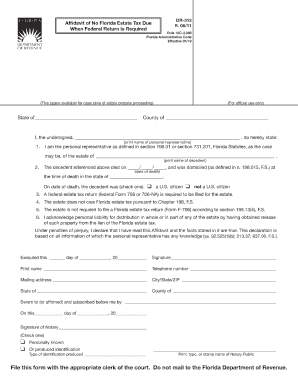

Form DR 313 Florida Department of Revenue MyFlorida Com

What is the Form DR 313 Florida Department Of Revenue MyFlorida com

The Form DR 313 is a document issued by the Florida Department of Revenue that is primarily used for tax-related purposes. This form is essential for taxpayers who need to report specific information regarding their tax obligations. It serves as a means for individuals and businesses to communicate necessary data to the state, ensuring compliance with Florida tax laws. Understanding the purpose and requirements of Form DR 313 is crucial for maintaining accurate records and fulfilling tax responsibilities.

How to use the Form DR 313 Florida Department Of Revenue MyFlorida com

Using the Form DR 313 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports the information you will report on the form. This may include financial records, previous tax returns, and any relevant correspondence from the Florida Department of Revenue. Next, fill out the form carefully, ensuring all fields are completed accurately. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the guidelines provided by the Florida Department of Revenue.

Steps to complete the Form DR 313 Florida Department Of Revenue MyFlorida com

Completing the Form DR 313 requires attention to detail. Here are the essential steps:

- Review the form instructions carefully to understand the requirements.

- Gather all necessary supporting documents to ensure accuracy.

- Fill in all required fields, double-checking for any errors or omissions.

- Sign and date the form where indicated to validate your submission.

- Choose your submission method: online or by mail, and follow the specific instructions for each method.

Legal use of the Form DR 313 Florida Department Of Revenue MyFlorida com

The legal use of Form DR 313 is governed by Florida tax laws and regulations. To be considered valid, the form must be completed accurately and submitted in accordance with the guidelines set forth by the Florida Department of Revenue. This includes ensuring that all signatures are authentic and that the information provided is truthful and complete. Non-compliance with these regulations can lead to penalties or legal repercussions, making it essential to adhere to the legal standards associated with this form.

Key elements of the Form DR 313 Florida Department Of Revenue MyFlorida com

Key elements of the Form DR 313 include:

- Taxpayer Identification: Essential for identifying the individual or business submitting the form.

- Reporting Period: Indicates the specific time frame for which the tax information is being reported.

- Income Information: Details regarding income sources that are relevant to the tax obligations.

- Signature Section: A place for the taxpayer to sign, affirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

Form DR 313 can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer this method for its convenience and speed. Ensure you follow the online submission guidelines provided by the Florida Department of Revenue.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate address. Be sure to use the correct postage and allow adequate time for delivery.

- In-Person Submission: Some individuals may choose to submit the form in person at designated Florida Department of Revenue offices. This option allows for immediate confirmation of receipt.

Quick guide on how to complete form dr 313 florida department of revenue myflorida com

Create Form DR 313 Florida Department Of Revenue MyFlorida com effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent sustainable alternative to conventional printed and signed documents, as you can access the correct format and safely keep it online. airSlate SignNow provides you with all the resources you need to generate, modify, and electronically sign your documents swiftly and without hassle. Handle Form DR 313 Florida Department Of Revenue MyFlorida com on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Form DR 313 Florida Department Of Revenue MyFlorida com seamlessly

- Locate Form DR 313 Florida Department Of Revenue MyFlorida com and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form DR 313 Florida Department Of Revenue MyFlorida com to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form dr 313 florida department of revenue myflorida com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form DR 313 from the Florida Department of Revenue?

Form DR 313 is a document used by the Florida Department of Revenue, which allows businesses to report and remit certain tax types. It serves as an essential tool for ensuring compliance with state regulations. By using Form DR 313, businesses can streamline their tax reporting process efficiently.

-

How can airSlate SignNow help with Form DR 313 submissions?

airSlate SignNow simplifies the process of preparing and submitting Form DR 313 Florida Department Of Revenue MyFlorida com by allowing users to eSign and send documents electronically. This eliminates the need for physical signatures and paperwork, making the process faster and more efficient. With airSlate SignNow, you can accurately manage your submissions with ease.

-

Is there a cost associated with using airSlate SignNow for Form DR 313?

Yes, airSlate SignNow offers various pricing plans to meet the needs of different businesses. While specific pricing may vary, our solutions remain cost-effective, particularly when managing essential documents like Form DR 313 Florida Department Of Revenue MyFlorida com. You can choose a plan that suits your organization's needs and budget.

-

What features does airSlate SignNow offer for managing Form DR 313?

airSlate SignNow provides a range of features to effectively manage Form DR 313 Florida Department Of Revenue MyFlorida com, including customizable templates, automated workflows, and secure electronic signatures. These tools enhance your document management and improve overall efficiency, reducing the chance of errors in your submissions.

-

Are there integrations available for airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various popular applications that can enhance your workflow. This includes links to bookkeeping, tax preparation software, and customer relationship management platforms, making it easier to manage your Form DR 313 and other business documents. Integration capabilities ensure a smooth transition between tasks.

-

Can airSlate SignNow help with compliance for Form DR 313?

Absolutely! airSlate SignNow focuses on keeping your document processes compliant, especially for important forms like Form DR 313 Florida Department Of Revenue MyFlorida com. Our platform enables you to maintain accurate records and adhere to state requirements, reducing the risk of non-compliance and ensuring smooth operations.

-

Is it easy to track changes made to Form DR 313 using airSlate SignNow?

Yes, airSlate SignNow allows users to track changes made to Form DR 313 Florida Department Of Revenue MyFlorida com effortlessly. The platform provides a complete audit trail, which helps you keep track of who made changes and when. This transparency is crucial for compliance and accountability.

Get more for Form DR 313 Florida Department Of Revenue MyFlorida com

- Sp ausnet inverter energy system ies generator connection form

- Quit claim deed nc form

- Borang single form

- Jac contest entry form

- Ap chemistry chapter 14 chemical kinetics form

- Afto form 134

- How to file child support in ga form

- Rewards checkup after lesson 10 name date total points of 100 points part 1 form

Find out other Form DR 313 Florida Department Of Revenue MyFlorida com

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure