Form 3522 LLC Tax Voucher Ftb Ca

What is the Form 3522 LLC Tax Voucher Ftb Ca

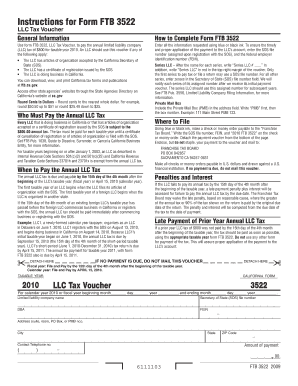

The Form 3522, also known as the LLC Tax Voucher, is a crucial document for Limited Liability Companies (LLCs) operating in California. This form is used to report and pay the annual minimum franchise tax to the California Franchise Tax Board (FTB). The tax applies to all LLCs registered in California, regardless of their income level. Completing this form accurately ensures compliance with state tax regulations and helps maintain the good standing of the LLC.

How to use the Form 3522 LLC Tax Voucher Ftb Ca

Using the Form 3522 involves several steps to ensure that the tax payment is processed correctly. First, gather all necessary information about your LLC, including its name, address, and California Secretary of State file number. Next, fill out the form with the required details, including the amount due. Once completed, the form can be submitted along with the payment through various methods, including online payment options or by mailing a check. Ensuring that the form is filled out accurately will help avoid penalties and ensure timely processing.

Steps to complete the Form 3522 LLC Tax Voucher Ftb Ca

Completing the Form 3522 involves a straightforward process. Follow these steps:

- Obtain the latest version of the Form 3522 from the California Franchise Tax Board website.

- Enter your LLC's legal name and address in the designated fields.

- Provide your California Secretary of State file number.

- Indicate the amount of the minimum franchise tax due.

- Review all entries for accuracy before submission.

- Choose your payment method and submit the form as instructed.

Key elements of the Form 3522 LLC Tax Voucher Ftb Ca

The Form 3522 contains several key elements that must be completed for successful submission. These include:

- LLC Name: The legal name of your LLC as registered with the state.

- File Number: The unique identifier assigned to your LLC by the California Secretary of State.

- Tax Amount: The total amount due for the minimum franchise tax.

- Payment Method: Options for how the tax will be paid, whether online or by mail.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Form 3522 to avoid penalties. Typically, the form must be submitted by the 15th day of the fourth month after the end of your LLC's tax year. For most LLCs operating on a calendar year, this means the deadline is April 15. Keeping track of these deadlines ensures that your LLC remains compliant with California tax laws.

Penalties for Non-Compliance

Failure to file the Form 3522 or pay the minimum franchise tax can result in significant penalties. The California Franchise Tax Board may impose a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, interest will accrue on any overdue payments. To avoid these consequences, it is crucial to submit the form and payment on time.

Quick guide on how to complete form 3522 llc tax voucher ftb ca

Complete Form 3522 LLC Tax Voucher Ftb Ca seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools you need to draft, modify, and eSign your documents swiftly without delays. Manage Form 3522 LLC Tax Voucher Ftb Ca on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to adjust and eSign Form 3522 LLC Tax Voucher Ftb Ca with ease

- Locate Form 3522 LLC Tax Voucher Ftb Ca and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose how you would like to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 3522 LLC Tax Voucher Ftb Ca and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3522 llc tax voucher ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3522 and why is it important for my business?

Form 3522 is essential for businesses that need to comply with certain regulatory requirements. It ensures that you keep accurate records and meet legal obligations, helping to avoid potential penalties. Using airSlate SignNow simplifies the process of completing and submitting form 3522, making it efficient and hassle-free.

-

How can airSlate SignNow help me complete form 3522?

With airSlate SignNow, you can easily fill out and eSign form 3522 using our intuitive platform. The tool provides templates and guided workflows, allowing you to streamline the process. This not only saves time but also enhances accuracy and compliance with the necessary regulations.

-

Is there a cost associated with using airSlate SignNow for form 3522?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans provide great value, ensuring that you can manage form 3522 and other documents cost-effectively. Check our website for details on pricing options and choose the one that fits your requirements best.

-

What features does airSlate SignNow offer for managing form 3522?

airSlate SignNow includes features specifically designed to enhance your experience with form 3522, such as document sharing, template creation, and automated reminders. Additionally, the platform supports team collaboration, enabling multiple users to work on form 3522 simultaneously. These features ensure a seamless workflow and improved productivity.

-

Can I integrate airSlate SignNow with other tools for handling form 3522?

Yes, airSlate SignNow offers integration options with various applications and platforms used in business operations. This allows you to connect with CRM systems, cloud storage, and other essential tools for managing form 3522 efficiently. Integrations enhance your workflow efficiency and ensure data consistency across platforms.

-

Is it safe to eSign form 3522 using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and compliance, providing a safe environment for eSigning form 3522. With robust encryption and authentication protocols, your documents are protected at every stage. You can trust our platform to safeguard your sensitive information.

-

How long does it take to complete form 3522 with airSlate SignNow?

The time it takes to complete form 3522 with airSlate SignNow can vary based on individual needs, but our user-friendly interface is designed to save you time. Typically, you can fill out and eSign form 3522 within minutes, making it an efficient solution for busy professionals. Speed up the process and ensure timely submissions with our platform.

Get more for Form 3522 LLC Tax Voucher Ftb Ca

- Church receipt form

- Waiver notice of form

- Call of regular meeting of the board of nonprofit church corporation with direction to secretary form

- Interim pastor agreement form

- Beta test agreement sample pdf form

- Letter happy independence form

- Letter of explanations form

- Employment agreement between church and bookkeeper form

Find out other Form 3522 LLC Tax Voucher Ftb Ca

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document