taxes owed, helping to maintain transparency and accountability within the tax system.

How to use the REV 1500 Department Of Revenue

Using the REV 1500 Department Of Revenue form involves several key steps. First, gather all relevant financial information, including income, deductions, and any applicable credits. Next, accurately fill out the form, ensuring that all entries are correct and complete. Once the form is filled, it can be submitted through the designated channels, which may include online submission or mailing a physical copy to the appropriate state office.

Steps to complete the REV 1500 Department Of Revenue

Completing the REV 1500 Department Of Revenue form requires careful attention to detail. Here are the steps to follow:

- Collect all necessary financial documents, such as income statements and receipts.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form either online or by mailing it to the appropriate department.

Legal use of the REV 1500 Department Of Revenue

The legal use of the REV 1500 Department Of Revenue form is governed by state tax laws. This form must be filled out truthfully and submitted within the required deadlines to avoid penalties. Electronic signatures are accepted, provided they comply with the relevant eSignature regulations, ensuring that the form holds legal validity.

Required Documents

To complete the REV 1500 Department Of Revenue form, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

Form Submission Methods

The REV 1500 Department Of Revenue form can be submitted through various methods, including:

- Online submission via the state revenue department's website.

- Mailing a hard copy to the designated address.

- In-person submission at local revenue offices.

Quick guide on how to complete rev 1500 department of revenue

Easily prepare REV 1500 Department Of Revenue on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, enabling you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hindrances. Manage REV 1500 Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign REV 1500 Department Of Revenue effortlessly

- Locate REV 1500 Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign REV 1500 Department Of Revenue while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1500 department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the REV 1500 Department Of Revenue form used for?

The REV 1500 Department Of Revenue form is utilized by businesses to report certain tax information. It helps ensure compliance with state regulations and allows you to accurately submit necessary documentation. By using airSlate SignNow, you can easily eSign and send your REV 1500 form securely.

-

How can airSlate SignNow help with filing the REV 1500 Department Of Revenue?

airSlate SignNow streamlines the process of completing the REV 1500 Department Of Revenue form by providing an intuitive interface for document management. You can quickly fill out the form, eSign it, and send it directly to the Department of Revenue. This not only saves time but also improves accuracy in your submissions.

-

What features does airSlate SignNow offer for managing REV 1500 Department Of Revenue forms?

airSlate SignNow offers features like customizable templates, real-time tracking, and automated reminders for the REV 1500 Department Of Revenue forms. These functionalities enhance efficiency and help ensure that you meet all filing deadlines. Additionally, our platform supports various file formats for your convenience.

-

Is airSlate SignNow a cost-effective solution for handling the REV 1500 Department Of Revenue?

Yes, airSlate SignNow is a cost-effective solution for managing the REV 1500 Department Of Revenue forms. Our subscription plans are designed to fit the budgets of businesses of all sizes, providing necessary features without breaking the bank. The ability to eliminate paper processes also contributes to long-term savings.

-

Can I integrate airSlate SignNow with other software for filing the REV 1500 Department Of Revenue?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and eCommerce platforms, making it easier to manage your REV 1500 Department Of Revenue filings. This integration ensures that all relevant data is synced, reducing the risk of errors during submission.

-

What are the benefits of using airSlate SignNow for the REV 1500 Department Of Revenue?

Using airSlate SignNow for the REV 1500 Department Of Revenue offers several benefits, including enhanced efficiency, better document management, and improved compliance. With our electronic signatures, you can ensure quick turnaround times on important tax documents. Moreover, the platform enhances security and confidentiality in handling sensitive information.

-

Is customer support available for issues related to REV 1500 Department Of Revenue filings?

Yes, airSlate SignNow provides robust customer support to assist you with any issues related to your REV 1500 Department Of Revenue filings. Our support team is knowledgeable about various tax documents and can guide you through the submission process. You can signNow out via chat, email, or phone for timely assistance.

Get more for REV 1500 Department Of Revenue

Find out other REV 1500 Department Of Revenue

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe