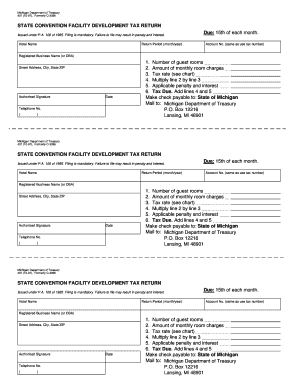

Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return

What is the Form 407, State Convention Facility Development Tax Return

The Form 407, known as the State Convention Facility Development Tax Return, is a tax document used in the United States to report and remit taxes related to state convention facilities. This form is typically required by businesses that operate or manage convention facilities and are subject to specific state tax regulations. The information included in this form helps state authorities assess the tax obligations of these facilities, ensuring compliance with local tax laws.

How to obtain the Form 407, State Convention Facility Development Tax Return

To obtain the Form 407, individuals or businesses can visit the official website of their state’s tax authority. Most states provide downloadable versions of tax forms, including the Form 407, in PDF format. Additionally, physical copies may be available at local tax offices or government buildings. It is important to ensure that the correct version of the form is used, as different states may have variations of the Form 407.

Steps to complete the Form 407, State Convention Facility Development Tax Return

Completing the Form 407 involves several key steps:

- Gather necessary financial documents, including revenue reports and expense statements related to the convention facility.

- Fill out the form with accurate information, including the facility's name, address, and tax identification number.

- Report the total taxable revenue generated by the facility during the reporting period.

- Calculate the tax owed based on the applicable state tax rate.

- Review the completed form for accuracy before submission.

Legal use of the Form 407, State Convention Facility Development Tax Return

The legal use of the Form 407 is crucial for compliance with state tax laws. When properly completed and submitted, the form serves as a formal declaration of tax obligations. It is important to ensure that all information is truthful and accurate, as discrepancies can lead to penalties or legal issues. The form must be signed and dated by an authorized representative of the business to validate its legal standing.

Key elements of the Form 407, State Convention Facility Development Tax Return

The Form 407 includes several key elements that must be accurately reported:

- Facility Information: Name, address, and tax identification number.

- Revenue Details: Total taxable revenue generated during the reporting period.

- Tax Calculation: The applicable tax rate and the total tax owed.

- Signature: Signature of the authorized representative, certifying the accuracy of the information.

Filing Deadlines / Important Dates

Filing deadlines for the Form 407 vary by state, but they typically align with the end of the fiscal year or specific quarterly reporting periods. It is essential for businesses to be aware of these deadlines to avoid late fees or penalties. Checking the state tax authority's website for the most current deadlines is advisable, as they may change from year to year.

Quick guide on how to complete form 407 state convention facility development tax return form 407 state convention facility development tax return

Effortlessly prepare Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return on any device

Managing documents online has gained traction among both businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly and without holdups. Manage Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return without hassle

- Locate Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return and click Get Form to begin.

- Utilize the tools available to submit your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 407 state convention facility development tax return form 407 state convention facility development tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 407, State Convention Facility Development Tax Return?

The Form 407, State Convention Facility Development Tax Return is a crucial document for businesses participating in events within state convention facilities. This form is used to report applicable tax liabilities and ensure compliance with state regulations. Understanding its requirements is vital for avoiding penalties.

-

How can airSlate SignNow help me with the Form 407, State Convention Facility Development Tax Return?

airSlate SignNow streamlines the eSigning and document management process for the Form 407, State Convention Facility Development Tax Return. Users can easily send, sign, and manage their forms electronically, making the submission process quicker and more efficient. This minimizes the potential for errors in tax reporting.

-

Is there a cost associated with using airSlate SignNow for the Form 407, State Convention Facility Development Tax Return?

Yes, while airSlate SignNow offers cost-effective solutions, various pricing plans are available based on your business needs. These plans provide flexibility, ensuring you only pay for the features you use while facilitating the process of submitting your Form 407, State Convention Facility Development Tax Return efficiently.

-

What features does airSlate SignNow offer for managing the Form 407, State Convention Facility Development Tax Return?

airSlate SignNow provides several features designed to simplify the management of the Form 407, State Convention Facility Development Tax Return, including customizable templates, advanced tracking, and automated reminders. These features help ensure that your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other platforms for filing the Form 407, State Convention Facility Development Tax Return?

Yes, airSlate SignNow offers seamless integrations with various software platforms and applications. This allows users to easily incorporate their document workflows with tools like CRMs, cloud storage, and accounting systems when managing the Form 407, State Convention Facility Development Tax Return.

-

What are the benefits of using airSlate SignNow for the Form 407, State Convention Facility Development Tax Return?

Using airSlate SignNow for the Form 407, State Convention Facility Development Tax Return provides numerous benefits, including enhanced security, real-time collaboration, and reduced administrative burden. This helps businesses streamline their tax processes while ensuring compliance and accuracy.

-

How secure is the submission of the Form 407, State Convention Facility Development Tax Return with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Form 407, State Convention Facility Development Tax Return. The platform employs state-of-the-art encryption and compliance measures to ensure that user data and electronic signatures are secure throughout the submission process.

Get more for Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return

Find out other Form 407, State Convention Facility Development Tax Return Form 407, State Convention Facility Development Tax Return

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample