Mutual of Omahas Guaranteed Issue Whole Life Brochure Form

What is the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

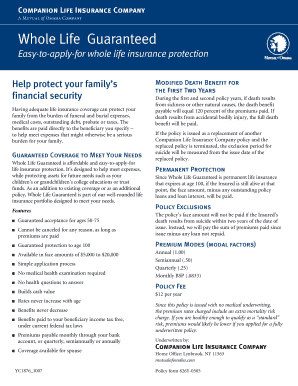

The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form is a document designed for individuals seeking whole life insurance coverage without the need for medical underwriting. This form provides essential information about the insurance product, including coverage details, premium costs, and benefits. It serves as a guide for potential policyholders to understand the terms and conditions associated with the insurance policy, ensuring they are well-informed before making a decision.

How to use the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

Using the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form involves several steps. First, individuals should review the brochure to familiarize themselves with the policy features and benefits. Next, they can complete the form by providing necessary personal information, such as name, address, and contact details. Once completed, the form can be submitted electronically or printed for mailing, depending on the preferred method of submission. It is crucial to ensure all information is accurate to avoid delays in processing.

Steps to complete the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

Completing the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form requires attention to detail. The following steps outline the process:

- Read through the entire brochure to understand the insurance policy.

- Fill in your personal information accurately, including your full name, address, and date of birth.

- Provide any additional required information, such as beneficiaries and payment preferences.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or print it for mailing.

Legal use of the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form is legally binding once completed and submitted according to the guidelines set forth by the issuing company. To ensure its legal validity, it is essential to comply with electronic signature regulations, such as the ESIGN Act and UETA. These laws recognize electronic signatures as valid, provided they meet specific criteria, including the intent to sign and consent to use electronic records.

Key elements of the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

Several key elements are essential to the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form. These include:

- Personal information fields for the applicant.

- Details about the insurance coverage, including face value and premium amounts.

- Information regarding beneficiaries and payment options.

- Terms and conditions outlining the policy's coverage and limitations.

- Signature line for the applicant to confirm their understanding and acceptance of the policy.

Eligibility Criteria

To qualify for the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form, applicants generally must meet specific eligibility criteria. These criteria may include age restrictions, residency requirements, and the absence of certain pre-existing health conditions. It is important for applicants to review the eligibility requirements outlined in the brochure to ensure they meet the necessary conditions before submitting the form.

Quick guide on how to complete mutual of omahas guaranteed issue whole life brochure form

Complete Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form effortlessly

- Obtain Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mutual of omahas guaranteed issue whole life brochure form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form?

The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form is a comprehensive document that outlines the features and benefits of the whole life insurance policy offered by Mutual of Omaha. This form is designed to provide potential policyholders with essential information, ensuring they understand their options for financial security.

-

What are the key benefits of the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form?

The key benefits highlighted in the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form include lifelong coverage, fixed premium payments, and a cash value component that grows over time. Additionally, this policy is designed for individuals who may have difficulty obtaining coverage due to health issues, making it accessible for many.

-

How much does the Mutual Of Omahas Guaranteed Issue Whole Life policy cost?

The pricing of the Mutual Of Omahas Guaranteed Issue Whole Life policy varies based on factors such as age and health status, which can be addressed in the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form. However, the premiums are fixed and affordable, providing certainty for policyholders over the life of the policy.

-

What features are included in the Mutual Of Omahas Guaranteed Issue Whole Life policy?

The Mutual Of Omahas Guaranteed Issue Whole Life policy features permanent coverage, a cash value that accumulates over time, and guaranteed acceptance regardless of health. The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form provides detailed insights into these features, ensuring potential customers understand their value.

-

Can I customize my Mutual Of Omahas Guaranteed Issue Whole Life policy?

While the core components of the Mutual Of Omahas Guaranteed Issue Whole Life policy are standardized, additional options may be available depending on individual needs. The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form is a great resource to explore customizable features that may enhance your coverage.

-

Is the Mutual Of Omahas Guaranteed Issue Whole Life policy suitable for seniors?

Yes, the Mutual Of Omahas Guaranteed Issue Whole Life policy is particularly suitable for seniors as it offers guaranteed acceptance without medical exams. The Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form explains how this policy can provide peace of mind for elderly individuals seeking lifelong coverage.

-

What happens if I miss a payment on my Mutual Of Omahas Guaranteed Issue Whole Life policy?

If a payment is missed on the Mutual Of Omahas Guaranteed Issue Whole Life policy, there is typically a grace period during which the policy remains in force. Information about potential consequences and grace periods can be found in the Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form, ensuring policyholders are well-informed.

Get more for Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

- Indian passport renewal bahrain form

- Baltarusijos vizos anketos pildymas form

- 3 specimen signature sample form

- Thailand visa application form filled sample

- Ollerton football club photo ampamp video consent form

- S45 model de certificat dassegurana de cauci per a form

- S46 form

- Solicitud de compensacin de deudas form

Find out other Mutual Of Omahas Guaranteed Issue Whole Life Brochure Form

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer